Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteTop Picks for Rare Earth Stocks in 2025

From the phone in your hand to the car on the road and the turbines spinning offshore, rare earth magnets power much of modern life. These elements may sound obscure, but without them, EVs lose efficiency, wind power slows down, and defense systems fall behind.

In 2025, rare earths are no longer just a hidden part of industry. They’ve become a centerpiece of the U.S.–China trade conflict, hit by tariffs and export controls, and backed by billions in government funding to secure supply.

For investors, this means rare earth stocks now sit at the crossroads of technology, geopolitics, and opportunity, making rare earth stocks worth a closer look.

Why Rare Earth Stocks Matter

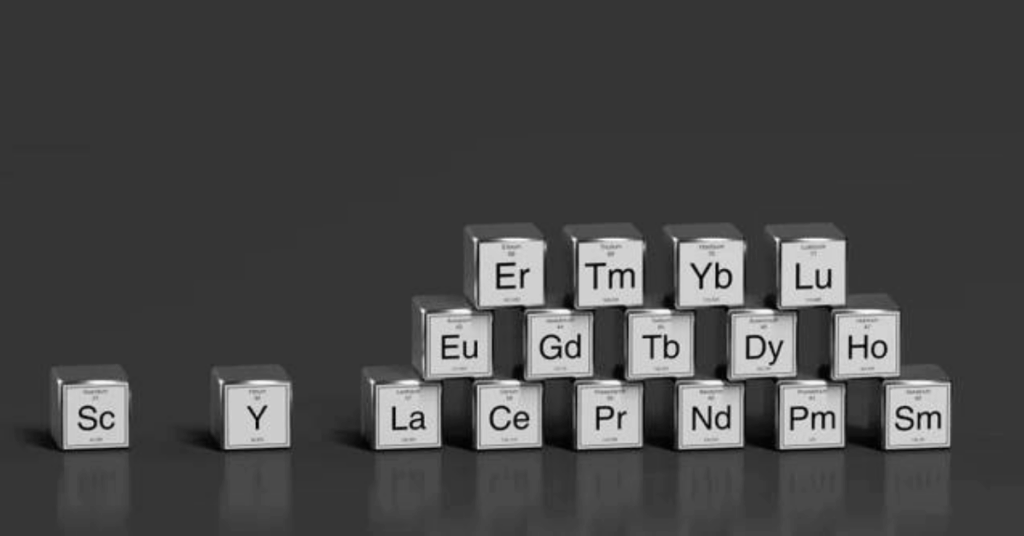

When we talk about rare earths, we’re referring to 17 elements. The ones that matter most to investors are NdPr (neodymium–praseodymium), which powers permanent magnets, and dysprosium and terbium, which keep those magnets stable under heat.

These magnets are essential for:

- EVs: Used in traction motors that drive efficiency and range.

- Wind turbines: Critical for permanent magnet synchronous generators.

- Defense: Found in missile guidance systems, jet engines, and sonar.

- Consumer tech: In smartphones, laptops, and speakers.

Demand is steady and rising. But the bottleneck isn’t mining, it is the midstream refining and magnet-making capacity that remains heavily concentrated in a handful of countries. That is why rare earths are as much a policy story as a commodity story.

China and the US Sets the Pace

When it comes to rare earths, two players dominate: China and the U.S.

China’s position is entrenched. It accounts for nearly 70% of global mine output and more than 80% of refining capacity. In late 2024, Beijing tightened its grip further with export bans on certain technologies and controls on seven critical rare earth metals. For Chinese buyers, supply is insulated. For ex-China buyers, premiums are rising.

The U.S., on the other hand, is scrambling to build a secure domestic supply chain. In May 2024, the Biden administration introduced a 25% tariff on Chinese rare earth magnets (effective 2026) — the first direct tariff on these components. Then in 2025, Trump doubled down, escalating tariffs on Chinese goods to a cumulative 54%. In response, Beijing heightened export controls, setting the stage for a two-tiered market where outside-China buyers pay more.

This clash has pushed Washington to back domestic projects with:

- Department of Defense funding for processing and magnet plants.

- Streamlined permitting for critical mineral projects.

- Tax credits for new U.S. facilities.

Europe is also stepping up. Under its 2024 Critical Raw Materials Act, the EU set a 2030 target to reduce Chinese reliance, with Neo Performance Materials already opening Europe’s first large-scale magnet plant in Estonia.

