Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhy Is SMR Stock Dropping?

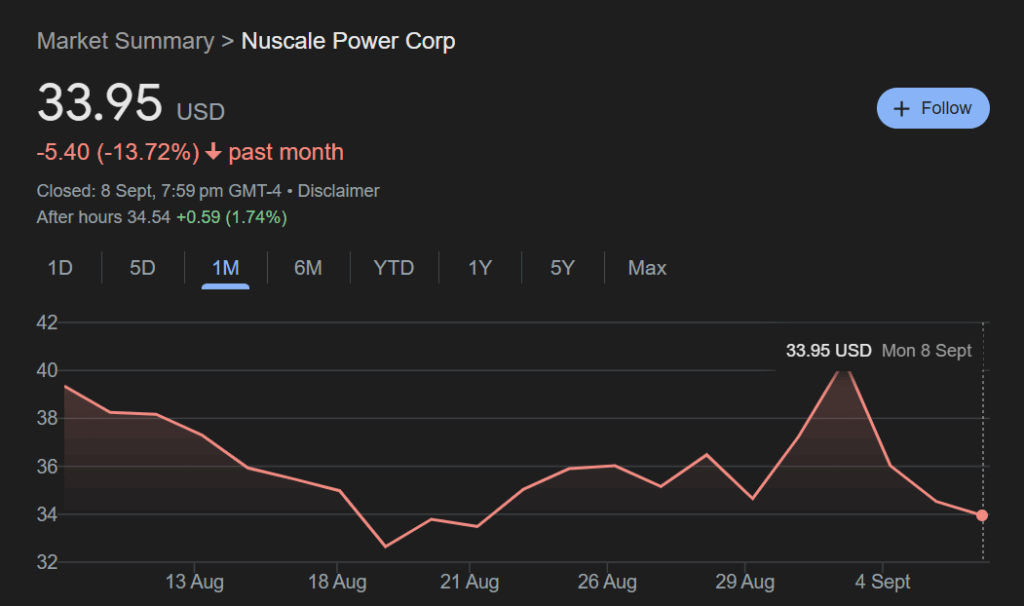

NuScale Power Corporation (NYSE: SMR) has been one of the most closely watched names in the nuclear and clean energy space. After explosive rallies tied to breakthroughs in small modular reactor (SMR) approvals and new partnerships, its stock has also suffered sharp pullbacks.

Several forces explain the recent declines:

Profit-taking After A Surge

In early September 2025, NuScale’s shares jumped more than 40% on news of a landmark deal with the Tennessee Valley Authority (TVA) and ENTRA1 to potentially deploy up to 6 GW of NuScale SMRs. Once that euphoria faded, short-term traders locked in profits, triggering a sharp pullback.

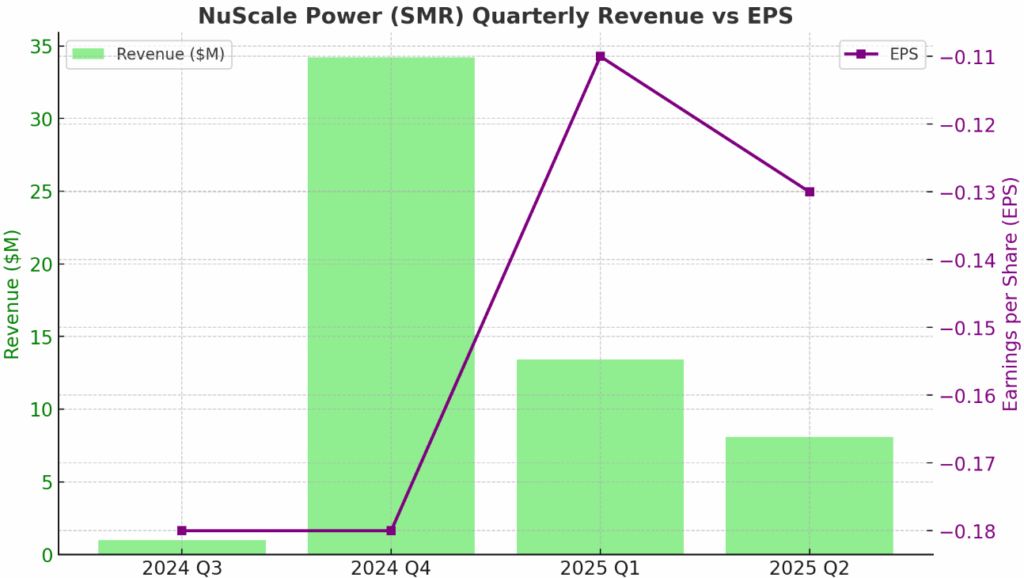

Earnings and Financial Pressure

In Q2 2025, NuScale reported $8.1 million in revenue and a wider quarterly loss. While revenue was higher year-over-year, analysts expected stronger performance. Persistent losses continue to weigh on investor sentiment.

