Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom3-5-7 Rule: The Tool for Risk Management

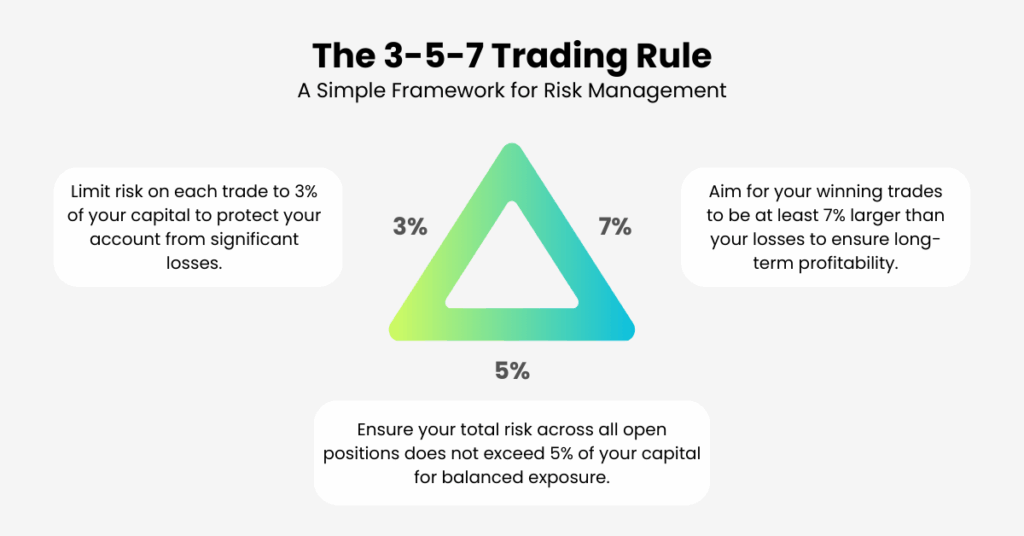

Trading can be unpredictable, and even the best traders face losses. To navigate these risks effectively, having a solid risk management strategy is essential. One of the most powerful frameworks to achieve this is the 3-5-7 rule.

It helps you balance risk and reward, keeping you in control of your trades. In this article, we’ll break down how the 3-5-7 rule works, its importance in trading, and practical examples of how to implement it with a focus on protecting your capital while achieving profitable returns.

What is the 3-5-7 Rule in Trading?

The 3-5-7 rule is a structured risk management strategy that is designed to protect traders from catastrophic losses while enabling them to capture meaningful profits. Here’s what it entails:

- 3% per trade: Limit the risk on any single trade to 3% of your capital.

- 5% total exposure: The combined risk of all open positions should not exceed 5% of your total trading capital.

- 7% profit-to-loss ratio: Ensure that your winners are at least 7% larger than your losses.

By adhering to these limits, the 3-5-7 rule encourages discipline, mitigates emotional trading, and promotes long-term profitability. Let’s dive deeper into each component.

Breaking Down the 3-5-7 Rule in Trading

The 3% Rule: Risk Per Trade

The first part of the 3-5-7 rule is the 3% risk per trade. This means that no single trade should risk more than 3% of your total account balance. This approach is crucial for protecting your capital from large losses that could be difficult to recover from.

- Why 3%? Limiting your risk to 3% per trade ensures that even if you face a losing streak, your account won’t be wiped out. It forces you to think critically before entering any trade, considering both risk and potential reward.

Example:

- If you have a $10,000 trading account, your maximum loss on any single trade should be $300 (3% of $10,000).

- This encourages careful position sizing. For example, if a stop loss is $1 away from your entry point, you can afford to buy 300 shares. If the stop loss is $0.50 away, you can buy 600 shares.

This rule helps you preserve capital and maintain discipline, which is essential for long-term trading success.

The 5% Rule: Total Exposure

The second part of the 3-5-7 rule focuses on your total exposure. It dictates that your combined risk across all open positions should not exceed 5% of your capital. This encourages diversification, spreading your risk across different markets or asset classes to avoid overexposure.

