Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomBox Theory Explained: All You Need to Know

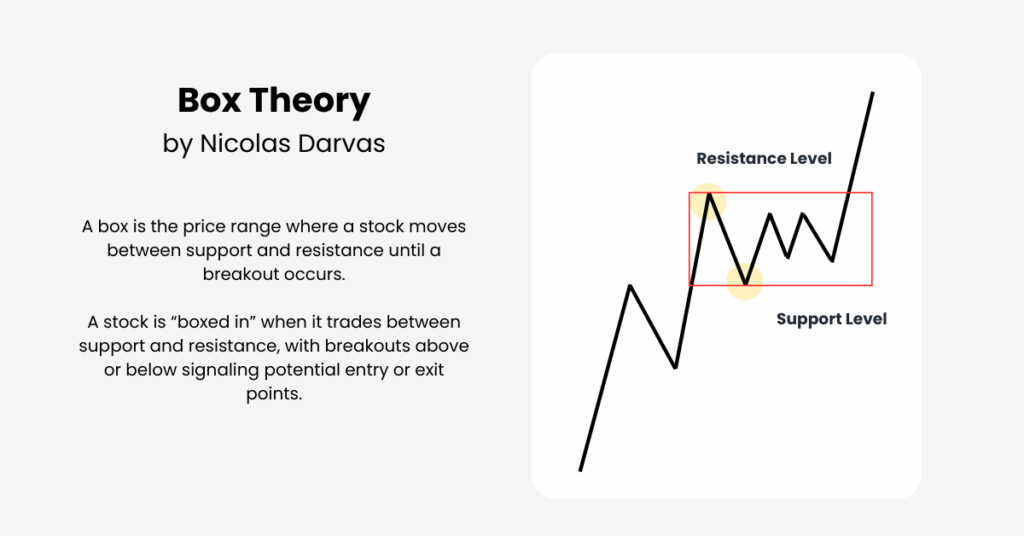

In technical analysis, box theory is a price-action method that helps traders identify consolidation zones and anticipate breakouts. The idea is straightforward: markets often move in ranges, or “boxes,” before trending higher or lower. By learning how to spot these boxes, traders can improve timing, manage risk, and trade with more discipline.

Origins of Box Theory

Box theory was popularised in the 1950s by Nicolas Darvas, a professional dancer who turned to stock trading. He claimed to have grown a relatively small stake into over US$2 million by following a rules-based, price-and-volume strategy now known as the Darvas Box Theory.

Darvas described his approach in the book How I Made $2,000,000 in the Stock Market. Later investigations suggested that parts of his reported profits were difficult to verify.

Still, the method’s principles of focusing on momentum, clear rules, and disciplined risk management remain widely studied and applied in modern markets.

Understanding the Box

A box is a trading range formed between two levels:

- Support (Box Bottom): The level where buyers repeatedly step in.

- Resistance (Box Top): The ceiling where sellers cap price advances.

- Breakout: When price closes above the box top (bullish) or below the box bottom (bearish).

Darvas Box Rules (Step by Step)

Nicolas Darvas’ system included strict rules:

- Momentum filter: Focus on stocks making new 52-week highs.

- Box setup: After a high, if three consecutive sessions fail to make a new high, the highest point becomes the box top, and the subsequent low becomes the box bottom.

- Entry: Buy only when price breaks out above the box top, ideally on increasing volume.

- Stop-loss: Place just below the box bottom.

- Pyramiding: Add to the position when new, higher boxes form.

- Exit: Sell when price closes back inside the previous box.

This disciplined framework kept Darvas in strong uptrends while avoiding most sideways noise.

Strengths and Limitations of Box Theory

| Strengths | Limitations and Risks |

| Simple to understand and apply, even for beginners | False breakouts can trap traders and cause losses |

| Provides clear, rule-based entries and exits | Signals can lag, meaning part of the move may already be missed |

| Aligns traders with strong momentum and trends | Works best in trending markets, less effective in choppy conditions |

| Can be adapted across stocks, forex, indices, and crypto | Originally designed for equities, requires adjustments for other assets |

How Modern Traders Adapt Box Theory

1. Volume Confirmation

Breakouts supported by rising volume are considered higher-quality signals. Weak-volume breakouts often fail.

2. ATR and Time Filters

In forex and crypto, traders replace the “52-week high” with 20- to 40-day highs and use Average True Range (ATR) to avoid overly tight boxes.

3. Position Sizing and Pyramiding

Instead of going all in, traders may risk 0.5–1% of equity per breakout and add as new boxes form, keeping risk controlled.

4. False Breakout Checklist

- No volume surge on breakout

- Quick close back inside the box within 1–2 sessions

- Broader market turning risk-off

5. Trailing Stops

Stops are moved to prior box levels as the trend continues, protecting gains without cutting winners short.

Darvas Boxes vs. Generic Range Boxes

- Darvas Boxes: Rule-based, tied to new highs and volume, trend-following.

- Generic Range Boxes: Any sideways consolidation zone, used in both trend- and mean-reversion systems.

Knowing the difference helps traders apply the right strategy for their market.

Frequently Asked Questions

Is box theory the same as support/resistance trading?

Not exactly. Darvas’ system uses strict rules around new highs and volume to define boxes, while general range trading is more flexible.

Does box theory still work today?

It can, especially in trending markets. But traders should adapt the rules to modern conditions, add risk controls, and be aware of false breakouts.

Which markets can use box theory?

Originally equities, but it can be applied to forex, indices, and crypto with modifications such as shorter lookback periods and ATR filters.

Final Thoughts

Box theory has endured for decades because of its simplicity, discipline, and focus on momentum. While no method guarantees success, it provides a solid framework for traders to identify consolidations, manage risk, and ride strong trends. For best results, combine box theory with volume analysis, position sizing, and other technical tools.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.