Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is Chinese Yuan?

The Chinese yuan (CNY), officially called the renminbi (RMB), is the national currency of the People’s Republic of China. The term renminbi means “people’s currency,” while yuan refers to its main unit of account. Issued and regulated by the People’s Bank of China, the yuan trades as both onshore (CNY) and offshore (CNH) versions.

CNY vs CNH

CNY and CNH are two forms of the Chinese yuan used in different markets.

- CNY (onshore yuan) is traded inside mainland China under the supervision of the People’s Bank of China (PBoC), with a daily reference rate and strict capital controls.

- CNH (offshore yuan) trades outside China, mainly in Hong Kong, Singapore, and London where it is freely priced by supply and demand.

The two share the same value unit but have separate liquidity pools, so their exchange rates can differ slightly depending on market conditions and policy actions.

Key Differences Between CNY and CNH

| Feature | CNY (Onshore Yuan) | CNH (Offshore Yuan) |

| Regulator | People’s Bank of China (PBoC) | Market forces in offshore centres |

| Trading Location | Mainland China | Hong Kong, Singapore, London |

| Convertibility | Partially convertible, subject to capital controls | Freely convertible for international use |

| Price Determination | Central parity rate with ±2% trading band | Market-driven based on demand and sentiment |

| Primary Use | Domestic trade and settlement | International trade, hedging, and investment |

| Currency Code | CNY | CNH |

Is the Yuan a Floating Currency?

The Chinese yuan is a managed floating currency, not a fully free-floating one. The People’s Bank of China (PBoC) sets a daily midpoint rate against a basket of major currencies and allows the onshore yuan (CNY) to move within a ±2% band around that rate. This system balances market forces with policy control.

Why Trade the Chinese Yuan

The reason to trade the Chinese yuan is that it offers unique access to the world’s second-largest economy and reflects one of the most influential monetary systems in global finance. As China’s trade network and currency usage expand, the yuan presents traders with opportunities to diversify, hedge, and capture policy-driven market moves.

Here are the key reasons why many investors choose to trade the Chinese yuan:

A Window into the World’s Second-Largest Economy

China contributes nearly 18% of global GDP and remains the largest exporter worldwide. Trading the Chinese yuan allows investors to follow shifts in China’s growth, inflation, and monetary policy, all of which shape global supply chains and commodity prices. When China stimulates or tightens its economy, yuan pairs often react first, making them a useful barometer for global market sentiment.

Diversification and Correlation Benefits

The yuan’s movement often differs from traditional major pairs such as EUR/USD or USD/JPY, since it reflects regional policy and trade dynamics. Adding Chinese yuan exposure to a forex portfolio can help diversify risk and tap into Asia-driven opportunities, especially when Western markets move in the opposite direction.

Rising International Use

The yuan’s international role continues to expand as China promotes settlement in its own currency.

According to SWIFT, the renminbi (RMB) accounted for over 4% of global payment value in 2024, nearly double its share five years earlier. More countries now settle imports and exports directly in yuan, boosting liquidity in popular yuan FX pairs such as USD/CNH and EUR/CNH, and enhancing the yuan’s long-term relevance in the forex market.

Who Trades the Chinese Yuan

The Chinese yuan attracts a diverse mix of participants, from central banks to retail traders. Each group trades the yuan for different purposes from managing trade exposure to speculating on policy moves or interest-rate differentials.

Central Banks and Sovereign Funds

Many central banks and sovereign wealth funds hold yuan as part of their foreign-exchange reserves.

As China’s global trade share has expanded, official institutions such as the People’s Bank of China (PBoC), the Monetary Authority of Singapore (MAS), and the European Central Bank (ECB) have increased their yuan holdings for diversification and stability.

Multinational Corporations and Exporters

Corporates and import-export businesses trade or hedge yuan exposure to manage cash flows.

Chinese and overseas companies settle contracts in CNY or CNH to reduce conversion costs and exchange-rate uncertainty when paying suppliers or receiving payments from China.

Institutional Investors and Hedge Funds

Investment banks, hedge funds, and asset managers trade the yuan to capture interest-rate spreads, macro trends, and policy shifts. They often use USD/CNH spot, forwards, or non-deliverable forwards (NDFs) to express their views on Chinese growth, monetary easing, or trade-balance changes.

Retail Traders and Speculators

Retail traders access yuan FX pairs like USD/CNH through regulated online brokers. They speculate on short-term moves driven by Chinese economic data, U.S. dollar strength, and risk sentiment. Because the yuan reacts to macro headlines and policy fixings, it offers active traders frequent trading setups.

Governments and Trade Partners

Countries engaged in major trade with China including Russia, Brazil, Saudi Arabia, and members of ASEAN use the yuan for bilateral settlement. This trend, supported by China’s Cross-Border Interbank Payment System (CIPS), is steadily increasing global demand for yuan liquidity.

Chinese Yuan Current Performance

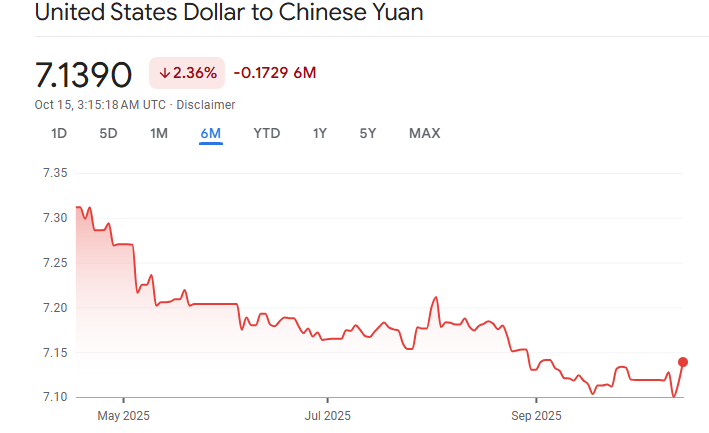

Over the past six months, the Chinese yuan has strengthened modestly against the U.S. dollar, with USD/CNY falling from around 7.31 in April 2025 to 7.14 in mid-October 2025, a 2.36% appreciation.