- Why 5%? By limiting total exposure to 5%, you prevent your portfolio from being overly sensitive to the movement of one particular asset or market. It ensures you don’t put all your eggs in one basket.

Example:

- If your account balance is $50,000, you should not have more than $2,500 at risk across all open positions combined.

- This encourages you to trade in multiple sectors or use different asset classes, reducing the chance of losing large amounts due to a single market downturn.

This rule fosters a balanced portfolio, reducing the potential for major losses and helping you withstand volatility.

The 7% Rule: Profit-to-Loss Ratio

The final part of the 3-5-7 rule emphasizes the profit-to-loss ratio. To ensure long-term profitability, it recommends that your winning trades should be at least 7% larger than your losing trades. This ensures that even if your win rate is lower, your profitable trades will offset your losses.

- Why 7%? The 7% target helps create a positive expectancy, meaning that over time, your wins will outweigh your losses. It encourages you to aim for high-quality trades with strong potential for growth, rather than focusing on quantity.

Example:

- If your average loss is $300, your average win should be at least $321 (7% more than the loss).

- Over time, this small difference compounds and contributes significantly to account growth, even if you have more losing trades than winning ones.

This rule shifts your mindset from being overly focused on being right on every trade to being focused on quality trades that have higher profit potential.

Building a Portfolio with the 3-5-7 Rule

Let’s take a look at how you can apply the 3-5-7 rule in real trading scenarios. Consider that you have a $10,000 portfolio. Following the rule, you’ll allocate your capital and manage risks as follows:

Step 1: Divide Your Portfolio into Risk Levels

Split your portfolio into three categories based on risk:

- 40% for low-risk assets ($4,000)

- 30% for moderate-risk assets ($3,000)

- 30% for high-risk assets ($3,000)

Step 2: Choose Assets for Each Category

Low-Risk Assets (3% Return):

- $2,000 in Apple (AAPL) (Stable, large company)

- $1,000 in S&P 500 Index (SPX) (Diversified U.S. market)

- $1,000 in Gold (XAU/USD) (Safe haven asset)

Moderate-Risk Assets (5% Return):

- $1,500 in Alphabet (GOOGL) (Tech company with steady growth)

- $1,000 in Nasdaq 100 Index (NDX) (Tech-focused index)

- $500 in Pfizer (PFE) (Stable healthcare stock)

High-Risk Assets (7% Return):

- $1,500 in Bitcoin (BTC/USD) (Volatile cryptocurrency)

- $500 in Ethereum (ETH/USD) (Another volatile crypto asset)

- $1,000 in Tesla (TSLA) (High-growth but volatile company)

Step 3: Monitor and Adjust Your Portfolio

Review your portfolio every few months. If certain assets (e.g., crypto or tech stocks) grow too large, rebalance by shifting some gains into safer assets to maintain the 3-5-7 balance. This approach ensures that you stay within your target risk thresholds.

Adapting the 3-5-7 Rule to Market Conditions

While the 3-5-7 rule provides a solid structure, you should remain flexible and adapt to changing market conditions:

- In volatile markets, tighten your risk management by reducing your 3% per trade risk limit to 2% or 1%. This will help protect your portfolio from large swings.

- In stable markets, you might slightly increase your risk per trade (up to 4%), but always stay within the 5% total exposure rule.

This flexibility ensures that you can adjust to market conditions without deviating from the core principles of the 3-5-7 rule.

Conclusion: Long-Term Success with the 3-5-7 Rule

The 3-5-7 rule offers a solid framework for risk management by limiting risk per trade to 3%, capping total exposureat 5%, and aiming for a 7% profit-to-loss ratio. This approach ensures discipline and consistent profitability.

However, be mindful of common mistakes:

- Ignoring Volatility: In volatile markets, adjust risk using tools like ATR.

- Not Adjusting as Your Portfolio Grows: Regularly reassess exposure limits.

- Overconfidence: Never break the rules, even on “sure win” trades.

By sticking to the 3-5-7 rule and avoiding these pitfalls, you’ll trade with more confidence and success.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.