Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomMorning Star Candlestick Pattern Guide

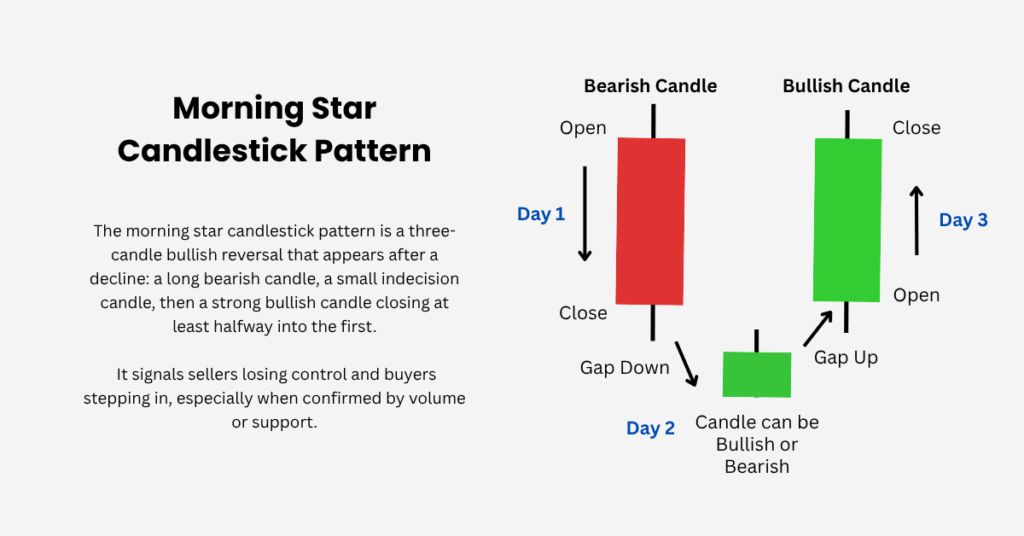

The morning star candlestick pattern is a three candle bullish reversal that appears after a decline. Traders value it because it blends clear price action with disciplined risk control. This guide moves step by step from definition and psychology to identification, confirmation, and trade execution so the flow stays logical and easy to follow.

What Is A Morning Star Candlestick Pattern

A morning star signals a shift from selling pressure to buying pressure.

- Candle 1 is a long bearish real body that shows control by sellers

- Candle 2 is a small real body that reflects hesitation and indecision

- Candle 3 is a strong bullish real body that closes well into Candle 1

The pattern is strongest when Candle 3 closes at least halfway into Candle 1 and ideally beyond two thirds of its body.

Psychology Behind The Morning Star Pattern

The story unfolds in three steps. First, bears dominate and push price lower. Second, momentum stalls as participants hesitate and short sellers start to cover. Third, buyers step in with conviction and drive price back through prior supply. This transition from control to conflict to control is why the morning star candlestick pattern is treated as a reversal cue rather than a simple bounce.

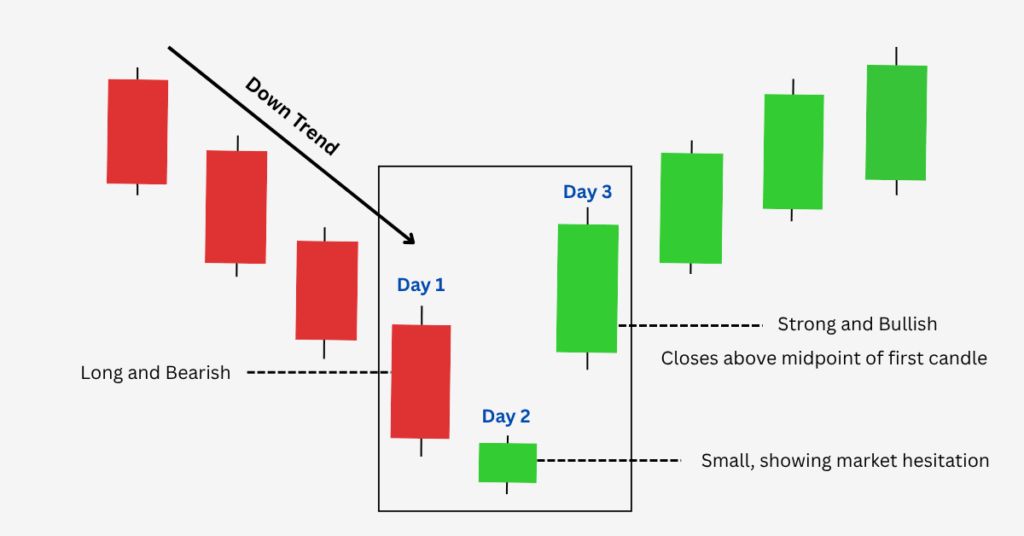

How To Identify A Morning Star Candlestick Pattern

Work through these checks in order to filter for higher quality setups.

- Clear Downtrend

The pattern has meaning only after a visible decline or a series of lower lows and lower highs. - Three Candles With Structure

- Candle 1 is a large bearish candle

- Candle 2 is a small body that can be bullish or bearish

- Candle 3 is a strong bullish candle that closes at least halfway into Candle 1

- Helpful Placement Details

The body of Candle 2 often sits below the close of Candle 1. A small gap helps in equities but is optional in round the clock markets like forex and crypto. - Location And Confluence

The setup works better near a previous support level, round number, demand zone, or a rising moving average that buyers already respect. - Volume Or Volatility Confirmation

Rising volume or visible volatility expansion on Candle 3 strengthens the message that control has changed hands.