This trend reflects a stabilising Chinese economy, steady exports, and selective intervention by the People’s Bank of China (PBoC) to support the currency.

Although global demand and policy divergence with the U.S. still affect yuan movements, the USD/CNY pair has traded within a tight range between 7.10 and 7.25 since May, signalling a controlled yet resilient exchange rate environment.

Popular Yuan FX Pairs

The Chinese yuan (CNY/CNH) is traded against major global currencies, giving traders access to both regional and international market dynamics. Among all combinations, USD/CNH is by far the most traded yuan pair, but several others are gaining traction as the yuan’s global role expands.

USD/CNH

The U.S. dollar vs offshore yuan (USD/CNH) is the most liquid and widely traded yuan pair.

It reflects both Chinese monetary policy and global dollar strength. Because CNH trades freely in offshore markets like Hong Kong and Singapore, this pair offers real-time exposure to shifts in investor sentiment toward China. Many brokers quote USD/CNH instead of USD/CNY due to easier accessibility and fewer restrictions.

USD/CNY

The U.S. dollar vs onshore yuan (USD/CNY) operates under direct oversight from the People’s Bank of China (PBoC). The PBoC sets a daily midpoint reference rate and allows the yuan to trade within a ±2% band around it. This pair is less accessible to foreign traders but often signals how Chinese policymakers guide currency direction.

EUR/CNH

The euro vs offshore yuan (EUR/CNH) connects Europe’s largest trading bloc with China’s financial markets. It’s popular among institutions managing cross-border trade flows or hedging exposure to both the European Central Bank (ECB) and the PBoC’s policy cycles. EUR/CNH liquidity has improved steadily as more European banks settle transactions directly in yuan.

AUD/CNH and GBP/CNH

Pairs like AUD/CNH and GBP/CNH appeal to traders looking to capture interest-rate differentials or commodity-linked trends. The Australian dollar’s correlation with raw-material exports makes AUD/CNH sensitive to China’s demand for metals and energy. Meanwhile, GBP/CNH reflects yield spreads between the Bank of England and Chinese rates, adding diversification for advanced forex strategies.

CNH/JPY

The offshore yuan vs Japanese yen (CNH/JPY) is an increasingly active Asian regional pair, driven by trade and capital flow between the two largest Asian economies. While spreads are wider than in major pairs, CNH/JPY can be used to express views on Asian monetary policy divergence or safe-haven demand.

How to Trade Chinese Yuan

Trading the Chinese yuan (CNY/CNH) gives you exposure to one of the most influential currencies in global markets. Because the yuan operates under a managed float system, traders must understand its market structure, policy drivers, and trading hours before entering a position.

Follow these steps to start trading the Chinese yuan effectively:

Understand the Difference Between CNY and CNH

- CNY is the onshore yuan, traded within mainland China under the control of the People’s Bank of China (PBoC).

- CNH is the offshore yuan, traded in Hong Kong, Singapore, and London, where it floats more freely.

- Most brokers offer USD/CNH rather than USD/CNY because offshore trading is more accessible to international investors.

Choose a Regulated Forex Broker

Select a broker regulated by reputable authorities such as the FCA (UK). Look for features that support yuan trading:

- Availability of USD/CNH and EUR/CNH pairs

- Competitive spreads and transparent pricing

- Stable execution during Asian and U.S. trading sessions

- Clear risk disclosures and fund protection measures

Open a Demo Account First

Start with a demo or virtual account to practise trading strategies without risking real funds.

Demo trading lets you:

- Learn platform tools and charting functions

- Test trade sizes, leverage, and stop-loss settings

- Understand how PBoC fixings, U.S. dollar moves, and China data releases affect yuan prices

Analyse the Market

Combine fundamental and technical analysis:

- Fundamentals: Track China’s GDP, inflation, PMI, and policy statements from the PBoC.

- Technical tools: Use moving averages, Fibonacci retracements, and support/resistance zones on USD/CNH charts.

- News events: Watch for U.S.–China trade updates, monetary policy shifts, or central-bank interventions that can move the yuan sharply.

Plan Your Trade

Set clear entry and exit points before opening a position:

- Define your entry level, stop-loss, and take-profit orders.

- Limit leverage and risk no more than 1–2 % of your capital per trade.

- Consider using trailing stops to protect profits in trending markets.

For example: If you expect the yuan to weaken, you might go long USD/CNH at 7.14 with a stop-loss at 7.10 and a target at 7.20.

The best time to trade USD/CNH is when Asian and European markets overlap (around 08:00–12:00 GMT), as this period offers higher liquidity and tighter spreads.

Conclusion

The Chinese yuan (CNY/CNH) has evolved into one of the most watched currencies in the forex market, offering traders exposure to China’s economic momentum and policy direction. Understanding what is Chinese yuan and how you trade it helps you navigate its dual structure, onshore (CNY) and offshore (CNH) and the unique balance between market dynamics and central bank control.

In a globalised economy, trading the yuan isn’t just about speculating on price movements; it’s about recognising China’s growing influence on commodities, trade, and monetary trends. Whether you’re diversifying a portfolio or exploring emerging market opportunities, forex trading with the Chinese yuan can open doors to new strategies and perspectives.

Trade wisely, stay informed, and always align your decisions with clear analysis and risk management because in forex, understanding the market’s foundation is as important as timing your next move.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.