Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomVia Transportation, Inc. known for powering on-demand transit and public mobility systems. It is set to make one of 2025’s most closely watched IPOs. With government contracts, expanding European presence, and a massive total addressable market (TAM), investors are watching closely.

IPO Date: When Will Via List?

Via Transportation’s IPO is expected to price during the week of September 8, 2025, with an estimated first trading day on September 12, 2025 on the NYSE under the ticker VIA, subject to final market conditions.

Dates remain provisional. Final timing depends on market conditions and regulatory approvals.

What is Via Transportation?

Via Transportation, Inc. is a New York–based transit-tech company founded in 2012. Its mission is to modernize public mobility by providing software and operational services for on-demand and scheduled transportation.

Core Offerings

- TransitTech Software: Route optimization, scheduling, and dispatch for buses, vans, and school transport.

- Paratransit & Special Services: Digital solutions for seniors, disabled riders, and non-emergency medical transportation.

- Government Partnerships: Long-term contracts with cities, school districts, and transit agencies (90%+ of revenue comes from government clients).

Business Model & Growth Drivers:

Recurring Revenue from Governments

Via’s core model is to provide software and services for public transit, paratransit, school transport, and municipal routing, with multi-year contracts that reduce churn risk.

Expanding Addressable Market:

- TAM: $545 billion across global public transportation.

- Current penetration: <1%, showing long runway for growth.

Improving Path Toward Profitability

Via has consistently narrowed net losses while increasing gross margins. Investors will weigh whether the IPO proceeds accelerate a pivot to break-even.

IPO Terms & Offering Structure

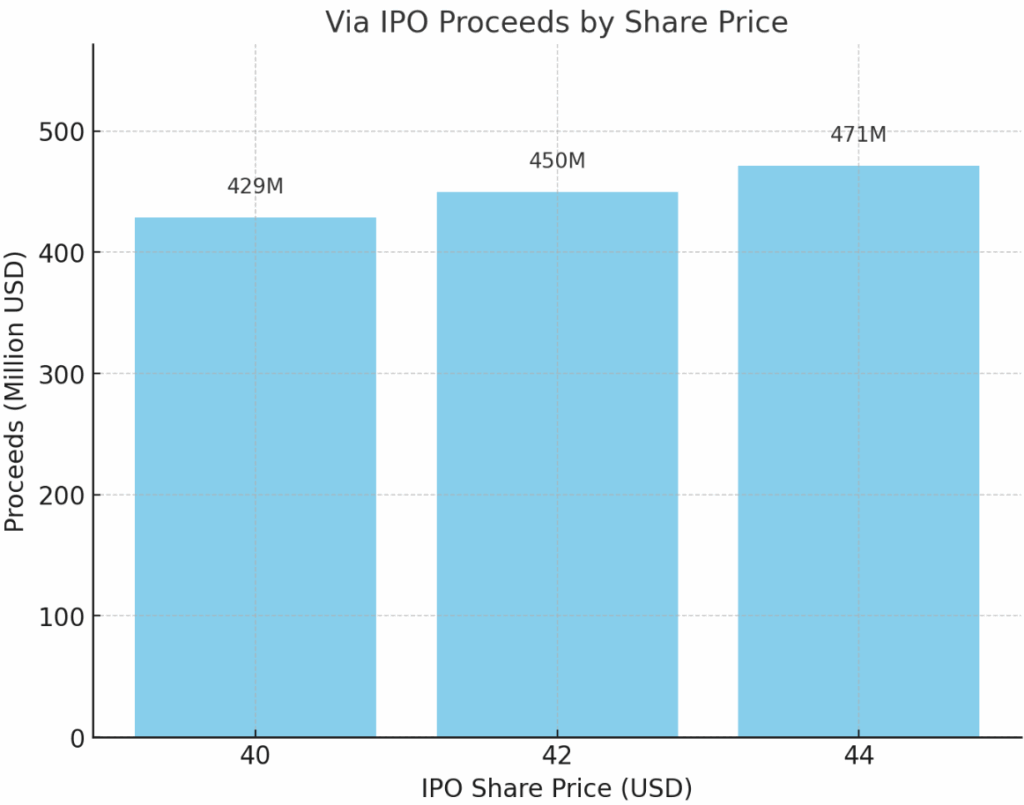

Via Transportation plans to offer 10.71 million Class A shares in its IPO, with a proposed price range of $40 to $44 per share. Of the total, approximately 7.14 million shares will be newly issued by the company, while 3.57 million shares will be sold by existing shareholders, making about one-third of the deal a secondary offering.

The company has also granted underwriters a 1.61 million share overallotment option (green-shoe), which could increase the total size of the offering if exercised. Leading the underwriting syndicate are Goldman Sachs, Morgan Stanley, Allen & Co., and Wells Fargo, alongside other bookrunners. This structure allows Via to raise new capital for growth initiatives while giving early investors an opportunity to partially exit, a balance often viewed as a sign of maturity in IPO markets.

Valuation & Fundraising Potential

At its proposed price range of $40 to $44 per share, Via Transportation is targeting a valuation between $3.2 billion and $3.8 billion, with most analysts placing the midpoint around $3.5 billion.

