Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

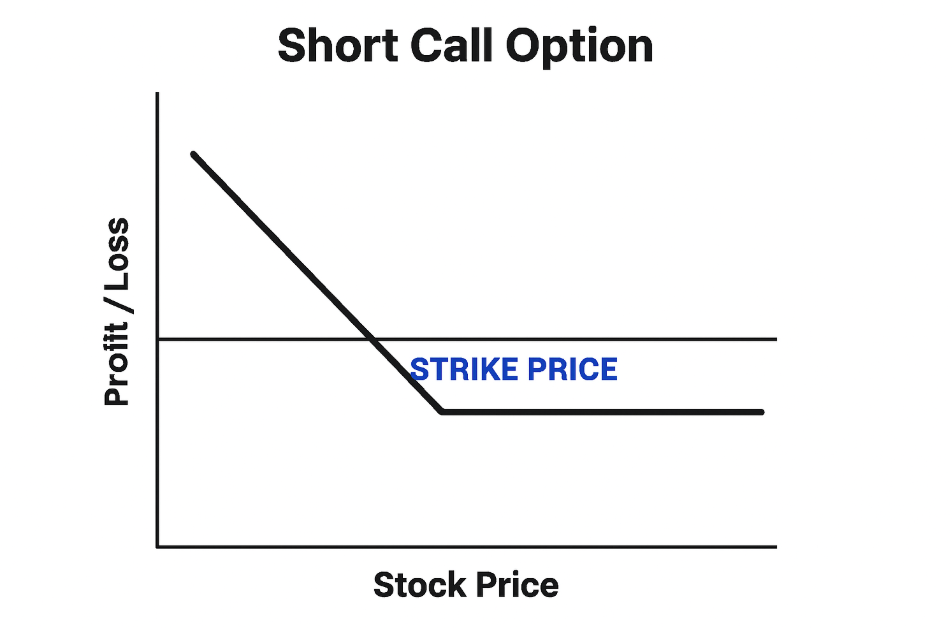

A short call option is one of the most advanced strategies in options trading. While it offers a steady premium income, it also comes with unlimited risk if the underlying asset rises sharply. Traders use short calls when they expect prices to remain flat or decline.

What Is a Short Call Option?

A short call option is an options strategy where a trader sells a call contract, collecting premium income while taking on the obligation to sell the underlying asset at the strike price if exercised. Profit is limited to the premium received, but potential loss is unlimited if the asset price rises.

- If the market stays below the strike, the option expires worthless and you keep the premium.

- If the price rises above the strike, the buyer can exercise, forcing you to deliver the asset at the strike price.

Key facts about short calls:

- Profit is limited to the premium received.

- Loss can be unlimited because asset prices have no upper cap.

- They can be covered (you own the underlying) or naked (you don’t own it).

Because of the risk, naked short calls are best suited for professional traders with strict risk controls.

How to Short Call Option

To short a call option, a trader sells a call contract on an underlying asset they expect will not rise above the strike price. The seller collects a premium upfront but takes on unlimited risk if the price surges, making margin and risk management essential.

Placing a short call option trade involves these steps:

Select the underlying asset

Pick a stock, ETF, or index you believe will stay flat or decline. For example, if XYZ trades at $90, you might target a $100 call option.

Choose strike and expiration

Most traders short out-of-the-money (OTM) calls, where the strike is above the current market price. This increases the chance the option expires worthless.

Sell to Open (STO)

Place a “sell to open” order for the call option. This creates your short call position and credits you with the option premium immediately.

Provide margin

Naked short calls require substantial margin because of unlimited risk. Brokers set the collateral requirement based on volatility and exposure.

Monitor position

Keep an eye on:

- Theta (time decay): works in your favor.

- Vega (implied volatility): spikes hurt a short call.

- Delta (price movement): rising delta means more exposure if the stock climbs.

Adjust or exit

If the market moves against you, you can:

- Buy to close the option early.

- Roll to a later expiration or higher strike.

- Hedge by buying another call (creating a bear call spread).

