Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomOklo Stock Forecast: Is OKLO a Buy or Not?

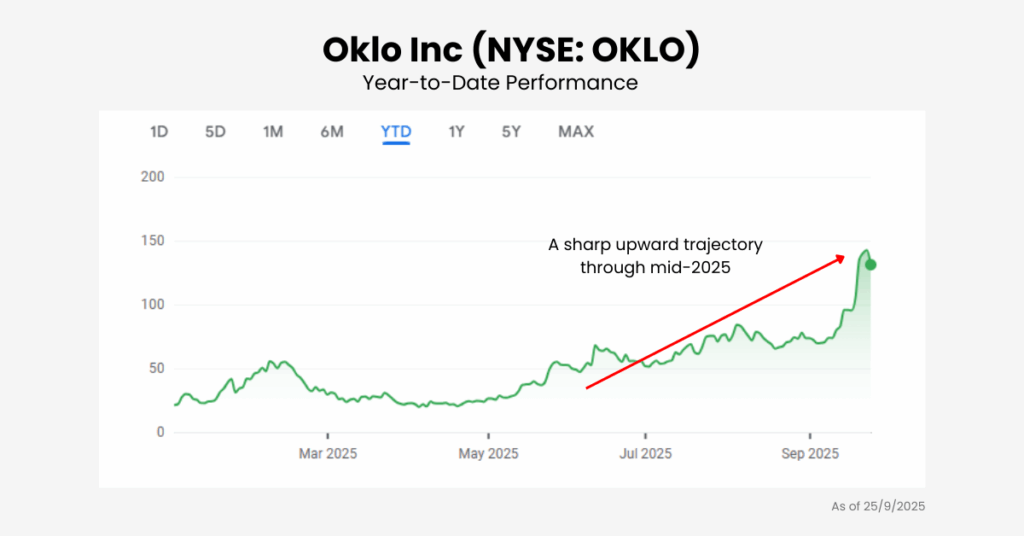

Oklo (NYSE: OKLO) has delivered one of the most eye-popping runs on Wall Street. A staggering 1,605.79% return on investment (ROI) over the past year. Few companies in any sector have matched that pace. The California-based nuclear startup is betting on small modular reactors (SMRs) and recycled fuel.

For traders, the story has been one of parabolic gains. For long-term investors, the question is whether this momentum rests on solid ground or fragile hype.

In this article, we break down the Oklo stock forecast with a look at its performance, price, partnerships, analyst views, and the risks you can’t ignore.

Who Is Oklo?

Oklo is a company developing compact fast reactors, with its flagship Aurora design targeting small-footprint, lower-cost nuclear power. Unlike traditional plants, Aurora units are designed to run on HALEU fuel and recycled nuclear waste, turning what was once seen as a liability into an asset.

In September 2025, Oklo announced the first phase of an advanced fuel center in Tennessee, an investment of up to $1.68 billion that could support around 800 jobs. The goal: build a circular fuel ecosystem that can support deployment at scale.

Still, Oklo remains a pre-revenue company, meaning investors are paying today for a vision that depends on pilots, licensing, and customer contracts later this decade.

Recent Performance

Recent stock performance has been nothing short of extraordinary. Over the last year, Oklo surged from single digits to triple-digit territory, putting its market capitalization in the low tens of billions. That’s a valuation level more common for companies with thousands of employees and billions in revenue. Yet, Oklo has around 120 staff and no operating reactors.

The disconnect between scale and market cap is a major point of contention. Bulls argue this shows investors are pricing in Oklo’s role as a first mover in the nuclear revival. Bears see it as a red flag that momentum, not fundamentals, has driven the stock higher.

What the Numbers Say

To understand the debate, it helps to look at the basics. Oklo’s financials show zero revenue, ongoing quarterly losses, and a reliance on equity financing to fund operations. Losses narrowed slightly in recent quarters, but insiders, including senior executives, have sold shares in recent months, a move skeptics interpret as a signal of caution at elevated prices.

From a scale perspective, the mismatch is stark: Oklo trades at a valuation of more than $10 billion with ~120 employees, making its market cap per employee one of the highest in the energy sector. That imbalance underscores why fundamentals remain a weak spot even as headlines push the stock higher.

