Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

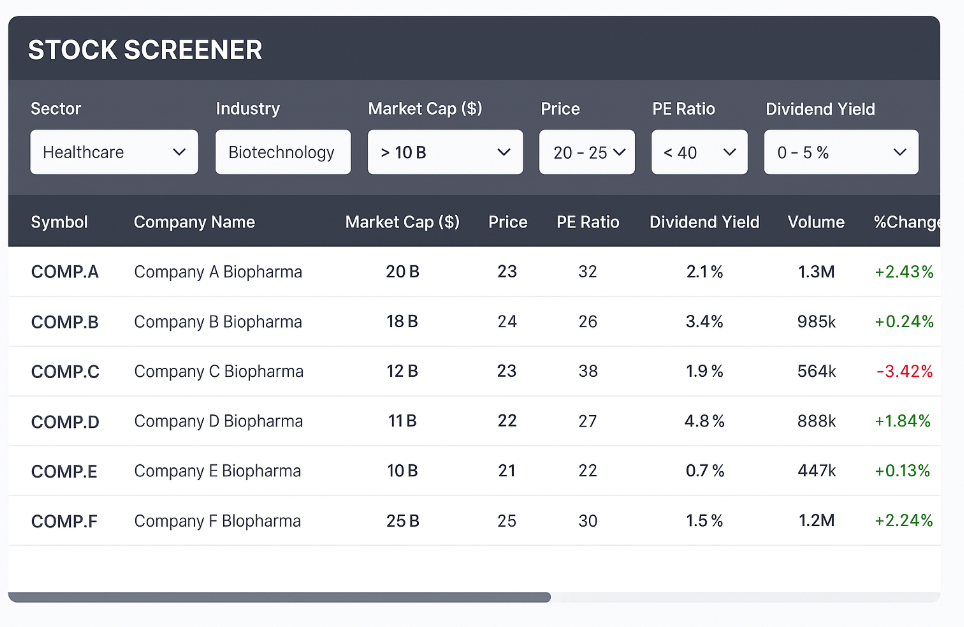

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomIf you’ve ever wondered how traders find opportunities in a market filled with thousands of stocks, the answer is often a stock screener. This powerful tool helps traders and investors cut through the noise by filtering stocks based on specific criteria such as price, valuation, sector, or technical signals.

What Is a Stock Screener?

A stock screener is an online or software-based tool that lets traders filter and sort stocks using both fundamental and technical criteria. Instead of manually going through thousands of tickers, you can set rules such as:

- Price-to-Earnings (P/E) ratio below 20

- Dividend yield above 3%

- 50-day moving average above the 200-day moving average

- Market capitalization above $1 billion

A refined list of potential stocks that match your strategy, saving you hours of research. In short, a stock screener is like a search engine for traders, helping you quickly find stocks that fit your trading or investing style.

Why Are Stock Screeners Important?

Global exchanges list tens of thousands of stocks. Without filters, traders risk information overload. Stock screeners add value in several ways:

- Efficiency: Quickly generate a shortlist of stocks that meet your criteria.

- Objectivity: Rely on data instead of emotions when choosing trades.

- Flexibility: Adapt screening for short-term trading, swing trades, or long-term investing.

- Opportunity discovery: Spot hidden gems that manual research might miss.

For example, in the AI boom of 2023–2024, screeners focusing on revenue growth and momentum indicators highlighted NVIDIA (NVDA) and Super Micro Computer (SMCI) before they became mainstream picks.

Types of Stock Screeners

Traders use different types of stock screeners depending on whether they focus on fundamentals, technicals, or advanced data analytics. Here are the main categories:

Fundamental Stock Screeners

These are built for investors who prefer fundamental analysis, evaluating a company’s financial health and long-term value.

Typical filters include:

- Valuation metrics: Price-to-Earnings (P/E), Price-to-Book (P/B), EV/EBITDA

- Growth metrics: EPS growth rate, revenue growth, profit margins

- Financial stability: Debt-to-equity ratio, free cash flow, return on equity (ROE)

- Dividends: Dividend yield, payout ratio

For example, an income investor might screen for U.S. companies with Dividend Yield > 4%, Market Cap > $10B, and Debt-to-Equity < 0.5. This could bring up companies like Johnson & Johnson (JNJ) or Coca-Cola (KO).

