Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteGold vs. Bonds: Amid French Political Turmoil, an Era of Safe-Haven Reshuffling Is Arriving

Abstract: In the future, gold, commodities, and core technology stocks that are relatively insulated from the macroeconomic environment may emerge as new tools to hedge against fiscal and inflationary risks.

France’s political stalemate is becoming a microcosm of a global long-term bond storm, a crisis that is profoundly reshaping the risk pricing of assets worldwide.

This week, French President Emmanuel Macron appointed his ally, Defense Minister Sébastien Lecornu, as the new prime minister—the fifth to serve during Macron’s second term.

His predecessor was forced to resign last week after failing to win a confidence vote in parliament for an unpopular budget-cutting plan. The expectation that fiscal policy would no longer be tightened initially boosted the French CAC 40 stock index.

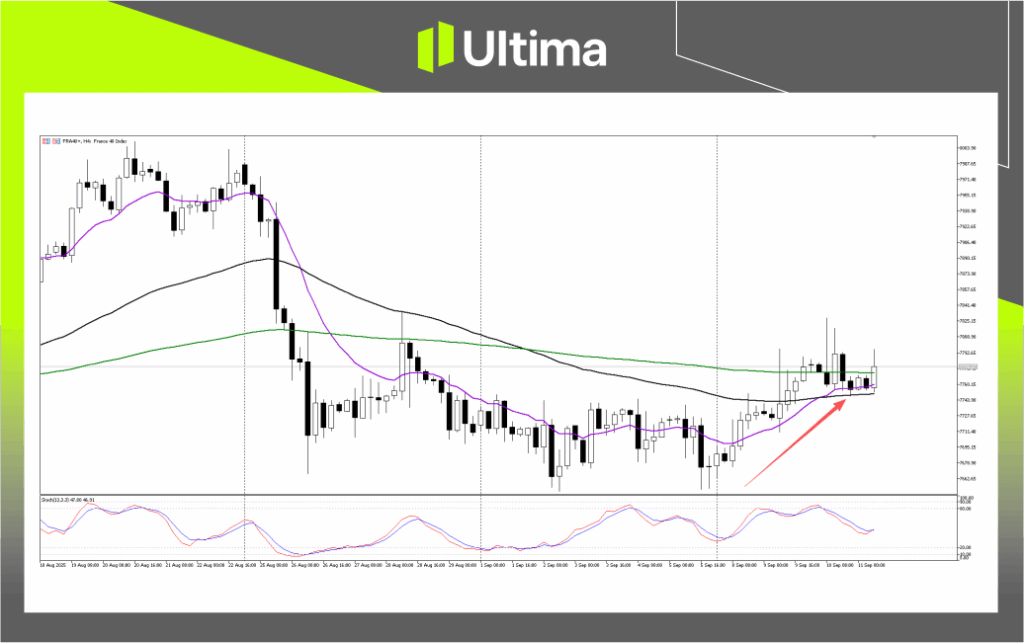

(Image: France CAC 40 Index 4-Hour Chart, Source: Ultima Markets MT5)

However, Ultima Markets reminds investors that the next critical juncture is this Friday, when rating agency Fitch will update its debt rating for France. Any negative action could further drive up France’s financing costs and, in turn, pressure the stock market.

A Microcosm of the Global Long-Term Bond Storm

France’s fiscal predicament is not an isolated case but rather a microcosm of a global storm in long-term bonds.

- In the United Kingdom, concerns over debt sustainability have led to a sharp sell-off in long-dated bonds, with borrowing costs approaching highs not seen since 2000.

- In Japan, debt servicing costs already account for a huge portion of the national budget. Its debt-to-GDP ratio of 240%, combined with structurally weak demand, places its ultra-long-term bonds at significant risk.

These developed economies are collectively entering a new era of “fiscal dominance.” Governments are inclined to rely on fiscal deficits to stimulate growth, which in turn forces central banks to maintain low interest rates under the constraint of high debt.

The result is that short-term interest rates are anchored by policy, but inflation expectations are difficult to suppress. The market can only reprice this reality through soaring long-term interest rates and currency depreciation, creating a vicious cycle of “deficits—inflation—interest rates—higher deficits.”

What bondholders require is a risk premium for inflation and solvency, not more fiscal stimulus.

The September Curse and Structural Selling Pressure

The current sell-off in the global long-term bond market is also related to seasonal and structural factors.

Statistically, over the past decade, global government bonds with maturities exceeding 10 years have recorded a median loss of 2% in September, making it the worst-performing month of the year.

A deeper structural change is coming from Europe. The reform of the Netherlands’ nearly €2 trillion pension system is reshaping the market landscape. The new system requires less demand for long-duration hedging instruments and allocates more capital to riskier assets such as stocks.

Given that Dutch pension funds hold nearly €300 billion in European bonds, the exit of this major buyer of European long-term debt undoubtedly constitutes a substantial headwind for future demand and has pushed the 30-year government bond yields of Germany and France to multi-year highs.

Where Should Investors Turn?

Against a backdrop where fiscal expansion has become the global norm and risks in long-term bonds continue to accumulate, Ultima Markets believes investors need to reassess their asset allocation strategies:

- Persistent Pressure on the Yield Curve: In a “fiscal dominance” model, short-term interest rates are constrained by central banks, while long-term rates remain elevated due to risk premiums. This will lead to a continued steepening of the yield curve. For bond investors, simply holding long-term bonds becomes increasingly risky; coupon-focused or carry strategies may become a better option.

- Rising Global Currency Volatility: Some heavily indebted nations may attempt to dilute their debt stock through currency depreciation, which will exacerbate volatility in the global foreign exchange market.

- A Shift in Safe-Haven Assets: As the safe-haven properties of sovereign bonds continue to erode, their traditional role in asset allocation is being challenged. Gold, commodities, and core technology stocks that are relatively insulated from the macroeconomic environment may emerge as new tools for hedging against fiscal and inflationary risks.

Disclaimer

The comments, news, research, analysis, prices, and other information contained herein are provided as general market information only, to assist readers in understanding market conditions, and do not constitute investment advice. Ultima Markets has taken reasonable measures to ensure the accuracy of this material, but cannot guarantee its precision, and it may be changed at any time without notice. Ultima Markets will not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server