Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteHydrogen Stocks: 2025-2028 Opportunities?

Hydrogen has been called many things; the fuel of the future, a green bubble, and even the biggest wealth-building opportunity of the decade. The truth lies somewhere in between. While project cancellations and cost overruns have dampened early hype, hydrogen stocks still represent a bold way to play the global transition to clean energy.

For investors, hydrogen offers both established industrial exposure and speculative retail plays. The sector is volatile, but with governments backing hydrogen in Europe, the US, and India, the opportunities after 2028 could be massive.

What Are Hydrogen Stocks?

Hydrogen stocks are simply shares of companies building the hydrogen economy. Some focus on producing hydrogen at scale, others specialise in fuel cells, storage, or distribution, and a growing number are innovating in niche applications.

Industrial giants like Linde and Air Products dominate the supply chain, while innovators such as Plug Power, Ballard Power, Bloom Energy, and FuelCell Energy develop technologies that could reshape transport and power generation.

For investors who prefer diversification, ETFs like Global X Hydrogen ETF (HYDR) and VanEck Hydrogen Economy ETF (HDRO) provide broad exposure across multiple players.

Why Industries Use Green Hydrogen

Industries are turning to green hydrogen because it decarbonises activities that electricity alone cannot handle. In steelmaking, hydrogen can replace coal in direct reduced iron (DRI). Fertiliser companies rely on hydrogen as a feedstock for ammonia, and switching to green hydrogen reduces emissions dramatically.

Shipping and aviation are also experimenting with hydrogen-based fuels such as green ammonia and methanol, which offer zero-carbon options for long-haul travel.

Even though green hydrogen is still roughly twice the cost of grey hydrogen, history shows that cost curves can fall fast. In 2010, solar in India cost ₹18 per unit; today, it is closer to ₹3. The same dynamic could unfold in hydrogen, especially as about 70% of hydrogen’s production cost comes from renewable electricity. Falling power prices, subsidies, and economies of scale will make green hydrogen more competitive.

The Global Reality Check for Hydrogen Stocks

The optimism around hydrogen is tempered by some harsh realities. Hydrogen isn’t a straight-line growth story. Here are the key challenges that remain:

- Cancellations and delays: More than 20% of European projects have been scrapped.

- Stock drawdowns: Many hydrogen stocks fell 30–50% in 2024 as investors reassessed risks.

- Efficiency limits: Power-to-hydrogen-to-power efficiency is only 35–40%, far lower than batteries.

- EU skepticism: The European Court of Auditors called 2030 hydrogen targets unrealistic.

- IEA downgrade: In 2025, the IEA cut its low-emissions hydrogen outlook by 25% due to low FID conversion.

For investors watch FIDs (final investment decisions) and offtake contracts, not just project announcements.

India’s Long-Term Hydrogen Opportunity

While Europe struggles with execution, India has emerged as one of the most promising long-term hydrogen stories. The country achieved its Paris Agreement green-energy target five years ahead of schedule in 2025 and is now pushing toward 500 GW of renewable capacity by 2030. This renewable base provides the perfect foundation for scaling green hydrogen.

Companies like Oriana Power are building gigawatt-scale electrolyser factories, which will serve both domestic projects and exports. Analysts estimate India will need around 500 GWh of battery storage to balance its 500 GW of renewables, much of which will complement hydrogen production. Export ambitions are also clear, with India positioning itself as a supplier of green hydrogen and ammonia to Europe and Asia.

Green hydrogen in India may not scale meaningfully until after 2028, but when it does, the combination of cheap renewables, government incentives, and industrial demand could make it one of the largest growth markets globally.

Leading Hydrogen Stocks to Watch

The hydrogen sector includes a mix of blue-chip giants, technology innovators, and penny stocks.

Blue-Chip Leaders

- Linde (LIN): Global industrial gas leader with hydrogen pipelines and supply contracts.

- Air Products (APD): Building large-scale hydrogen hubs across the US and Middle East.

Fuel-Cell Innovators

- Plug Power (PLUG): From forklifts at Amazon/Walmart to hydrogen plants across the US/EU. Its vertical integration strategy could cut costs and secure supply.

- Ballard Power (BLDP): Supplies fuel cells for buses, trucks, and trains; positioned for China’s hydrogen transport push.

- Bloom Energy (BE): Solid-oxide fuel cells for stationary power.

- FuelCell Energy (FCEL): Stationary hydrogen + carbon capture, with projects in South Korea.

Hydrogen Penny Stocks Under $5

- Plug Power (PLUG): Recently beaten down, but could rerate if execution improves.

