Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website

Crude Oil Prices Remain Subdued: Will Supply Pressure or Geopolitical Risks Take the Lead?

The International Energy Agency (IEA) recently released its September 2025 Oil Market Report, highlighting that the market is currently caught between concerns over supply-demand imbalance and heightened geopolitical turmoil.

On one hand, increased output from OPEC+—together with China’s continued crude stockpiling—has eased concerns about future shortages. On the other hand, with hopes for a Russia-Ukraine settlement stalled, markets worry that further Western sanctions on Russia and Iran could restrict supplies.

Given the current downbeat trend in crude oil, the key question for markets is whether prices will extend their decline or find momentum for a potential rebound.

1. The Weight of Oversupply

Several factors are contributing to the current oversupply, keeping a lid on prices. Middle Eastern countries are increasingly using natural gas for power generation, which frees up more crude oil for export. Meanwhile, Russia is working to maintain its fiscal revenues by keeping its oil exports strong. While OPEC+ has tried to stabilize the market with production adjustments, these efforts have been largely offset by a combination of other factors, leading to a surplus.

In the U.S., a continued oversupply and weak fuel demand are also dragging prices down. Although U.S. crude inventories recently dropped due to a sharp decline in imports and a rise in exports, distillate inventories unexpectedly rose by 4 million barrels (well above the expected 1 million). This significant increase highlights the underlying weakness in demand.

Even a recent 25-basis-point rate cut by the Federal Reserve didn’t provide much support. While such a move typically stimulates the economy and boosts energy demand, the strong U.S. dollar negated this effect. A powerful dollar makes dollar-denominated crude more expensive for foreign buyers, further suppressing global demand.

2. Geopolitical Risks and Unexpected Shocks

Despite the bearish fundamentals, geopolitical risks remain the biggest source of uncertainty.

Although Ukraine’s attacks on Russian refineries continue, U.S. President Trump’s desire for lower oil prices has muted their impact. President Trump has also urged Europe to completely stop importing Russian crude, which could reduce Russia’s exports if it were to happen. However, India is likely to keep buying large volumes of Russian oil, and Japan has rejected the U.S.’s proposal for tariffs on countries importing Russian crude. Meanwhile, China continues to build up its crude stockpiles, adding another layer of complexity to the geopolitical landscape.

While these tensions have reignited political spats, they haven’t yet directly impacted the supply-demand balance. Their main effect has been to cause sharp, short-term swings in market sentiment. For now, a major, tangible supply disruption seems unlikely, so the influence of geopolitics on prices is expected to remain limited.

3. What’s Next for Crude Oil

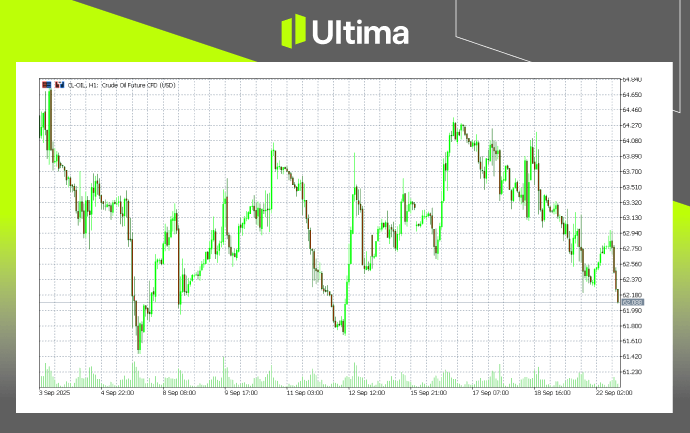

In September, Brent crude prices have been trading in a tight range between $61 and $65 per barrel, with bearish sentiment dominating the market.

For investors, a cautious approach is advised. One strategy could be to wait for a rebound towards the $64.00–$64.50 resistance zone. If prices show signs of weakness at this level, it could present an attractive opportunity to short the market. Conversely, a drop below the key $62.00 support level would reinforce the bearish signal and could lead to further selling.

Traders should be prepared for increased volatility if this breakdown occurs and be sure to use disciplined risk management.

While geopolitical uncertainty could temporarily lift prices, the underlying market conditions are still weak. Recent attacks on Russian energy facilities have created temporary fears of supply disruptions, but unless there is a significant, widespread event, the impact of these geopolitical factors is likely to be short-lived.

4. Conclusion

In the short term, the oil market is facing multiple bearish pressures. The key to navigating this environment isn’t to predict a specific price, but rather to understand the core drivers of volatility. The central theme remains oversupply, while geopolitical risk is the most significant wildcard.

A prudent approach for investors is to respect the current trend while remaining cautious. It’s important to use technical analysis to pinpoint potential entry and exit points and to always enforce strict risk management. Remember, markets are constantly changing, and any trading decision should align with your own analysis and personal risk tolerance.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server