Shareholder Overhang

Fluor Corporation, NuScale’s largest shareholder, converted preferred shares and may sell portions of its holdings. Insider and institutional selling have added downward pressure, making retail investors nervous.

Sector Competition

While NuScale scored the TVA–ENTRA1 deal, TVA is also pursuing a GE-Hitachi BWRX-300 reactor at Clinch River. Competing SMR technologies may limit NuScale’s market share and slow adoption.

For active traders, these combined pressures explain the stock’s volatility, enthusiasm over breakthrough deals quickly collides with the reality of dilution, competition, and ongoing losses.

What Does NuScale Power Corp Do?

NuScale Power is a U.S.-based nuclear technology company developing small modular reactors (SMRs). Its VOYGR power plants are designed around compact, factory-built reactor modules that can be scaled up in multiples to meet demand.

Key features:

- Regulatory milestones. NuScale’s 50 MWe SMR design was certified by the U.S. Nuclear Regulatory Commission (NRC) in 2023. In May 2025, the NRC granted Standard Design Approval for an uprated 77 MWe version, strengthening its technical credibility.

- Applications. SMRs can support clean baseload electricity, hydrogen production, water desalination, district heating, and even powering data centers that face surging energy needs from artificial intelligence growth.

- Global reach. Beyond the U.S., NuScale is working with Romania and other international partners to commercialize its technology.

This makes NuScale the only American company with NRC-certified SMR technology, a powerful differentiator in a market where regulatory approval is a massive barrier to entry.

Is SMR Stock a Good Buy?

Whether SMR stock is a good buy depends on your time horizon and risk tolerance:

- Short term: Volatility is extreme. Profit-taking, insider selling, and dilution risks create near-term headwinds. Day traders and swing traders can exploit this volatility but must manage risk tightly.

- Long term: Analysts remain cautiously optimistic. TipRanks average target: $42 (range $31–$60). StockAnalysis average: $38.33 (range $21–$60). Fintel/AlphaSpread consensus: around $39 (range $14–$55).

At current levels, that suggests moderate upside. But these targets assume NuScale executes on projects like TVA–ENTRA1, avoids major delays, and keeps financing intact.

For traders, the setup looks more speculative than defensive. Long-term investors may view dips as entry points, but short-term players should treat SMR like a momentum stock, not a safe utility.

SMR Stock Forecast 2030

Analyst outlook for SMR stock in 2030 is highly divided.

- On the bullish side, some analysts believe NuScale could deliver multi-bagger returns if its small modular reactors achieve wide deployment and capture market share. Projections in this camp see prices potentially reaching triple-digit levels by the end of the decade.

- On the bearish side, other analysts caution that NuScale’s financial losses, execution risks, and intense competition could leave the stock trading in the single digits, far below today’s price.

- The truth likely lies between these extremes. Much will depend on NuScale’s ability to secure financing, build reactors on time and on budget, and maintain strategic partnerships with utilities.

Some projects SMR could reach $149.89 by 2030, a potential 3× to 4× return from today’s levels. On the other hand, some estimates SMR may average only $3.75 by 2030, implying a near-wipeout.

2030 forecasts are speculative scenarios, not guarantees. Traders should focus on near-term catalysts quarterly earnings, insider activity, and project milestones while keeping an eye on the long-term vision.

Does NuScale Have a Future?

NuScale has a future, but it’s not guaranteed. For traders, this is a high-beta clean energy stock: a potential long-term winner if commercialization succeeds, but vulnerable to deep pullbacks if milestones slip.

Despite risks, NuScale does have a path forward:

- Technical advantage: Only NRC-certified SMR technology in the U.S.

- Strategic demand: SMRs align with the twin trends of clean energy mandates and the power-hungry AI revolution.

- High-profile partners: TVA–ENTRA1’s 6 GW framework, Romania’s deployment plans, and Department of Energy support give NuScale credibility.

However, past setbacks like the canceled Idaho UAMPS project in 2023 show how fragile execution can be.

Conclusion

NuScale Power’s journey shows both the promise and the peril of betting on next-generation nuclear technology. The company is at the forefront of U.S.-approved SMR designs, with potential applications ranging from clean energy to powering AI data centers. Yet the stock remains volatile swinging between breakthrough announcements and financial headwinds.

For traders, SMR offers opportunity but demands discipline. Short-term moves can be sharp, while the long-term outlook depends on execution and policy support.

At Ultima Markets, we believe staying informed is the first step to trading smart. Our platform provides the tools, insights, and market analysis you need to navigate high-growth but high-risk sectors like nuclear energy. Trade with knowledge, trade with purpose.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.