Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteEURUSD on 4-Years High Ahead Fed Decision; Markets Eyes Policy Signals

The euro climbed to a four-year high against the U.S. dollar on Tuesday, as traders positioned for a widely expected Federal Reserve rate cut at next week’s policy meeting. Markets are nearly fully pricing in a 25-basis-point reduction, with expectations building for as many as three cuts in 2025.

Fed in Focus

The Fed began its two-day meeting on Tuesday under heightened political and market scrutiny. Futures markets indicate a near-100% probability of a quarter-point cut, potentially marking the start of a multi-month easing cycle.

The backdrop has been complicated by political developments. Governor Lisa Cook, often viewed as dovish, will participate in the decision after a U.S. court ruled she cannot be removed while litigation with President Trump continues. At the same time, the confirmation of Trump-backed appointee Stephen Miran has added a hawkish counterweight.

These dynamic underscores the Fed’s challenge: maintaining independence while navigating political pressure and calls for monetary support.

EUR/USD Breaks 4-Years High

The euro broke decisively above the key 1.1800 resistance level, after consolidating below it for nearly two months. Ultima Analysts note that dollar weakness remains the primary driver of gains, though the pair’s next leg higher will likely depend on the Fed’s guidance.

- A dovish Fed statement hinting at multiple cuts could extend EUR/USD’s rally toward 1.1850 and beyond.

- A more cautious tone, however, may trigger a dollar rebound, pulling the pair back toward support levels near 1.1740–1.1700.

EURUSD Technical Outlook

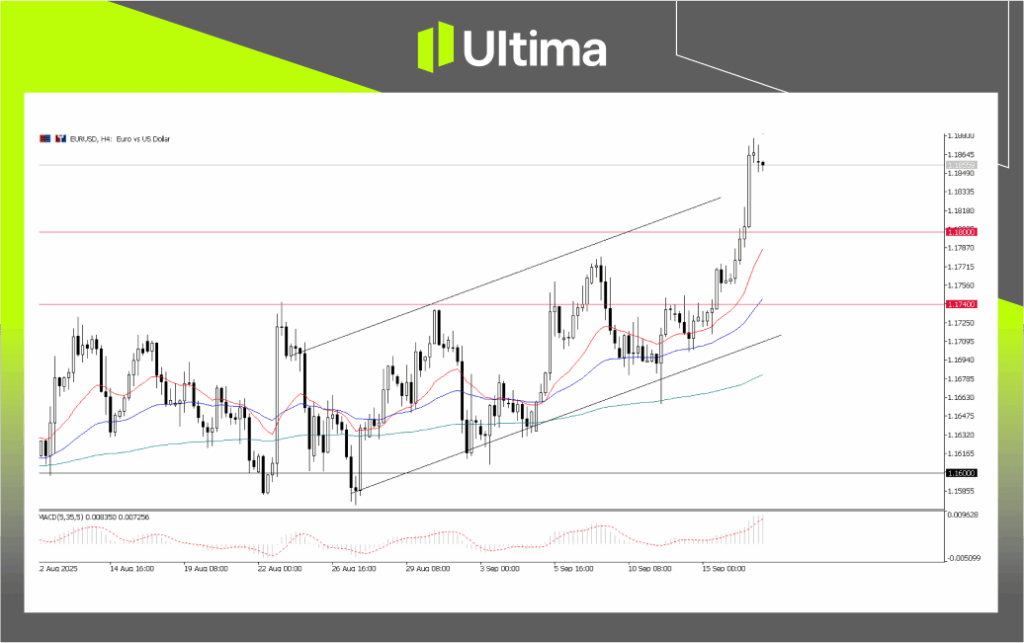

EUR/USD, 4-H Chart Analysis | Source: Ultima Market MT5

EUR/USD has broken decisively above the key resistance zone of 1.1740–1.1800, which now turns into a crucial support area. As long as pullbacks hold above this band, the pair’s upside momentum is likely to remain intact.

A dovish Fed statement signaling multiple rate cuts could further reinforce bullish sentiment, providing additional support for the euro’s rally. Conversely, any hawkish surprise or cautious tone could cap gains and trigger a retest of the newly established support levels.

Market Outlook on Fed, ECB

Markets broadly expect the Federal Reserve to deliver a 25-basis-point rate cut at its upcoming meeting, with odds remaining firmly in favor of easing. Traders are also increasingly pricing in three cuts in total for 2025, reinforcing conviction that a new easing cycle is about to begin.

The U.S. yield curve reflects this expectation: short-term rates are under heavy pressure, while the long end has remained relatively stable or edged lower. This dynamic suggests investors are adding exposure to longer-dated Treasuries in anticipation of an extended period of monetary accommodation.

Beyond the Fed, attention has also turned to the European Central Bank (ECB) after policymakers opted to leave rates unchanged this week. The ECB emphasized a meeting-by-meeting, data-dependent approach, refraining from committing to a clear easing path.

This growing policy divergence — with the Fed leaning toward easing while the ECB remains cautious — is set to be a major driver for EUR/USD and broader bond market dynamics in the months ahead.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

SC Version:

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server