Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

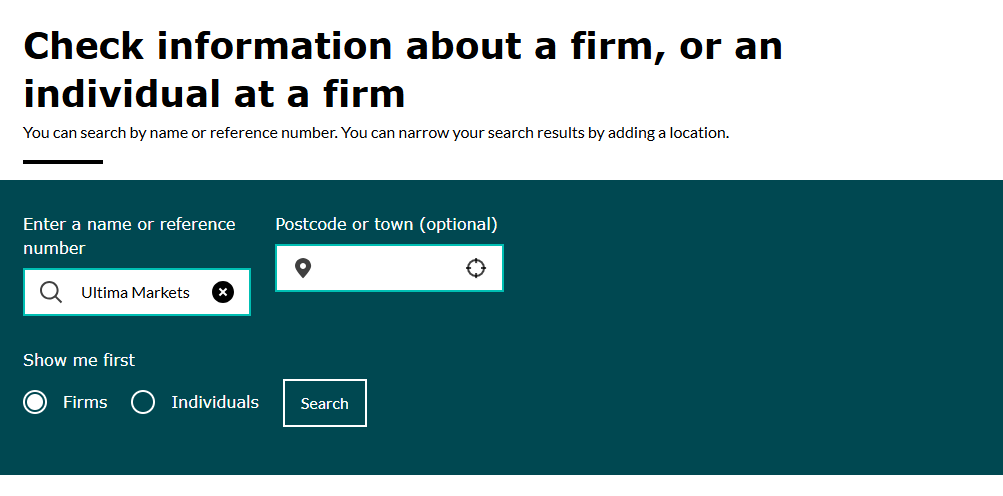

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomHow to Verify a Regulated Broker in 2025

Everyday in 2025, another name lands on a regulator’s warning list. In the year to March 2025, the UK’s FCA alone issued 2,240 alerts about unauthorised firms and individuals. In mid August 2025, CySEC added 17 more websites in a single notice, and IOSCO’s global alerts feed continues to update with fresh warnings.

A licence for a broker means rules that protect client money. It means ongoing supervision and the power to act when things go wrong. It also means clear avenues for redress through recognised complaint and compensation frameworks. Regulated brokers must meet conduct, disclosure, and capital standards that unregulated ones simply do not.

Unregulated or falsely regulated brokers can disappear with deposits, refuse withdrawals, or hide behind fake credentials. Clone firms may even reuse real licence numbers to look legitimate. In 2025, EU regulators warned that some firms misuse their regulated status in marketing, blurring the line between protected and unprotected products. If something sounds too good to be true, it probably is.

You can actually verify a broker in minutes. The steps that follow will help you check the claimed licence, confirm permissions on the official register, and spot warning signs before you fund an account.

Step 1: Check the Claimed Licence

First, look for precise legal text, not badges. Most regulators prohibit firms from using their logo in ways that imply endorsement. So the credible signal on a broker’s site is a plain-text status disclosure with the full legal entity name and a licence or reference number in the footer or legal pages. The FCA, for example, is explicit that firms must not use the FCA logo, and it repeats this in its public guidance.

Also watch for group naming and representative models. A trading broker’s website may show a well-known brand, while the legal footer names a different entity or an appointed representative acting under a principal firm’s licence. This structure is common in the UK.

In fact, at the end of February 2025, there were 2,571 principal firms overseeing 33,380 appointed representatives. That prevalence is exactly why the claimed licence must match the entity you will actually contact with.

