Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomVolatility Contraction Pattern (VCP) Explained

The Volatility Contraction Pattern (VCP), popularized by renowned trader Mark Minervini, is one of the most powerful tools for identifying breakout opportunities in the stock market. In this article, we’ll explore how the VCP works, its key characteristics, and how traders can use it to identify stocks poised for explosive breakouts.

What is the Volatility Contraction Pattern (VCP)?

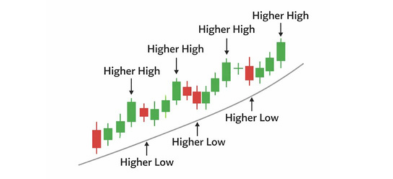

The Volatility Contraction Pattern (VCP) is a chart setup that forms when a stock undergoes a series of progressively smaller pullbacks (or contractions) in price and volume. This setup indicates that selling pressure is diminishing, and demand may be building, setting the stage for a potential breakout.

Minervini describes the VCP as a continuation pattern that typically occurs in stocks that are already in a strong uptrend. The pattern forms when price action tightens over time, signaling that the stock is ready for a strong breakout once demand overtakes the remaining supply.

Key Characteristics of the VCP Pattern

There are several critical features that define the Volatility Contraction Pattern (VCP). Understanding these components is crucial for identifying the pattern effectively:

1. Price Contractions

The heart of the VCP is a series of price pullbacks that get progressively smaller. For example, the first pullback might be 25%, the second might be 15%, and the final one could be just 8%. Each pullback indicates that selling pressure is easing, and the stock is preparing for a breakout.

2. Decrease in Volume

Along with the smaller price contractions, volume typically decreases with each pullback. This decline in volume signals that fewer sellers are active, and the stock’s supply is drying up. This creates a scenario where demand is starting to build.

3. Symmetry and Structure

A typical VCP forms a symmetrical base, where each contraction is smaller than the last. This structure suggests institutional investors are accumulating shares, which leads to a tight price range before a potential breakout.

4. Low Supply at the Pivot Point

As the stock price contracts, it often reaches a pivot point, a key level where the price action becomes very tight. When the stock breaks above this level on higher volume, it typically marks the start of a strong upward move.

5. Continuation in an Uptrend

The VCP works best when the stock is in a strong uptrend. The pattern acts as a pause or consolidation before the next leg higher, making it a valuable tool for traders looking to ride momentum.

How the VCP Works: The Psychological Play

The Volatility Contraction Pattern is not just about price movement; it’s also about understanding institutional investor behavior. As institutions accumulate shares, the price contracts and tightens, often with smaller pullbacks. This phase of the VCP pattern occurs when demand begins to surpass supply, leading to increased buying interest and setting up the conditions for a breakout.

This diminishing selling pressure signals that buyers are gaining control. Once demand outpaces the remaining supply, the stock breaks out with increased volume, confirming the strength of the move.

The Stages of the VCP Pattern

The VCP evolves over time, and traders watch for these distinct stages:

1. Wide Price Swings (Initial Volatility)

In the beginning, the stock experiences wild swings. This stage is marked by uncertainty, as traders who previously made profits are now facing potential losses. This leads to sharp price movements, often as the market struggles to find direction.

2. Smaller Pullbacks

As institutional buying begins, these wide swings subside, and price pullbacks become smaller. Each contraction shows diminishing selling intensity, signaling that sellers are running out of momentum, while buyers become more aggressive.

3. Breakout

In the final stage, the stock enters a tight consolidation, with price action narrowing significantly. Volume during this stage drops, showing that supply is limited. Once the stock breaks above this tight range with high volume, it signals the start of a potential breakout.

How to Trade the VCP Pattern

Trading the VCP involves identifying the correct entry point, managing risk, and using volume confirmation. Here’s a simple guide based on Mark Minervini’s approach:

1. Entry Point:

The ideal entry point occurs when the stock breaks above the final contraction, typically within 0 to 10% from the previous high. The breakout should be accompanied by high volume, which confirms strong demand.

2. Stop Loss:

Place your stop-loss just below the lowest point of the last contraction. This helps to limit your risk in case the breakout fails.

3. Profit Target:

Set your profit target at previous resistance levels or use a multiple of your risk to calculate a clear risk-to-reward ratio.

The VCP’s Risk-to-Reward Ratio

One of the key benefits of the VCP is its favorable risk-to-reward ratio. By entering near the pivot point and placing a tight stop-loss, traders can limit their risk to just 5-8% while aiming for higher returns. This makes the VCP an attractive setup for traders seeking low-risk, high-reward opportunities.

Scanning for VCP Opportunities

To spot VCP setups, traders can use stock scanners with filters for:

- Tightening price ranges

- Declining volume

- Strong uptrend

By setting these parameters, traders can quickly identify potential breakout candidates. Using scanners allows traders to focus on high-potential setups without having to manually analyze each stock, improving efficiency and accuracy.

VCP Works Best in Trending Markets

The VCP works most effectively in strong uptrends, as it maximizes the chances of a successful breakout. In a sideways or choppy market, the success rate of the VCP is lower.

Even in less favorable conditions, the VCP pattern offers a low-risk entry with a high-reward potential, making it a powerful tool for traders focused on high-probability setups.

Mastering the Volatility Contraction Pattern

The Volatility Contraction Pattern (VCP) is a valuable tool for traders looking to capture high-potential breakouts in trending stocks. By understanding the psychological dynamics, focusing on key entry points, and using risk management, traders can maximize their chances of success.

With time and practice, the VCP can become an essential part of your trading strategy, helping you identify stocks with the potential for explosive moves while controlling your risk.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.