Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomDovish Fed, Banking Stress & Trade Tensions Poise Markets for Volatility

Fed Speeches & Policy Signals

In his recent speech, Fed Chair Jerome Powell warned that the sharp slowdown in U.S. employment is increasing downside risks to the economy, signaling that the central bank is likely to cut rates twice more before year-end. This reinforced the market’s dovish expectations and triggered renewed selling pressure on the U.S. dollar.

The dovish tone was further strengthened as several other Fed officials echoed similar views:

- Stephen Miran (Fed Governor) stressed that his focus remains on inflation and employment, not on asset price gains, as he advocated for additional rate cuts.

- Christopher Waller (Fed Governor) also supported more easing but urged a measured approach, citing mixed economic signals.

- Neel Kashkari (Minneapolis Fed) said he doubts the U.S. economic slowdown is as severe as some believe but noted rising risks in the labor market, implying further easing remains on the table.

- Michelle Bowman (Fed Governor) publicly projected two more rate cuts this year.

- Powell also signaled the Fed may halt balance sheet runoff in the coming months to preserve liquidity in the financial system.

Overall, the tone from Fed officials remains clearly dovish, even if tempered with caution, and markets are interpreting this as a firm policy tilt toward further easing.

U.S. Banks Stress / Crisis Signals

Adding to market jitters, U.S. banks have tapped the Fed’s Standing Repo Facility to borrow more than $15 billion in recent days — a sign of growing liquidity strain in short-term funding markets. This has amplified concerns that mid-sized and regional banks may be coming under renewed pressure.

The financial sector saw the heaviest selling on Tuesday, dragging down the broader U.S. equity indices and erasing early session gains.

Key developments:

- Sector Under Pressure: The Financials Select Sector SPDR Fund (XLF) posted the worst performance among S&P 500 sectors.

- Regional Bank Concerns: Shares of Zions Bancorp and Western Alliance Bancorp were hit hard after disclosures of loan loss issues and fraud investigations, sparking renewed worries over credit quality.

- Credit Stress Signals: These developments raised concerns that tightening credit conditions could weigh further on financial markets and economic activity.

US Equities Face Uncertainty: Corrective Move Ahead?

U.S. equities opened higher on Tuesday but reversed intraday gains to close lower, reflecting growing investor unease. Markets are now increasingly focused on the potential fallout from regional banking stress and lingering U.S.–China trade tensions.

The combination of monetary easing expectations and credit stress signals is creating a tug-of-war for equities:

- Support: Dovish Fed signals and lower yields are offering short-term relief.

- Headwinds: Banking sector weakness and trade uncertainty are capping upside momentum.

This dynamic suggests the equity market may face a corrective phase, especially if financial stability concerns deepen or trade rhetoric escalates in the coming weeks.

