Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat Does Dividend Yield Mean?

Dividend yield represents the annual dividend an investor receives from a company relative to its current share price. It is expressed as a percentage and often used by traders and long-term investors to compare income opportunities across different stocks, sectors, or even asset classes.

In simple terms, dividend yield shows how much cash return a stock pays you for every dollar invested.

How to Calculate Dividend Yield

The formula for dividend yield is:

Dividend Yield = (Annual Dividends per Share ÷ Current Share Price) × 100

- Annual Dividends per Share: The total dividends paid over a year.

- Current Share Price: The stock’s latest market price.

Let’s break it down step by step:

- Find the company’s annual dividend per share.

Example: $0.50 paid quarterly = $2 annually.

- Check the stock’s current share price.

Example: $40.

- Apply the formula: (2 ÷ 40) × 100 = 5% dividend yield.

Dividend Yield Example

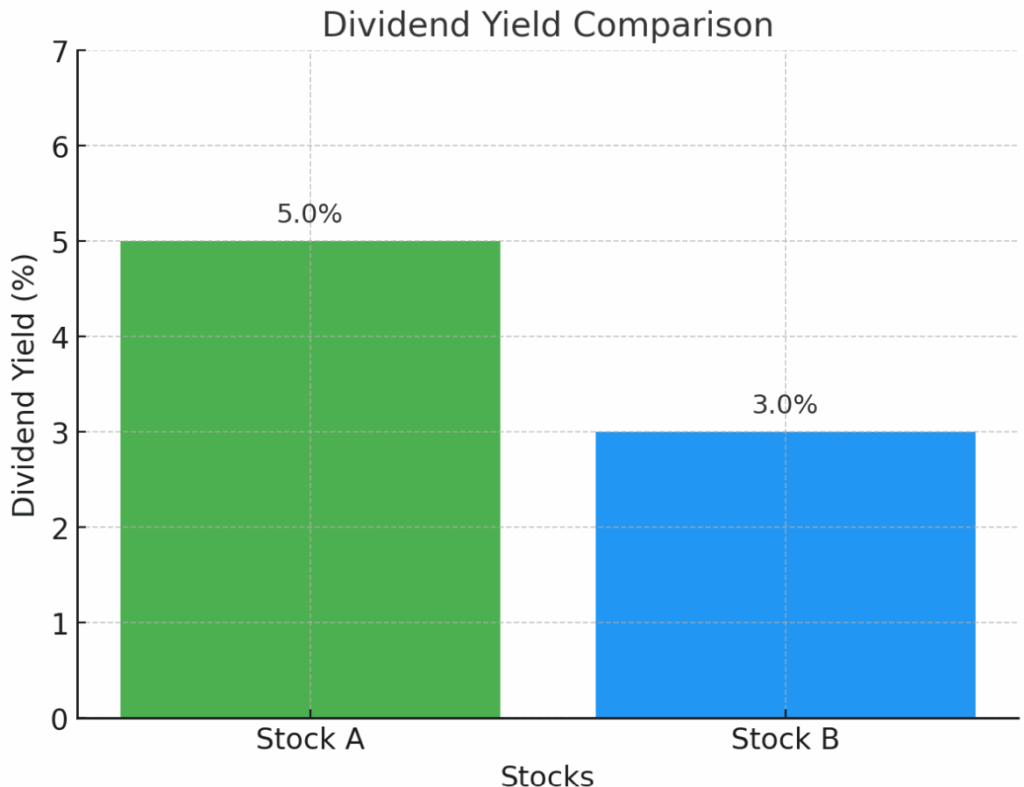

Imagine two stocks:

- Stock A: $2 annual dividend ÷ $40 price = 5% yield.

- Stock B: $3 annual dividend ÷ $100 price = 3% yield.

Stock A looks higher-yielding, but that doesn’t automatically make it better. Stock B may have stronger growth potential.