Doji Morning Star Versus Standard Morning Star

The Doji Morning Star is a common variant where Candle 2 is a doji with little or no body. It highlights stronger indecision and sometimes leads to a cleaner reversal. The trading logic is the same and you still want a decisive Candle 3 close deep into Candle 1.

Confirmation And Filters

Confirmation improves odds without overfitting.

- Close Beyond The Midpoint

Candle 3 should close beyond the midpoint of Candle 1. Deeper closes add conviction. - Follow Through Day

A higher close on the next session confirms ongoing demand. - Indicator Support

RSI turning up and crossing above 30 from oversold supports the reversal. A MACD bullish crossover adds momentum proof. A short term moving average crossing above a longer one reinforces trend change. - Bollinger Context

A bounce from the lower band combined with the morning star suggests exhaustion of the prior sell off.

Entry And Exit Tactics

Here is a simple rules based approach to trade the morning star candlestick pattern while keeping risk defined.

- Entry

Consider buying at or just above the high of Candle 3. Conservative traders wait for a small intraday pullback or a break above nearby resistance. - Stop Loss Options

Choose one method and be consistent.- Technical stop below the low of Candle 2 or the pattern low

- Fixed risk model such as one to two percent of account equity

- Trailing stop that moves under each higher swing low after the trade gains

- Time based stop where you exit if there is no positive progress after a set number of bars

- Targets

Use nearby resistance levels, measured move projections, or a risk to reward of at least one to two. Consider a partial take profit at the first target and trail the rest to capture extensions. - Position Sizing

Size so that the chosen stop represents a predefined fraction of your account risk.

Where the Morning Star Works Best

The formation is market agnostic and applies to forex, stocks, indices, commodities, and crypto.

- Intraday provides more signals but demands strict cost control and fast execution

- Daily and weekly produce fewer signals with generally higher quality and cleaner context

- News heavy assets require extra caution around announcements and data releases

Before you deploy the setup widely, weigh the trade offs.

Benefits and Limitations of the Morning Star

Here is a table that summarises the strengths and pitfalls of the morning star candlestick pattern at a glance.

| Benefits | Limitations |

| Early reversal signal near potential bottoms | False signals in choppy or range bound markets |

| Clear entry logic with a visible three candle structure | Sensitivity to execution costs on lower timeframes |

| Combines well with support zones and common indicators | Requires confirmation and disciplined risk control to be effective |

Common Mistakes to Avoid

Most frustrations come from avoidable errors. Here is what to watch.

- Taking the pattern in the middle of a range without context

- Ignoring Candle 3 strength and entering too early

- Using stops that are too wide or too tight for the chosen timeframe

- Overlooking spreads, slippage, and fees on lower timeframes

- Relying only on visuals without a written plan and predefined exits

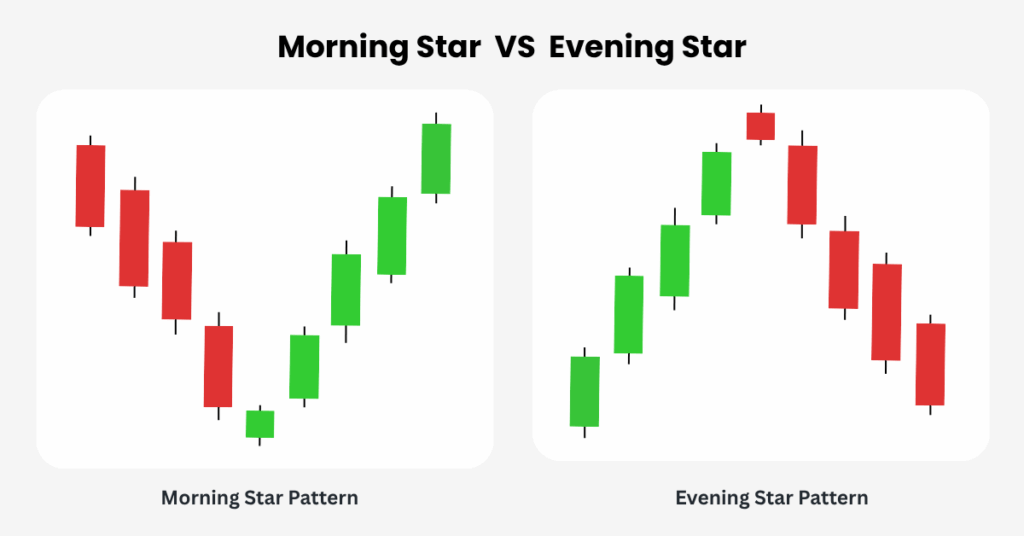

Now that the bullish setup is complete, it helps to recognise its bearish mirror image so you do not mix the two in live markets.

Morning Star vs Evening Star

So far we have focused on the bullish morning star. Its bearish counterpart is the evening star which appears after a rally. The structure is the same in reverse. A strong bullish candle, a small indecision candle, then a strong bearish candle closing deep into the first. Knowing both patterns sharpens your ability to read shifts in control across market cycles.

Beyond single three candle reversals, longer bullish formations can align with a fresh morning star near support.

Related Bullish Patterns for Context

Study cup and handle and rounding bottom patterns. When these longer formations align with a new morning star at support, the chance of a sustained recovery can improve.

Final Takeaway

The morning star candlestick pattern can add precision to your reversal playbook when used within a structured process. Focus on context, demand a decisive third candle, stack objective confirmations, and protect your downside. With those habits, the pattern becomes a disciplined way to participate in emerging upswings rather than a hopeful guess.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.