S&P 500: Reversal Signals Emerging Near Resistance

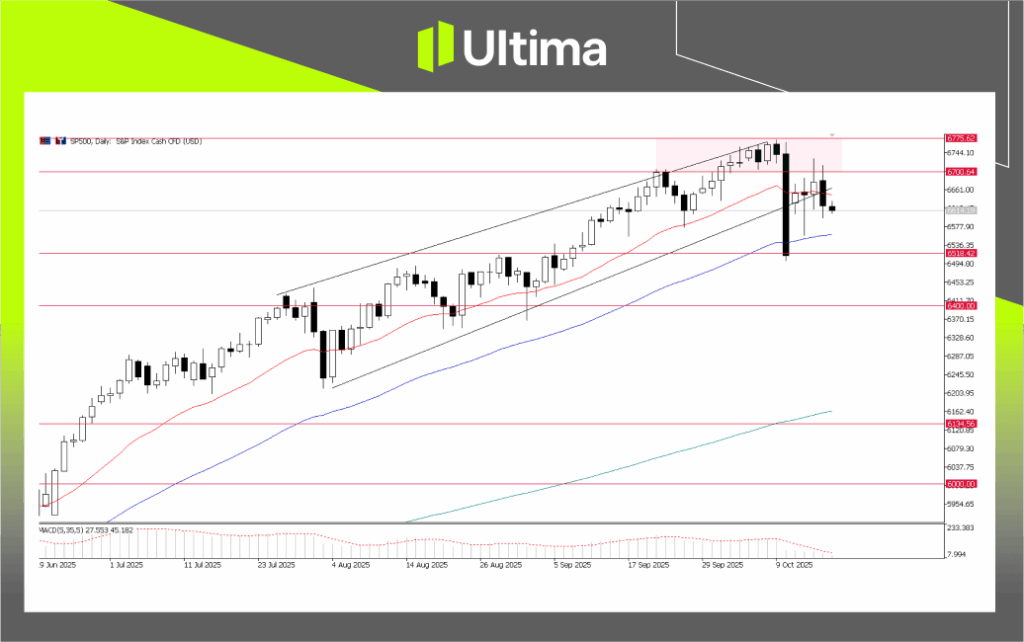

SP500, Daily Chart | Source: Ultima Market MT5

From a technical perspective, the recent two-day rebound attempt in the S&P 500 Index was rejected near the 6,700 resistance zone, a level we highlighted previously as a key upside barrier.

The latest price action suggests that the index may be forming an early reversal structure, potentially signaling the start of a corrective move within the current uptrend.

If the S&P 500 fails to reclaim and hold above 6,700, downside pressure could build, with short-term sentiment likely turning more defensive—particularly given the ongoing banking stress and trade uncertainty that are weighing on broader risk appetite.

Nasdaq 100: Resistance Zone Capping Upside Momentum

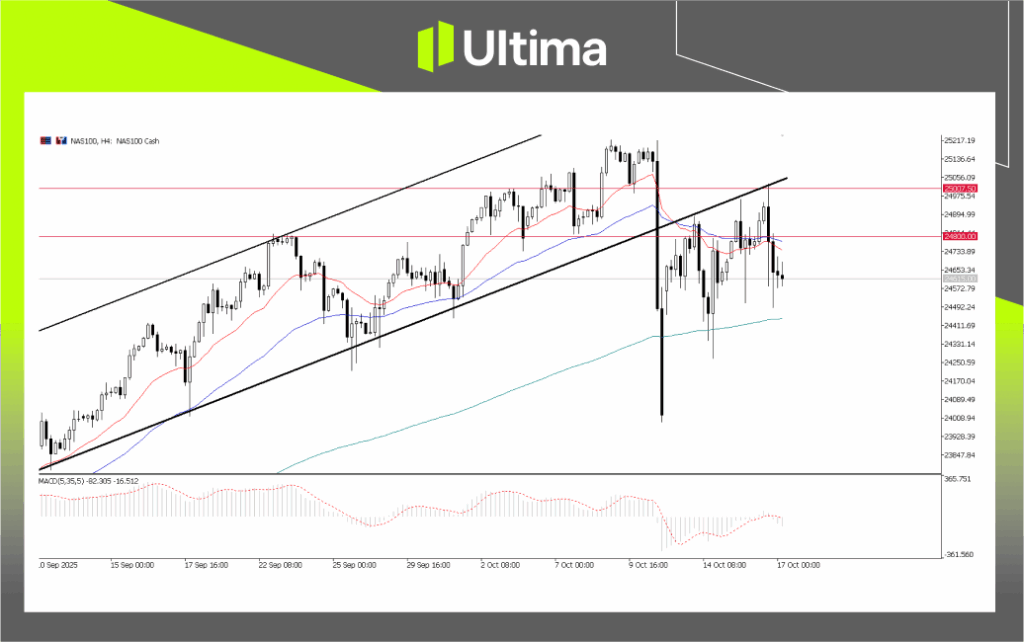

NAS100, H4 Chart | Source: Ultima Market MT5

Meanwhile, the Nasdaq 100 — despite its heavier weighting in the technology sector — remains vulnerable to broader market headwinds, as financial stress signals can spill over and weigh on overall U.S. equity sentiment.