What Is a Good Dividend Yield for a Stock

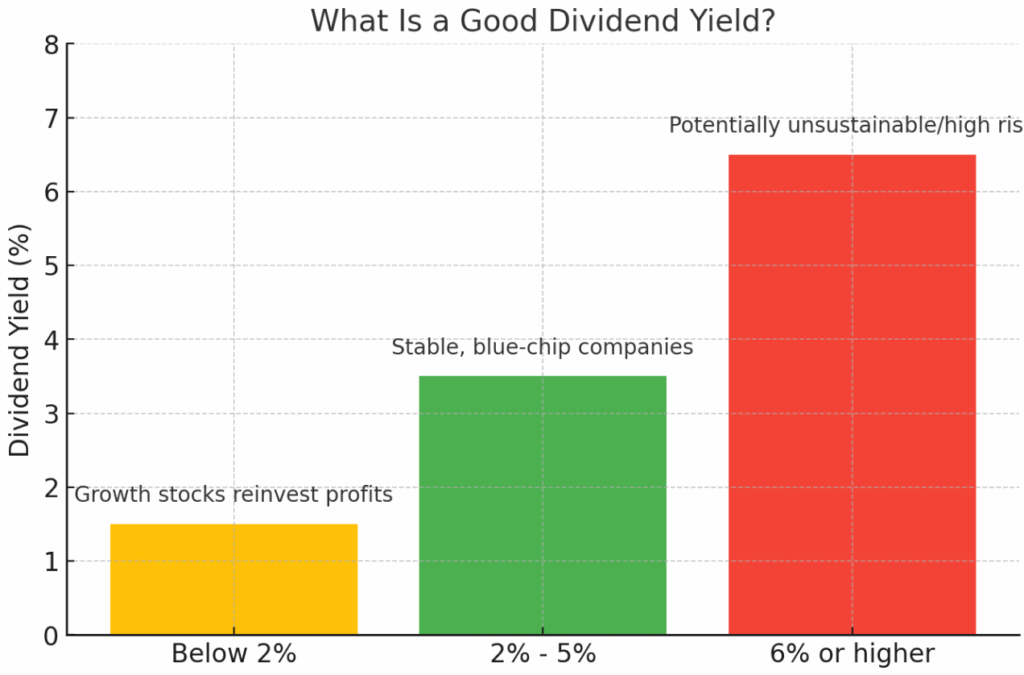

The idea of a “good” dividend yield is relative:

- 2%–5% yield: Often seen as stable for blue-chip companies.

- 6% or higher: Attractive but may indicate financial stress or unsustainable payouts.

- Below 2%: Common in growth stocks (tech, biotech), where earnings are reinvested.

Some traders always compares dividend yields against sector averages. For example, utilities may average 4%, while tech often averages below 1%.

Advantages and Disadvantages of Dividend Yield

While dividend yield is one of the most popular measures for evaluating income from stocks, relying on it alone can be risky. A high yield can attract investors seeking steady cash flow, but it may also mask underlying financial issues.

On the other hand, a low yield does not always mean a stock is unattractive, many growth companies prefer reinvesting profits rather than paying dividends.

Advantages

- Steady income stream: Dividends provide regular cash flow.

- Stability indicator: Mature companies with consistent payouts are often more resilient.

- Comparison tool: Helps investors weigh income potential vs. other assets (bonds, REITs, ETFs).

Disadvantages

- Misleading high yields: A collapsing share price can inflate dividend yield artificially.

- Dividend cuts: Companies can reduce or suspend payouts in downturns.

- Opportunity cost: High dividend stocks may offer less capital appreciation compared to growth stocks.

Dividend Yield and Inflation

Dividend yield must always be viewed against inflation. For example, a stock with a 3% yield may not provide real income growth if inflation is running at 4%. On the other hand, companies that consistently raise dividends (known as dividend growers) can help investors outpace inflation over time.

Dividend yield must be analysed alongside inflation:

- If yield < inflation: The investor’s real return is negative.

- If yield > inflation: Provides positive real income.

- Dividend growers: Companies that consistently raise dividends (e.g., Dividend Aristocrats) help investors protect purchasing power.

How Traders Use Dividend Yield

Beyond long-term investing, traders watch dividend yield for:

- Dividend capture strategies: Buying stocks just before the ex-dividend date to earn payouts.

- Sector rotation: Shifting into higher-yield sectors when interest rates fall.

- Risk assessment: Spotting red flags when dividend yield spikes due to price collapse.

This makes dividend yield a dual-purpose tool: income planning for investors and risk/market sentiment signals for traders.

Conclusion

So, what does dividend yield mean for investors and traders? At its core, it reflects how much income a stock pays relative to its price but its real value lies in how you apply it. A strong dividend yield can provide stability and income, while a weak or unsustainable yield may signal caution. The key is balance: evaluating yield alongside company fundamentals, sector averages, and inflation trends.

At Ultima Markets, we believe informed decisions create stronger trading outcomes. That’s why we provide traders with the tools, market insights, and education they need to go beyond the numbers. Whether you’re analysing dividend yield or exploring broader strategies, Ultima Markets empowers you to trade smarter and with greater confidence in today’s fast-moving markets.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.