Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteIs BBAI a Good Stock to Buy

BigBear.ai (NYSE: BBAI) is a high-risk, speculative stock. The company cut its 2025 revenue guidance to $125M–$140M, posted a wider Q2 loss of –$0.71 per share, and depends heavily on U.S. government contracts. While strong cash reserves (~$390M) provide stability, near-term volatility makes BBAI more suitable for risk-tolerant investors than conservative buyers.

What Does BBAI Company Do?

BigBear.ai (BBAI) is an artificial intelligence company that delivers decision-intelligence solutions, including data ingestion, predictive analytics, and risk assessment. Its technology helps U.S. government agencies and commercial clients improve situational awareness, anticipate outcomes, and make faster, more accurate decisions.

- Data ingestion & enrichment – turning raw information into actionable insights.

- Predictive analytics & risk assessment – supporting national security, defense, and commercial operations.

- Visualization & monitoring tools – helping clients detect blind spots and anticipate outcomes.

Its customer base is heavily tied to U.S. government agencies (Army, intelligence, homeland security) and expanding into commercial verticals like logistics, supply chain, and healthcare.

BBAI Recent Stock Performance

As of September 17, 2025, BigBear.ai Holdings Inc. (NYSE: BBAI) closed at $5.94, up +1.54% over the past month. After-hours trading lifted the stock slightly higher to $5.97.

Over the last 30 days, BBAI traded between $4.86 (low) and $6.00 (high), showing volatility after weaker Q2 earnings and lowered revenue guidance. Despite the pullback earlier in September, the stock rebounded sharply in mid-September, suggesting short-term investor optimism.

- Market Cap: $2.20B

- 52-Week High: $10.36

- 52-Week Low: $1.36

BBAI Stock Valuation

Valuing BigBear.ai (NYSE: BBAI) is challenging because the company is still unprofitable. Instead of traditional metrics like P/E, investors look at revenue multiples, cash position, analyst targets, and long-term growth potential in AI and defense contracting.

Market Capitalization

As of September 17, 2025, BBAI’s market cap is approximately $2.20 billion at a closing price of $5.94.

Earnings and Profitability

- P/E Ratio: Not applicable since the company is generating net losses.

- Q2 2025 EPS: Adjusted loss of –$0.71 per share, much wider than analyst expectations.

- Revenue Guidance: For FY 2025, revised downward to $125M–$140M, from prior $160M–$180M. This weaker outlook directly impacts valuation models.

Cash and Balance Sheet Strength

- Cash Reserves: Roughly $390.8M as of June 30, 2025.

- Debt: Relatively low, under $10M, giving BBAI more financial flexibility than some peers.

- Runway: With strong cash, the company can sustain operations even while unprofitable, reducing immediate dilution risk.

Analyst Price Targets

Analysts currently set BigBear.ai (BBAI) price targets in the $4.00 to $8.00 range, with an average near $6.00–$6.75. Some estimates go as high as $8.00, while others are closer to $4.00–$5.00, reflecting a wide dispersion of expectations.

This range suggests modest upside from the current price of $5.94 (Sept 17, 2025), but also highlights the uncertainty surrounding BBAI’s ability to grow revenues and move toward profitability.

Valuation Challenges

- Uncertain Revenues: Heavy reliance on U.S. government contracts means valuation is highly sensitive to budget cycles and program delays.

- Profitability Timeline: With losses widening, traditional DCF models require aggressive growth assumptions, making valuation speculative.

- Competitive Landscape: Other AI and defense contractors (e.g., Palantir) have stronger profitability profiles, which sets a higher bar for BBAI.