Technically, the index is struggling to break above the 25,000 mark, with the 25,000–24,800 zone acting as a strong resistance area. The recent uptrend channel breakout adds to the cautious tone.

If the index fails to reclaim this zone, downside risks may build, especially in the current environment of banking sector stress and trade uncertainty.

U.S. Dollar: Trade and Fed Pressure Weigh on Sentiment

The U.S. dollar remains under pressure as rising Fed rate-cut expectations and renewed U.S.–China trade tensions weigh on sentiment and now potentially the banking stressing.

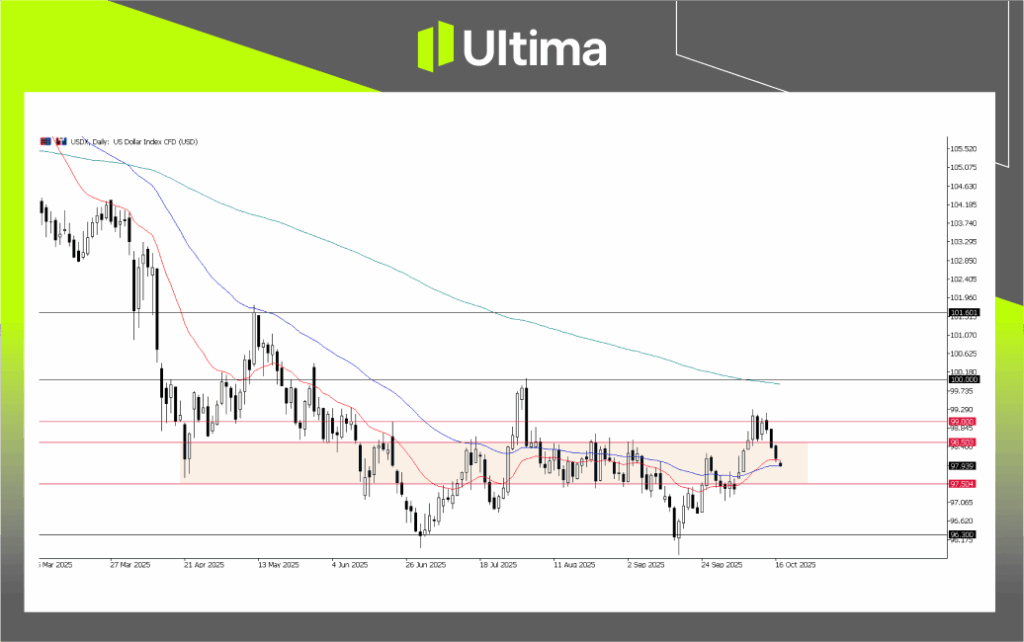

USDX, Daily Chart | Source: Ultima Market MT5

Technically, the index has broken back below 98.50, a key support zone that previously anchored its short-term rebound. A sustained move below this level increases the risk of a deeper pullback, with the next key support area seen near 97.50.

On the upside, 98.50 now acts as immediate resistance, followed by the 99.00 handle. Unless the dollar reclaims these levels decisively, downside bias may dominate in the near term.

Daily Market Insights

Global markets are facing a fresh wave of uncertainty as three major macro forces converge — a more dovish Federal Reserve stance, renewed signs of stress in the U.S. banking sector, and persistent U.S.–China trade tensions.

Fed officials’ increasingly dovish signals have heightened expectations for further rate cuts this year, weakening the dollar and boosting demand for safe-haven assets. At the same time, liquidity strains among regional banks have reignited credit quality concerns, putting pressure on financial stocks and capping broader equity gains.

Meanwhile, ongoing trade frictions continue to cloud the macro outlook, keeping risk sentiment fragile. Against this backdrop, investors are positioning defensively, with volatility likely to remain elevated in the near term.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server