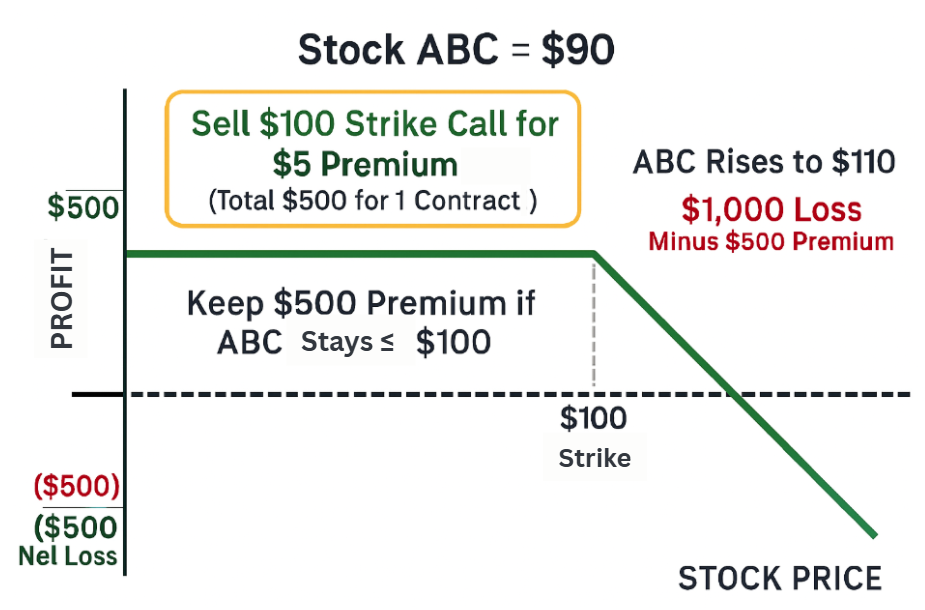

For Example:

- Stock ABC at $90.

- You sell a $100 strike call for $5 premium (total $500 for 1 contract).

- If ABC stays ≤ $100, you keep the full $500.

- If ABC rises to $110, your loss is $1,000 minus the $500 premium = –$500 net.

How to Hedge a Short Call Option

Because losses can escalate, professional traders often hedge their short calls. Some methods include:

- Bear Call Spread: Buy a higher strike call to cap your maximum loss.

- Covered Call: Hold the underlying shares, so you can deliver them if assigned.

- Rolling: Close the current short call and reopen at a later expiration or higher strike to buy time or adjust exposure.

For example, if you short a call at $100 and the stock rallies, buying a $105 call converts your position into a spread, limiting your risk.