If the IPO prices at the top of the range and the overallotment option is exercised, the company could raise up to $471 million in gross proceeds. This capital is expected to fund growth initiatives, expand its international footprint, and accelerate its push toward profitability.

For investors, the valuation places Via in the mid-cap technology bracket, making it comparable to other recent transit-tech and infrastructure software listings, while the balance of new issuance and secondary shares indicates both growth financing and partial liquidity for early stakeholders.

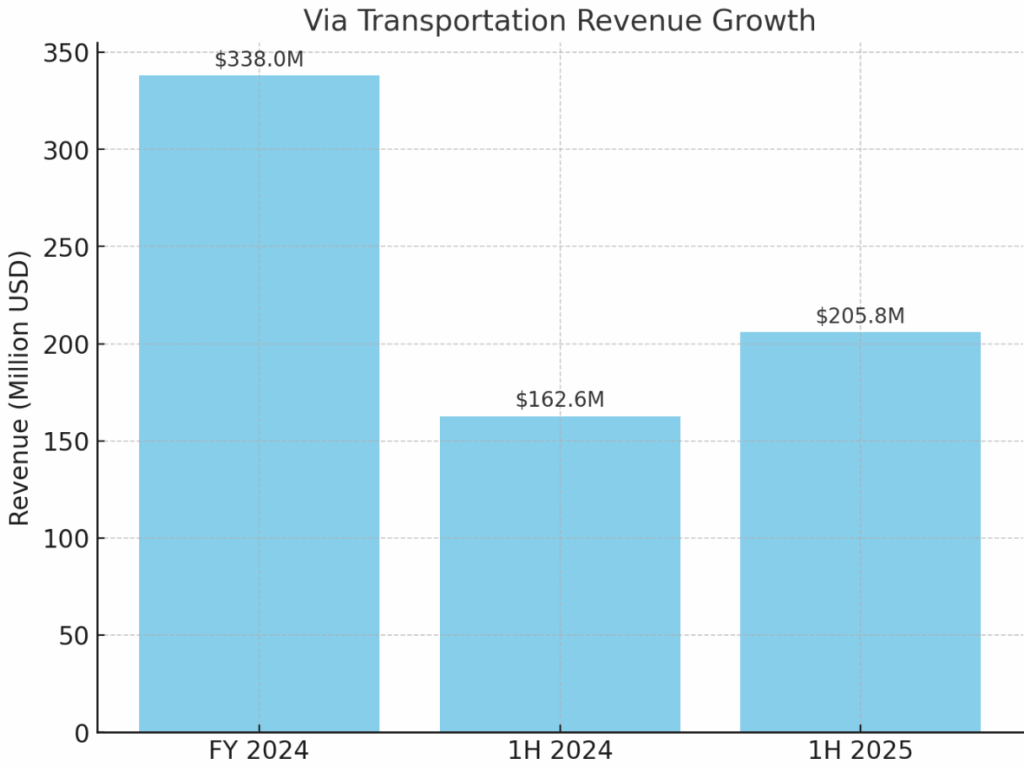

Financial Performance Snapshot

- 1H 2025 Revenue: $205.8 million, up 27% year-over-year.

- 1H 2025 Net Loss: $37.5 million, narrower than the $50.4M loss in 1H 2024.

- FY 2024 Revenue: ~$338 million (full-year).

- Customer Mix: >90% revenue from government contracts, giving more predictable cash flows.

- Regional Split: ~70% North America, 30% Europe.

Investor Expectations

Investor expectations for the Via IPO are shaped by both its strong fundamentals and the challenges ahead.

What Bulls See

- Defensive revenue base in public infrastructure.

- Large TAM with low penetration = long growth horizon.

- Secular support: Global push for sustainable, smart transit solutions.

What Bears See

- No profitability yet, raising valuation questions.

- IPO environment in 2025 is volatile; investor appetite has been uneven.

- Lock-up expiries could pressure stock if insiders sell aggressively.

Overall, the IPO is expected to attract interest from institutional investors seeking exposure to infrastructure technology, though retail sentiment may hinge on near-term market conditions and the broader performance of 2025 IPOs.

Key Dates to Watch

- Pricing: Week of Sept 8, 2025.

- Expected First Trade: Sept 12, 2025.

- Lock-up Expiry: ~180 days post-IPO (early 2026).

Conclusion

Via Transportation’s IPO stands out as one of the most anticipated listings of 2025, targeting a valuation of $3.2 to $3.8 billion with strong backing from long-term municipal contracts and a growing footprint in digital transit solutions. While profitability remains uncertain, the company’s narrowing losses and exposure to the massive $545 billion public mobility market highlight significant growth potential. Investors should weigh both the opportunity and the risks, particularly given the current volatility in global equity markets.

At Ultima Markets, we believe events like the Via IPO illustrate how innovation in public infrastructure and technology is reshaping investment opportunities worldwide. By staying informed and understanding both the fundamentals and the market context, traders can better navigate volatility and align their strategies with emerging trends.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.