Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What Is a Trading Edge

A trading edge is a measurable advantage that gives a trader a higher probability of profit over time. It’s the factor that makes your strategy statistically positive meaning your average gains exceed your average losses after costs. In short, a trading edge turns consistent analysis and risk control into long-term profitability.

Expectancy formula: Expectancy=(Pwin×Avg Win)−(Ploss×Avg Loss)

If the value is consistently > 0, you have a trading edge.

Signals your edge is real

- Rules you can state in one sentence (entry, stop, exit).

- Independent validation: backtest, out-of-sample, then forward test.

- Costs included (no “demo only” illusions).

- Stable performance across markets/sessions you actually trade.

Why Is Trading Edge Important

A trading edge is important because it gives traders a statistical advantage that separates skill from luck. With a proven edge, traders can manage risk objectively, achieve consistent growth, and make data-driven decisions instead of emotional ones, all of which are essential for long-term profitability.

- Consistency beats luck: A positive expectancy smooths results across large samples.

- Risk clarity: Knowing your edge informs stop placement, take-profit logic, and allowable drawdowns.

- Sane position sizing: With a measurable edge, you can size positions (e.g., fixed-fractional) without over-risking.

- Reviewability: Clear rules create clean data so you can improve or retire a setup based on evidence.

How to Gain a Trading Edge

Define the Behaviour You’re Exploiting

Choose one setup (e.g., trend pullback, breakout after volatility squeeze, mean reversion into VWAP). Write the entry, stop, exit in plain language.

Quantify Expectancy First

Backtest the setup. Then walk-forward on fresh data. Expectancy must remain positive after all costs.

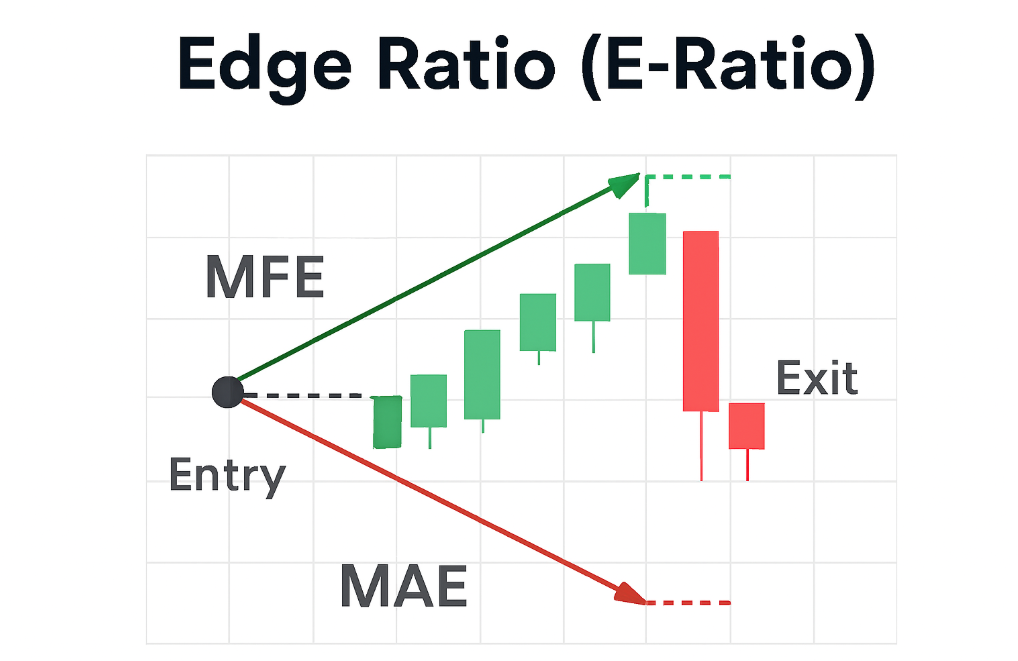

Place Stops/Exits with Data (MAE/MFE)

Study Maximum Adverse Excursion (MAE) and Maximum Favourable Excursion (MFE) from your trade log to set realistic stops, profit targets, and time-based exits.

Size Positions Prudently

Use fixed-fractional risk (e.g., 0.5%–1% per trade). If you model probabilities well, a fraction of Kelly can be a ceiling (never full Kelly in live trading).

Validate Live

Forward test with tiny size. Keep a one-page playbook: market, timeframe, filter, entry trigger, stop logic, exit logic, checklist, and post-trade review.

What Is Edge Ratio

Edge Ratio compares typical favourable excursion vs adverse excursion after your signal (often over the first N bars/candles, volatility-normalised).

- 1.0 means price tends to move in your favour more than against you at that horizon.

Use it to:

- Rank entries (which triggers have the best excursion profile?)

- Select holding period (exit around the bar where favourable excursion maxes)

- Refine stops (avoid stop levels where normal noise would hit you)

For example:

Your validated setup over 400 trades shows: Win rate 42%, Average win 2.4R, Average loss 1.0R

Expectancy = 0.42×2.4−0.58×1.0=1.008−0.58=0.428R per trade (pre-sizing).

Edge-ratio study shows most favourable movement arrives by bar 6 on M15. You adopt a time-based exit at bar 6 if target hasn’t hit. This improves realised expectancy and reduces decision fatigue.

Checklist for Building Your Edge

A trading edge doesn’t appear overnight. It’s developed through structured testing, discipline, and data. Use this checklist to build, measure, and refine your edge step by step for consistent trading performance.

Define Your Setup

Select a market, timeframe, and session you understand best. Write clear entry, stop, and exit rules based on observable behaviour. Include filters like trend direction, volatility level, or liquidity zone.

Backtest and Validate

Run historical tests to confirm positive expectancy after spreads and slippage. Use out-of-sample and forward testing to verify your results. Record every trade, outcome, and reason for entry to ensure transparency.

Manage Risk Effectively

Risk only a fixed percentage of equity per trade (0.5%–1% is common). Track Maximum Adverse Excursion (MAE) and Maximum Favourable Excursion (MFE) to fine-tune stops and targets. Set daily and weekly loss limits to prevent emotional decisions.

Optimise Position Sizing

Apply fixed-fractional or fractional Kelly sizing depending on confidence in your data. Adjust lot size as account balance changes, not emotions.

Review and Evolve

Keep a detailed trade journal and review performance monthly. Retire or adjust setups if expectancy drops or volatility regimes shift. Continue testing new ideas to adapt your edge to changing markets.

Conclusion

In forex trading, having a clear trading edge is what separates disciplined traders from emotional ones. Markets may shift, but a proven edge built through data, risk control, and continuous testing remains your strongest asset.

Focus on creating strategies with measurable expectancy, applying consistent risk management, and refining your position sizing as conditions change. The more you quantify your performance, the more confidence and stability you gain in every trade.

Whether you trade major pairs or CFDs, your trading edge is what keeps you profitable through volatility and uncertainty. Keep learning, testing, and improving because in forex, your edge is your survival.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.