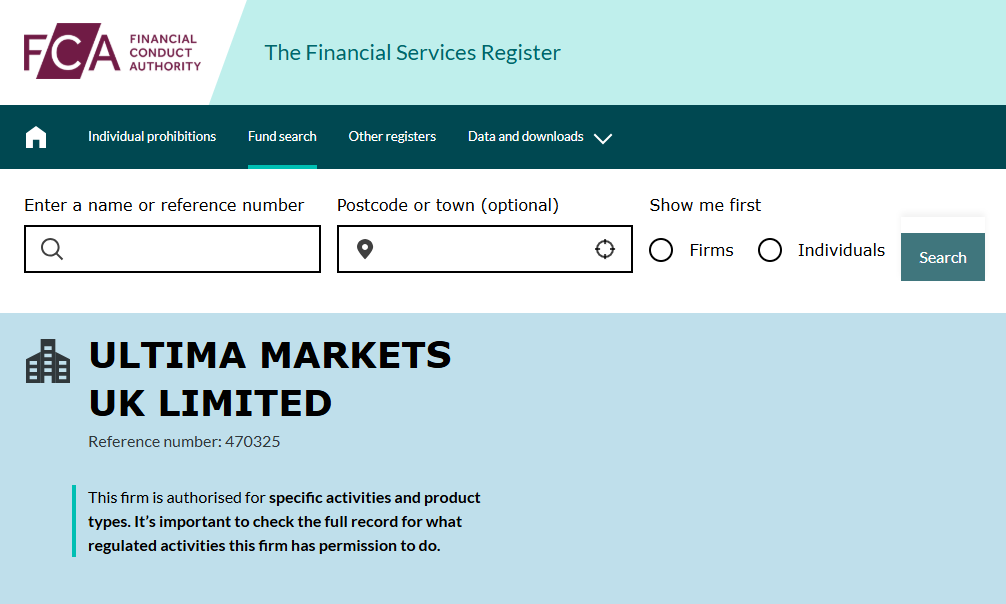

Step 2: Use the Official Register

Once you’ve identified a broker’s claimed licence, it’s important to confirm its authenticity. This can be done quickly through the official regulatory registers. By checking the relevant register, you can verify the legal entity name, reference number, and the specific permissions granted to the firm.

To verify a broker’s claim, visit the official register for the relevant regulatory body. You can search by the firm’s name or the licence number to check that it matches what the broker claims. You can also confirm the specific permissions the broker holds, ensuring that they are authorised to offer the services they claim, such as CFDs or forex trading. If anything seems inconsistent or unclear, this should raise a red flag.

Where to Search:

- FCA (UK): Visit the FCA Financial Services Register to search by the firm’s name or licence number.

- FSCA (South Africa): Access the FSCA Financial Sector Conduct Authority Register to look up licensed financial services providers.

- FSC (Mauritius): Use the FSC Mauritius Financial Services Register to verify the broker’s licence and status.

It’s also critical to watch out for clone firms, which may use legitimate licence numbers but operate without proper supervision. Always use these official resources to cross-check and ensure the broker’s regulatory claims are accurate before proceeding.

Step 3: Review the Broker’s Operations

Once you have confirmed a broker’s licence, it’s time to look deeper into their operational practices. A licence alone does not guarantee the safety of your funds or fair treatment during disputes, so it’s essential to assess the broker’s actual operational standards.

One factor to consider is whether the broker is a member of a recognised dispute resolution body, such as the Financial Commission. These bodies offer independent arbitration for disputes between traders and brokers, providing an alternative route for resolving conflicts outside of the court system.

Having access to such a dispute resolution system can act as a safety net, especially if issues arise that the broker is unwilling to resolve directly.

Lastly, look into any insurance coverage for client funds. Some regulated brokers, particularly those operating in high-risk environments, offer insurance to cover client deposits up to a certain amount. At Ultima Markets, for example, we align with global standards, with FCA regulation, access to dispute resolution bodies, and up to US$1 million in insurance coverage for client funds through our partnership with Willis Towers Watson (WTW).

This coverage is automatic for all Ultima Markets clients at no additional cost, further demonstrating our commitment to providing a safe and secure trading environment. By verifying these operational practices, you can rest assured that the broker you choose upholds the highest standards of client protection.

The Takeaway

In 2025, verifying a broker is less about flashy claims and more about conducting thorough due diligence. A broker’s regulatory licence is an important starting point, but it’s only the beginning of the process. It’s important to look beyond the surface and examine how the broker operates, how they manage client funds, and what protections they offer.

Remember, “verify first, trade later.” Taking a few extra minutes to ensure a broker’s legitimacy can save you from potential risks down the line.

Ultima Markets UK Ltd will meet these criteria in practice. As a broker regulated by the Financial Conduct Authority, Ultima Markets UK Ltd’s status and licence are available for verification on the FCA Financial Services Register.

Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.