Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteFed Delivers First Rate Cut Since December, Signals More to Come

The U.S. Federal Reserve cut interest rates by 25 basis points on Wednesday, lowering the federal funds target range to 4.00%–4.25%, marking its first move since December. Policymakers also signalled that two more cuts could follow before year-end, underscoring growing concerns about labor market weakness even as inflation remains above target.

Fed Stance Behind the Cut

Fed Chair Jerome Powell described the decision as a “risk management” step, highlighting signs of slowing job growth and rising unemployment pressures.

“We are not declaring victory over inflation, but we also recognize that the labor market is softening faster than expected,” Powell said at his press conference. “The dot plot reflects a committee that is attentive to both sides of our mandate. We have to keep our eye on inflation, but at the same time, we cannot ignore maximum employment.”

The decision was not unanimous. Newly confirmed Governor Stephen Miran dissented, favoring a larger 50-basis-point cut. His vote highlighted growing divisions within the Fed over how aggressively policy should be eased.

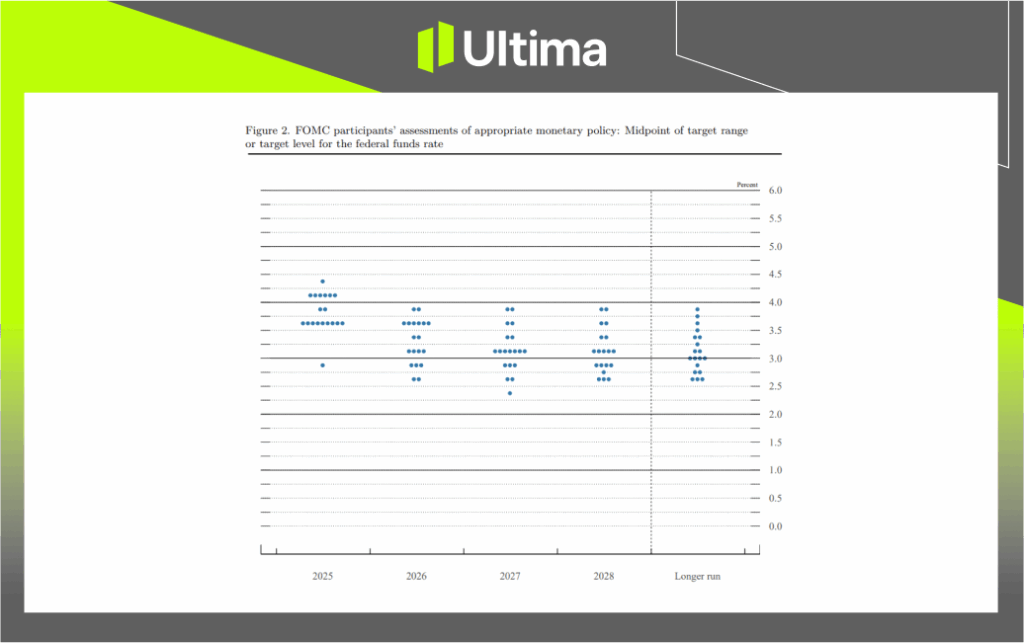

Fed Dot Plot Points to Two More Cuts

The September Summary of Economic Projections (SEP) showed a clear dovish tilt. The median “dot” now projects two additional 25-basis-point cuts by year-end, bringing the federal funds rate down to 3.50%–3.75% by December. That marks a notable shift from the June SEP, when policymakers envisioned just one-two cut.

Fed Dot Plot – September Meeting | Source: Federal Reserve

For 2026, the median projection shows rates drifting toward 3.0%, suggesting the Fed expects policy to remain in easing mode but not return quickly to the ultra-low levels of the past decade.

Growth and Inflation Outlook Revised

Alongside the rate path, Fed officials downgraded their GDP growth forecast for 2025 to 1.6% from 1.9%, citing weaker consumer spending and business investment. Unemployment is now projected to rise to 4.6% by year-end, with the median estimate at 4.5%, compared with 4.3% in June.

On inflation, the Fed sees both the PCE price index and core PCE holding at 3.0% and 3.1% in 2025, before gradually converging toward the 2% target by 2026–2027. While tariffs remain a risk, Powell stressed that “tariff effects appear to be more one-off than persistent.”

Market Reaction

Traders interpreted the updated dot plot as confirmation of a new easing cycle. Treasury yields fell sharply at the short end, while futures markets are now pricing in a near-certainty of three cuts in 2025, in line with the Fed’s median forecast.

The U.S. dollar initially weakened, pushing EUR/USD, GBP/USD, and gold to fresh highs. However, the move was quickly reversed, signaling a potential “sell-the-news” reaction as markets had already largely priced in the prospect of three cuts.

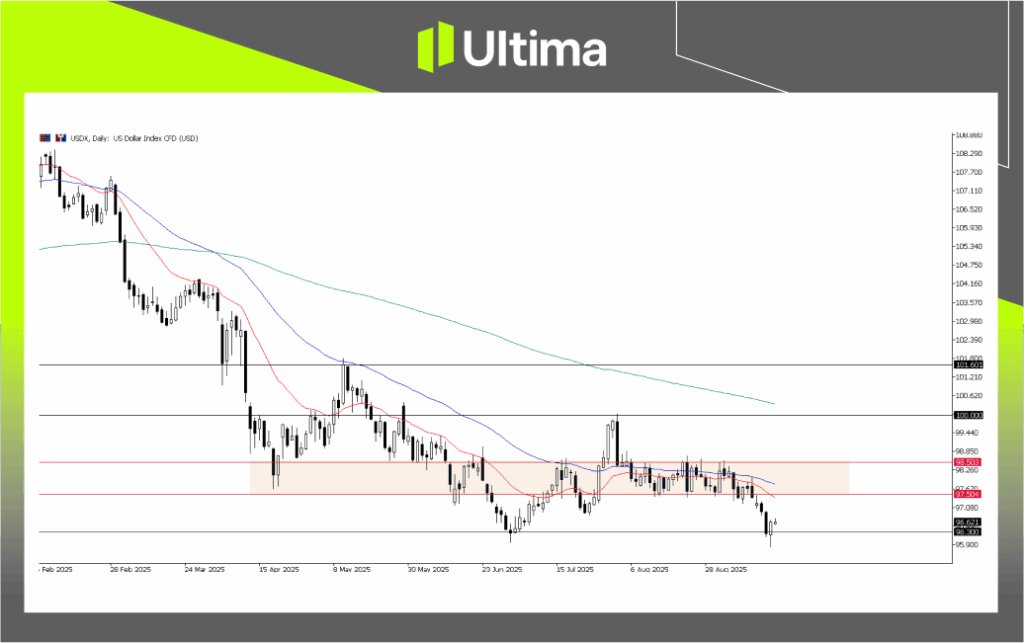

USDX, Day Chart | Source: Ultima Market MT5

Technically, the U.S. Dollar Index continues to find support near the previous low of 96.30. While a rebound has emerged from that level, the broader downtrend remains intact unless the dollar can reclaim the 97.50–98.50 resistance zone.

A sustained move above this band would be needed to shift sentiment back toward a bullish bias, while failure to do so keeps the risk tilted toward further downside.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server