Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteSofter U.S. PPI Signals Fed Policy Pivot Nears

Global equity markets extended gains on Wednesday after U.S. Producer Price Index (PPI) data came in softer than expected, reinforcing expectations that the Federal Reserve is on track to begin a new easing cycle next week.

All three major U.S. indices closed higher, while in Asia the rally continued, with Japan’s Nikkei 225 opening Thursday at another record high and Hong Kong’s Hang Seng Index climbing to multi-year highs.

PPI Underscores Cooling Inflation

The August PPI unexpectedly fell 0.1% month-on-month, compared with forecasts of a 0.3% rise, while annual producer inflation slowed to 2.6%. Core PPI rose 0.3% m/m and 2.8% y/y, both below expectations.

Although producer prices remain elevated, the data pointed to easing cost pressures for businesses, boosting confidence that consumer inflation is also moderating. This has further cemented bets on a 25-basis-point rate cut at the September 16–17 FOMC meeting, with markets pricing in nearly a 90% probability, according to CME FedWatch.

CPI in Focus

The next key test comes with August CPI data, due later Thursday. Consensus expectations point to a 0.3% monthly increase and an annual rate of 2.9%.

- A softer reading could fuel expectations of a deeper easing cycle, potentially extending cuts through early 2026.

- A hotter print may force the Fed to slow its pivot, tempering dovish market bets.

Fed Policy Outlook

Recent remarks from policymakers, including Governor Christopher Waller, have reinforced a dovish tilt, signaling a gradual easing cycle over the next three to six months.

Meanwhile, Governor Lisa Cook — also considered dovish — will participate in next week’s vote after a U.S. court ruled, she cannot be removed while litigation with former President Trump continues. Her presence further tilts the balance toward rate cuts.

With the September cut largely priced in, the real debate now centers on the trajectory of easing. Thursday’s CPI will likely dictate whether markets lean toward an extended series of cuts or scale back expectations for aggressive action.

Market Reaction

- Equities: Wall Street extended gains, with the Nasdaq and S&P 500 hovering near record highs. Asian and European markets followed with modest advances.

- Bonds: U.S. Treasury yields eased further, with the 10-year yield slipping to a four-month low at 4.02%, reflecting growing confidence in additional Fed cuts.

- Dollar: The U.S. dollar dipped briefly after the PPI release but rebounded, holding within the 97.50–98.50 range. Traders see CPI as the likely catalyst for the next breakout.

- Gold: Spot gold hovered near record highs above $3,600, supported by lower yields and continued hedging demand amid fiscal uncertainty.

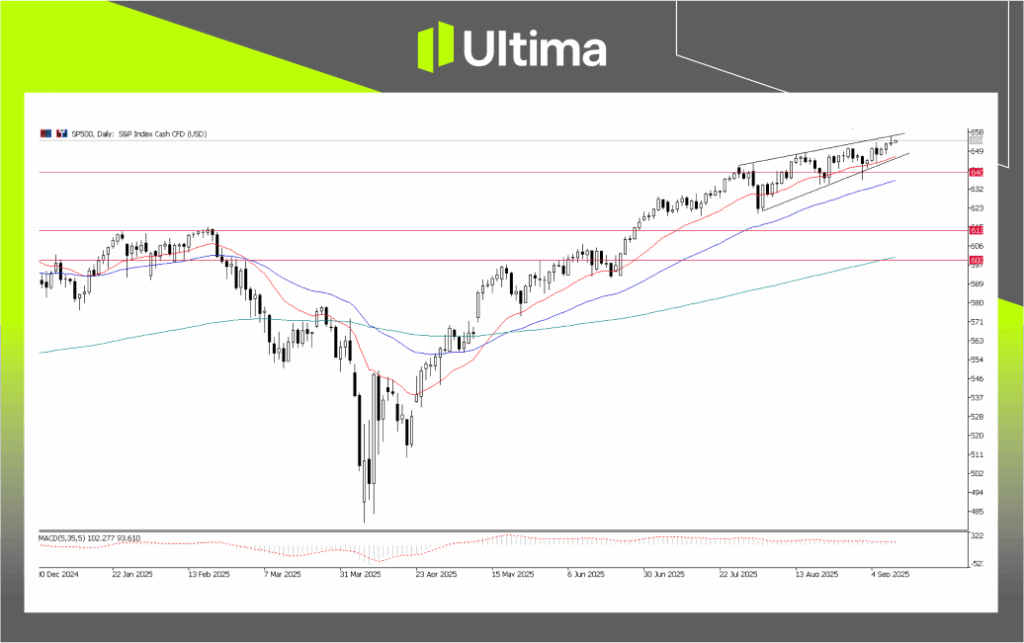

SP500, Day-Chart Analysis | Source: Ultima Market MT5

The S&P 500 Index continued to edge higher, reaching fresh record levels and reflecting market optimism over the Fed’s rate-cut outlook.

From a technical perspective, the broader uptrend remains intact, but the formation of a rising wedge pattern signals that momentum may be losing steam, warranting caution despite the upside bias.

Ultima Markets analysts note that while the index could extend gains in the near term, the risk of a short-term pullback looms following next week’s Fed meeting.

“Historically, U.S. equities have often retraced after the first rate cut, as investors lock in profits and recalibrate expectations for the easing cycle.” Said Shawn Lee, Senior Analyst at Ultima Markets.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server