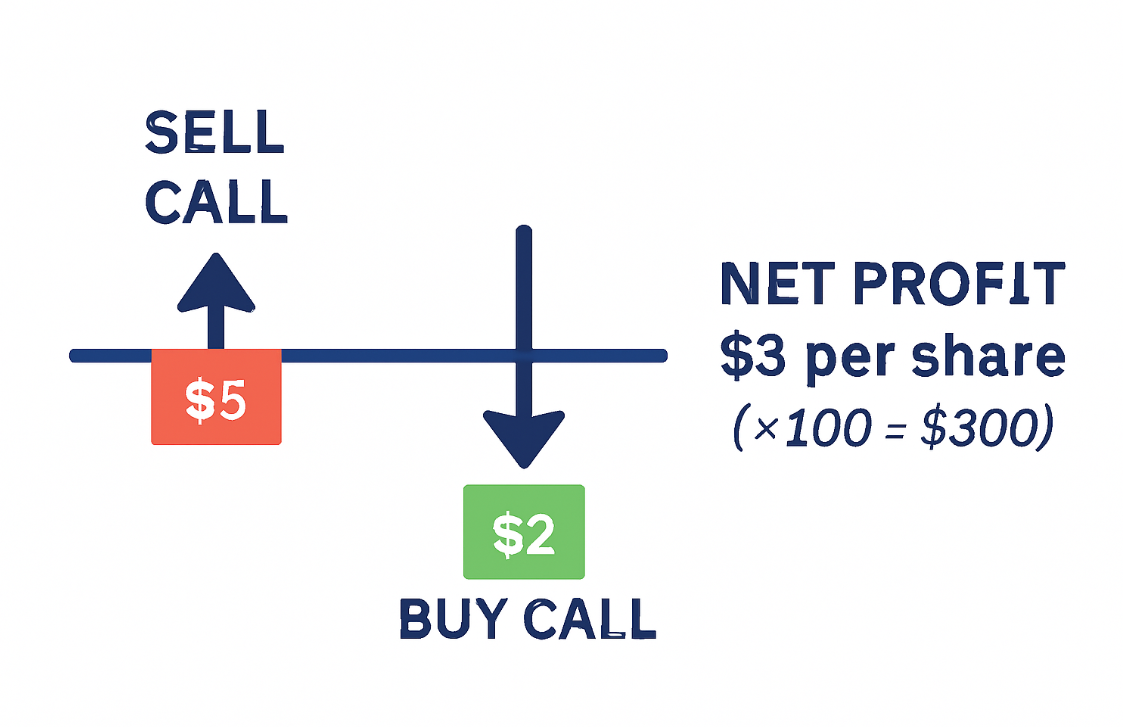

How to Close a Short Call Option

To close a short call option, you place a buy to close (BTC) order on the same contract, offsetting your original sale. If the option’s value has declined, you profit; if it has risen, you take a loss. Alternatively, you may let it expire worthless.

There are several ways traders can close or exit a short call position:

Buy to Close (BTC)

The most common method. You purchase the exact same option you originally sold. If the option premium is lower than when you sold, you lock in a profit. If higher, you realize a loss.

Example: You sold a call at $5 premium. If the premium falls to $2, buying it back nets you $3 per share profit (×100 = $300).

Let the Option Expire

If the underlying closes below the strike price, the option expires worthless. You keep the full premium received without needing to buy back the contract.

Example: You sold a $100 strike call, and the stock finishes at $95 at expiration. The option expires worthless, you keep 100% of the premium.

Assignment

If the underlying closes above the strike price, the buyer may exercise early or at expiration. You are then obligated to sell the underlying at the strike. For naked calls, this means sourcing shares from the market, potentially at a big loss.

Rolling the Short Call

A popular adjustment strategy. You buy to close your current call and simultaneously sell another call at a later expiration or different strike price. Rolling can extend the trade, reduce risk, or capture more premium.

Example of a Short Call Option

Imagine Stock XYZ is trading at $90. You sell a call with a $100 strike for $5 premium. Each contract covers 100 shares, so you collect $500.

Outcomes:

- If XYZ stays below $100, you keep the full $500 profit.

- If XYZ rises to $102, your obligation is to sell at $100. Your effective loss is $200, offset by the $500 premium, netting $300 profit.

- If XYZ jumps to $110, you lose $1,000, reduced by the $500 premium, leaving a net loss of $500.

This shows why the risk is unlimited while the reward is capped.

Short Calls vs Long Puts

A long put is safer for new traders since losses are capped, while short calls are mainly used by advanced traders seeking income in flat markets.

Both strategies are bearish but differ in risk and payoff:

| Factor | Short Call | Long Put |

| Max Profit | Premium received | Potentially large (if price collapses) |

| Max Loss | Unlimited | Limited to premium paid |

| Volatility Impact | Rising volatility hurts | Rising volatility helps |

| Time Decay | Works in your favor | Works against you |

Risks of Short Call Options

Because of these risks, regulators and brokers classify short calls as advanced strategies.

- Unlimited upside risk if the asset rallies.

- Margin requirements can be high and may lead to margin calls.

- Volatility spikes increase the option price, making losses worse.

- Early assignment risk around dividends or deep in-the-money contracts.

Conclusion

A short call option can generate steady premium income when markets remain flat, but it also carries unlimited risk if the underlying rallies. Traders should fully understand how to short call options, how to hedge, and how to close them effectively before using this advanced strategy. Compared to long puts, short calls demand greater discipline and risk management.

At Ultima Markets, we believe knowledge is the first step toward smarter trading. As a multi-regulated broker, we provide traders with the tools, education, and secure trading environment needed to navigate complex strategies like options with confidence. Whether you are exploring risk-hedging techniques or building long-term discipline, Ultima Markets supports your journey toward becoming a more informed trader.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.