Growth Drivers and Partnerships

Despite these concerns, the bull case is easy to see. Several catalysts have lined up to create genuine momentum:

- Policy support: The US and UK launched the Atlantic Partnership for Advanced Nuclear Energy, which could shorten approval timelines from years to potentially 24 months. Faster licensing is critical for Oklo’s reactors to reach customers sooner.

- AI energy demand: Hyperscalers like Microsoft, Google, and OpenAI are racing to build data centers, each demanding huge amounts of power. Oklo’s reactors could become a clean, reliable source of energy to fuel the AI boom.

- Liberty Energy alliance: In July 2025, Oklo announced a partnership with Liberty Energy to deliver integrated solutions. This “bridge-to-nuclear” model gives customers immediate energy with a path to zero-carbon baseload in the future.

- Fuel ecosystem: The Tennessee recycling facility would help secure Oklo’s fuel supply chain, a key bottleneck in the nuclear industry.

- Automation and digital readiness: Partnerships with ABB and Lightbridge are building the infrastructure and fuel fabrication needed to scale reactors efficiently.

Each of these steps reinforces the narrative that Oklo is positioning itself not just as a clean energy company, but as a cornerstone of the future power mix.

Oklo Stock Forecast and Analyst Views

The Oklo stock forecast is one of the most divided on Wall Street. Bulls, led by Wedbush analyst Daniel Ives, raised their target to $150, calling Oklo a “strategic winner” in the race to power AI with nuclear.

Yet the Street consensus sits around $80, far below current levels, with a mix of Buys, Holds, and even a Sell rating. Goldman Sachs initiated coverage with a Neutral rating and $117 target, acknowledging catalysts but warning of “considerable capital intensity.”

Some traders go further, warning that if NRC approvals stall, Oklo’s stock could tumble back toward $20–30 despite its huge rally.

To make sense of these opposing views, here’s how the Oklo stock forecast breaks down by scenario:

| Scenario | Price Outlook | Drivers | Risks |

| Bull case | $150+ | AI demand, faster licensing, Tennessee fuel center progress | Execution still unproven; regulatory hurdles |

| Base case | $80–100 | Policy support, partnerships, steady funding | Valuation remains stretched; limited revenue visibility |

| Bear case | $20–30 | Licensing setbacks, dilution, insider selling, sentiment collapse | Pre-revenue status weighs heavily |

This spread captures the essence of the Oklo debate: either it leads a nuclear renaissance, or its valuation unwinds as fundamentals catch up.

Risks to Consider Ahead

While the opportunities are compelling, the risks are equally pressing:

Execution Delays

Oklo has yet to operate a reactor. Even with DOE pilot support, building the first Aurora powerhouse is a complex process that could face licensing or construction setbacks.

Financing and Dilution

The company is pre-revenue and depends on equity raises. Its June 2025 offering raised $400 million, but more capital will be needed before cash flow arrives, putting shareholders at risk of dilution.

Policy and Political Scrutiny

Momentum is strong, but nuclear remains politically sensitive. A recent letter from Senator Ed Markey questioned federal ties to Oklo, underscoring how recycled fuel projects could trigger opposition.

Valuation and Sentiment Swings

Oklo’s stock has soared more than 1,600% ROI, but it also logged its worst day in two months in September 2025, falling 8% after Seaport Research downgraded it. Retail sentiment quickly flipped from bullish to neutral, while Goldman Sachs cautioned about capital risks even as it set a $117 target.

Narrative over Fundamentals

Much of Oklo’s rise is built on momentum and headlines. Without concrete progress at the NRC, some traders warn the stock could slide back toward $20–30, despite the long-term promise.

Conclusion

The Oklo stock forecast reflects both high promise and high uncertainty. Oklo is positioned at the crossroads of nuclear energy and AI demand, backed by policy support and strategic partnerships. Yet it remains a pre-revenue company with major execution challenges and a valuation many see as stretched.

For momentum traders, Oklo offers short-term excitement. For long-term investors, caution is key until reactors are licensed and revenue contracts are secured.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.