Current Conditions in 2025

The trade war has turned rare earths into a geopolitical chess piece. Here’s the reality:

- Ex-China buyers face supply insecurity and higher costs.

- China’s domestic buyers are shielded from tariffs and export rules.

- Non-China producers like MP Materials, Lynas, and Neo are in demand as buyers diversify.

- Government intervention through subsidies, loans, and offtake contracts is reshaping the investment case.

For investors, this means stocks tied to U.S. and EU supply chain buildouts are seeing more attention than ever, while Chinese firms remain dominant but less accessible for many portfolios.

Best Rare Earth Stocks to Watch Globally

Investors can choose between single-company plays for targeted exposure or ETFs for broad diversification. The right pick depends on whether you want to back mining, separation, or magnet-making capacity.

Upstream and integrated leaders

- MP Materials (NYSE: MP): U.S. mine-to-magnet leader with Mountain Pass and Texas facilities. Supported by the U.S. Department of Defense.

- Lynas Rare Earths (ASX: LYC): Largest producer outside China, with operations in Australia and Malaysia.

- Iluka Resources (ASX: ILU): Advancing Australia’s first fully integrated refinery with government financing.

Midstream and magnets

- Neo Performance Materials (TSX: NEO): Direct play on European magnet supply; Estonia plant supplying Bosch and Schaeffler.

- Energy Fuels (NYSEAMERICAN: UUUU; TSX: EFR): Produces separated NdPr and is progressing into heavy rare earths.

Project torque and specialty exposure

- Arafura Rare Earths (ASX: ARU): Nolans project with binding offtakes from Hyundai, Kia, and Siemens Gamesa.

- Ucore Rare Metals (TSXV: UCU): Building U.S. refining capacity in Louisiana with DoD support.

- NioCorp (NASDAQ: NB): Elk Creek project in Nebraska, combining niobium, scandium, and rare earths.

- USA Rare Earth (NASDAQ: USAR): New entrant with a Stillwater magnet plant targeted for 2026 and the Round Top project in Texas. High-beta, but levered to U.S. onshoring.

ETF option

The VanEck Rare Earth & Strategic Metals ETF (REMX) offers a diversified basket of miners, refiners, and magnet makers. Many investors use REMX as a core holding and add one or two single names for extra torque.

Risks to Consider

The biggest risk is geopolitics. Tariffs, export bans, or defense procurement cycles can shift margins overnight. Execution risk is also high. Building separation plants and magnet lines is capital intensive and prone to delays, as seen with Lynas’ Texas project.

Prices are volatile, with narrow supply chains reacting quickly to news. Environmental and permitting challenges in the U.S. and EU add another layer of uncertainty.

What to Watch Next

The main signal to track is real magnet tons outside China. Watch quarterly run rates at Neo’s Estonia facility and MP’s upcoming U.S. magnet plant because signed offtakes are more important than projections. Government funding and contracts are another catalyst. Defense stockpiles, EU grants, and export-credit financing all shorten payback periods and stabilize projects.

Qualification milestones also matter. Automotive-grade approval for NdPr and heavy rare earth oxides, like Energy Fuels recently achieved, is a sign that supply is commercially viable. Lastly, keep an eye on USGS updates and company production tables. They provide the cleanest view of supply growth and ongoing bottlenecks.

FAQs Investors Might Ask

What are the best rare earth stocks to buy?

It depends on your thesis: MP or USAR for U.S. onshoring, Lynas for scale outside China, Neo for EU magnets, and Iluka/Ucore for midstream leverage.

Is there an ETF for rare earth minerals?

Yes! REMX is the leading ETF in this space.

Which country is rich in rare earth minerals?

China leads, followed by Australia and the U.S., while Vietnam and Brazil also hold large reserves. But the bottleneck is not reserves , it is refining and magnet-making.

Is rare earth a good investment?

Yes, if you can handle volatility. Electrification and defense keep demand growing, but tariffs, export controls, and project delays can swing stocks sharply.

Conclusion

Rare earths are at the center of the clean energy and defense transition, but they are also a live battleground in the U.S.– China trade war. The winners will be companies that can turn ore into magnets, supported by policy tailwinds and binding offtakes.

For most investors, a practical approach is to start with REMX for diversified exposure and then add targeted operators like MP for U.S. onshoring, Neo for EU magnets, Lynas for scale outside China, or Iluka/Ucore for midstream leverage. Returns will ultimately follow one metric above all: magnet tons shipped.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.