- FuelCell Energy (FCEL): Turnaround potential via Asian projects.

- Ballard Power (BLDP): High risk, but Chinese adoption could be a catalyst.

- Advent Technologies (ADN): High-temp fuel cells for aviation and harsh environments.

- Hyzon Motors (HYZN): Hydrogen-powered trucks in pilot runs across US, EU, Australia.

- SPI Energy (SPI): Solar + EV + hydrogen “closed loop” clean energy ecosystem.

- American Resources Corp (AREC): Pivoting from coal to hydrogen hubs and rare earth recovery.

- Global Gas Corp (HGS): Ultra-speculative hydrogen distribution microcap.

Keep in mind that these penny stocks are high risk, high reward. They can skyrocket on contracts, or collapse on dilution. You must never invest more than you can afford to lose.

ETFs for Diversified Exposure

If picking single names feels too risky, ETFs are a practical solution. The Global X Hydrogen ETF (HYDR) focuses on hydrogen producers, fuel cell developers, and related technology firms. The VanEck Hydrogen Economy ETF (HDRO) offers more geographically balanced exposure, with roughly 39% of holdings in the US, 15% in Japan, and 13% in the UK. These baskets smooth out volatility while giving exposure to the broader hydrogen trend.

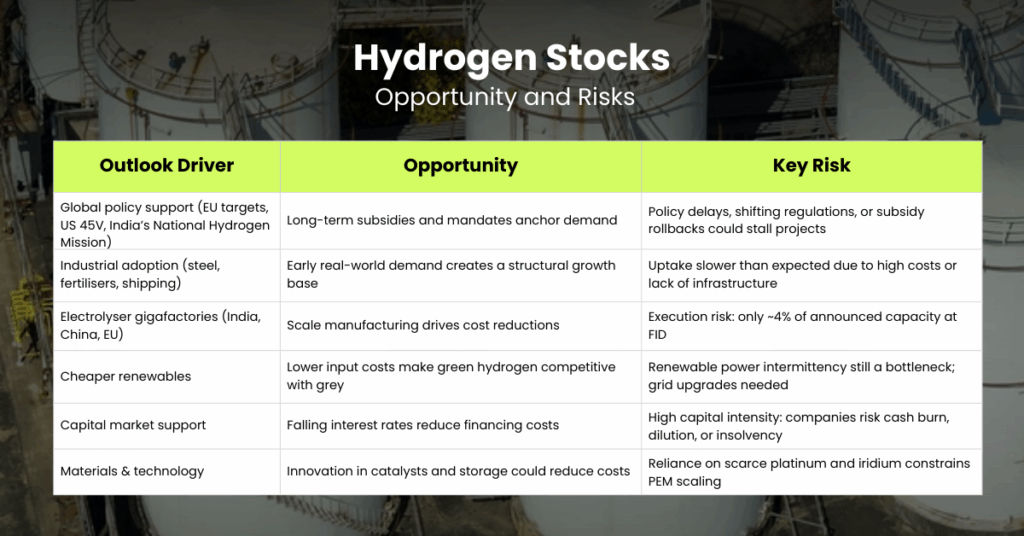

Outlook and Risks for Hydrogen Stocks

Hydrogen has already experienced both waves of hype and painful corrections, but the structural case for growth is still strong. Europe will need imports to reach its ambitious targets, the US has locked in a decade of policy support through 45V tax credits, and India is scaling renewables at record speed. Meanwhile, industrial users in steel, fertilisers, and shipping are creating the first real demand anchors for green hydrogen.

The real inflection point is expected after 2028, when electrolyser gigafactories, falling technology costs, and binding industrial offtakes converge. At that stage, hydrogen could transition from promise to profitability. For investors, the sector offers a high-risk, high-reward pathway. It is one that requires patience and careful positioning.

But with that outlook comes equally important risks. The table below highlights the biggest opportunities alongside the threats investors need to manage:

Conclusion

Hydrogen stocks are not a straight shot to riches. The sector is volatile, policy-driven, and still proving itself. But with industrial giants, government support, and the rise of India’s renewable base, the hydrogen economy could reshape energy markets in the next decade.

For investors, the smart play is balance:

- Core holdings in blue chips like Linde and Air Products.

- Satellite exposure to innovators like Plug, Ballard, Bloom, or FuelCell.

- Speculative bets in penny stocks. Only if you accept the risks.

- Diversification via ETFs for stability.

The road won’t be smooth, but for those who believe in the hydrogen economy, now is the time to watch closely.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.