Technical Stock Screeners

These cater to active traders and swing traders who rely on price action and technical signals.

Common filters include:

- Moving averages (e.g., 50-day, 200-day)

- Relative Strength Index (RSI)

- MACD crossovers

- Breakouts above resistance or below support

- Average daily trading volume

For example, a day trader could set filters for RSI < 30 (oversold), volume > 2M shares, and 50-day MA above 200-day MA to find potential rebound stocks.

Sector and Industry Screeners

Some screeners allow filtering by sector, industry, or theme. This is useful for traders targeting emerging trends such as clean energy, artificial intelligence, or electric vehicles.

For example, a trader bullish on renewable energy might screen for U.S. Clean Energy companies with market cap > $1B and revenue growth > 15%. This could identify stocks like Enphase Energy (ENPH) or First Solar (FSLR).

ETF and Mutual Fund Screeners

Beyond individual stocks, many platforms offer ETF and fund screeners. These allow investors to filter funds by expense ratio, asset class, performance, and sector exposure.

For example, an investor could search for ETFs with expense ratio < 0.2%, exposure to U.S. tech sector, and 5-year return > 10%, which might highlight Invesco QQQ (QQQ) or Vanguard Information Technology ETF (VGT).

AI-Powered and Custom Screeners

The latest evolution in trading tools are AI-powered screeners, which integrate big data, machine learning, and even social sentiment analysis.

Features include:

- Natural language queries (“Find undervalued energy stocks with low debt and strong EPS growth”)

- Integration with alternative data like Google Trends or Twitter sentiment

- AI-based scoring systems ranking stocks by probability of outperforming

Real-Time and Pre-Market Screeners

For day traders, real-time screeners are crucial. These track live price movements, unusual volume spikes, and pre-market movers before the opening bell.

For example, a trader watching for pre-market gainers with news catalysts and high liquidity could spot opportunities in companies announcing earnings beats or major partnerships

Advantages and Limitations of Stock Screeners

Like every trading tool, stock screeners come with both strengths and weaknesses. Understanding these helps you maximize their value while avoiding common pitfalls.

Advantages

- Saves research time

- Provides unbiased data filtering

- Customizable for all trading styles

- Helps improve decision-making and risk management

Limitations

- Free screeners may lack real-time accuracy

- Wrong filters can eliminate good opportunities

- Some asset classes (like bonds or international ETFs) may not be supported

- Screeners don’t replace deeper due diligence

How Different Traders Use Stock Screeners

Stock screeners aren’t one-size-fits-all. The way you use them depends on your trading style, time horizon, and risk appetite. Here’s how different types of traders put screeners to work:

- Day Traders: Scan for volatile, high-volume stocks each morning.

- Swing Traders: Search for momentum setups with RSI or MACD confirmation.

- Long-Term Investors: Focus on valuation metrics like P/E ratios, book value, and dividend yield.

- Quant Traders: Combine screeners with backtesting and automated strategies.

Conclusion

A stock screener is more than a convenience. It’s a powerful tool that transforms raw market data into actionable trade ideas. By filtering thousands of stocks down to a focused watchlist, you gain clarity, save time, and reduce emotional decision-making.

Whether you’re a day trader scanning for breakouts, a swing trader riding short-term momentum, or a long-term investor seeking stable dividend stocks, screeners help align opportunities with your strategy. Of course, the tool itself is only part of the equation, success also depends on trading with a broker that provides reliable data, transparent execution, and strong regulatory oversight.

At Ultima Markets, we combine technology with trust. As an FCA-regulated broker, we provide traders access to advanced platforms, educational resources, and tools designed to help you trade smarter. When you use a stock screener to identify opportunities, you can count on Ultima Markets to deliver the execution and support you need to act with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.