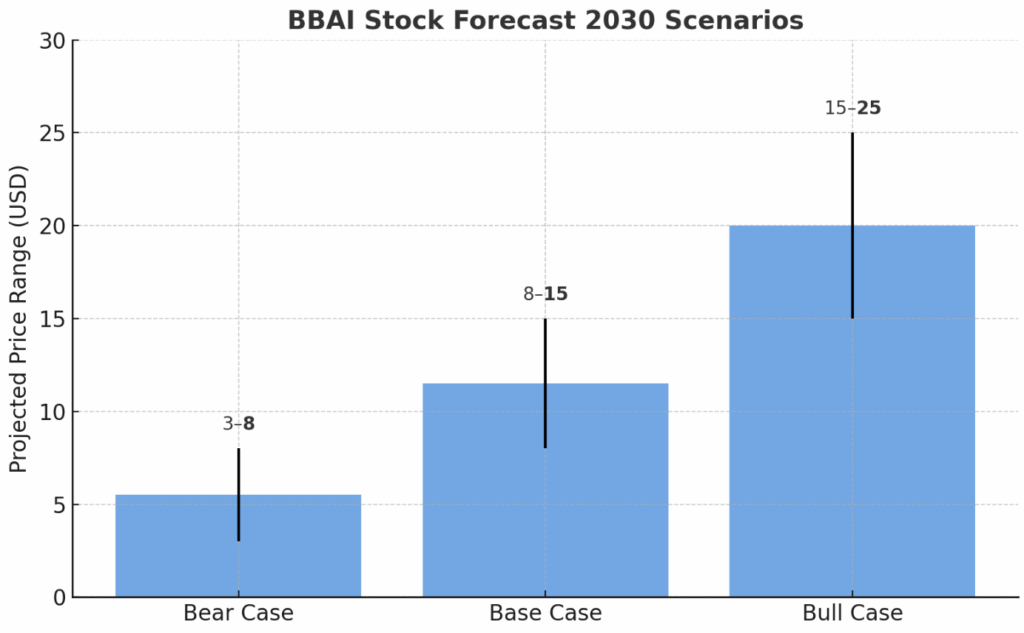

BBAI Stock Forecast 2030

Forecasting BigBear.ai (NYSE: BBAI) out to 2030 is highly speculative, but analysts and investors generally agree the company’s long-term outlook will depend on government defense contracts, AI adoption in commercial sectors, and its ability to control costs and achieve profitability.

Bull Case

If BigBear.ai secures long-term U.S. defense and homeland security contracts, expands into commercial AI solutions, and improves margins, revenue could grow significantly, potentially 5x–10x from 2025 levels. In this scenario, the stock could trade in the $15–$25+ range by 2030, assuming profitability or strong cash flow is achieved.

Base Case

In a middle-ground view, BBAI wins new contracts but growth is uneven due to delays or budget constraints. Revenue grows steadily, but losses narrow slowly. By 2030, the stock might trade in the $8–$15 range, reflecting moderate growth without full profitability.

Bear Case

If contract uncertainty continues, losses remain high, or competition from larger AI firms erodes market share, BBAI could struggle to scale meaningfully. In this case, the stock could remain volatile and trade in the $3–$8 range by 2030.

Should I Buy BigBear AI Stock Now?

BigBear.ai (NYSE: BBAI) is a speculative, high-risk stock. The company has strong cash reserves of about $390M and opportunities in defense and AI, but it also posted a wider Q2 2025 loss of –$0.71 per share and cut its revenue forecast to $125M–$140M. This mix of upside potential and near-term uncertainty makes BBAI better suited for risk-tolerant investors than for conservative buyers.

Reasons to Consider Buying

- Exposure to fast-growing AI and defense sectors.

- Large cash buffer and low debt reduce short-term financial risk.

- Potential for long-term upside if government contracts expand.

Reasons to Be Cautious

- Unprofitable with revenue guidance revised downward.

- Heavy dependence on U.S. government contracts, vulnerable to delays or cuts.

- Volatile stock price, with sharp swings after earnings.

Conclusion

BigBear.ai (BBAI) sits at the intersection of artificial intelligence and defense contracting, giving it strong long-term potential but also exposing it to short-term volatility. The company’s large cash reserves provide stability, yet its lowered revenue guidance and ongoing losses show that execution risk is high.

At Ultima Markets, we believe traders should always balance opportunity with risk. Staying informed on company fundamentals, sector trends, and broader market conditions is essential before making investment decisions. With the right tools and insights, you can approach stocks like BBAI more strategically and trade with greater confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.