Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteTaiwan Semiconductor Manufacturing Company Limited (TSMC, ticker: TSM) is the backbone of global chip production, powering everything from smartphones to artificial intelligence. Yet even a company with world-leading technology can see sharp stock swings. Recently, TSM stock slipped as investors reacted to new U.S. export-control changes, overseas cost concerns, and broader market caution.

Understanding why the stock is falling and what it means for long-term investors requires looking at both policy headlines and fundamental data.

Why Is TSM Stock Dropping Now?

U.S. Revokes Fast-Track Tool Exports to China

- In early September 2025, the U.S. Commerce Department revoked TSMC’s “Validated End-User” (VEU) status for its Nanjing facility.

- Until December 31, 2025, TSMC can continue to receive U.S. chipmaking tools freely. After that, all shipments will require case-by-case licenses.

- This is not a ban, but it injects regulatory friction and timing uncertainty into TSMC’s China operations. Investors worry about delays and supply chain bottlenecks.

- Shares dipped as traders priced in higher compliance costs and geopolitical risk.

Seasonal Market Weakness in Tech

- September often brings risk-off sentiment in equities. With tech stocks leading global benchmarks higher earlier this year, profit-taking has pressured semiconductors including TSMC.

Margin Dilution From Overseas Expansions

- TSMC is building new fabs in Arizona, Japan, and Germany to diversify production. While strategically important, these fabs are more expensive than Taiwan’s operations.

- Management warned gross margins could fall by 3–6 percentage points over the next five years as these plants ramp up.

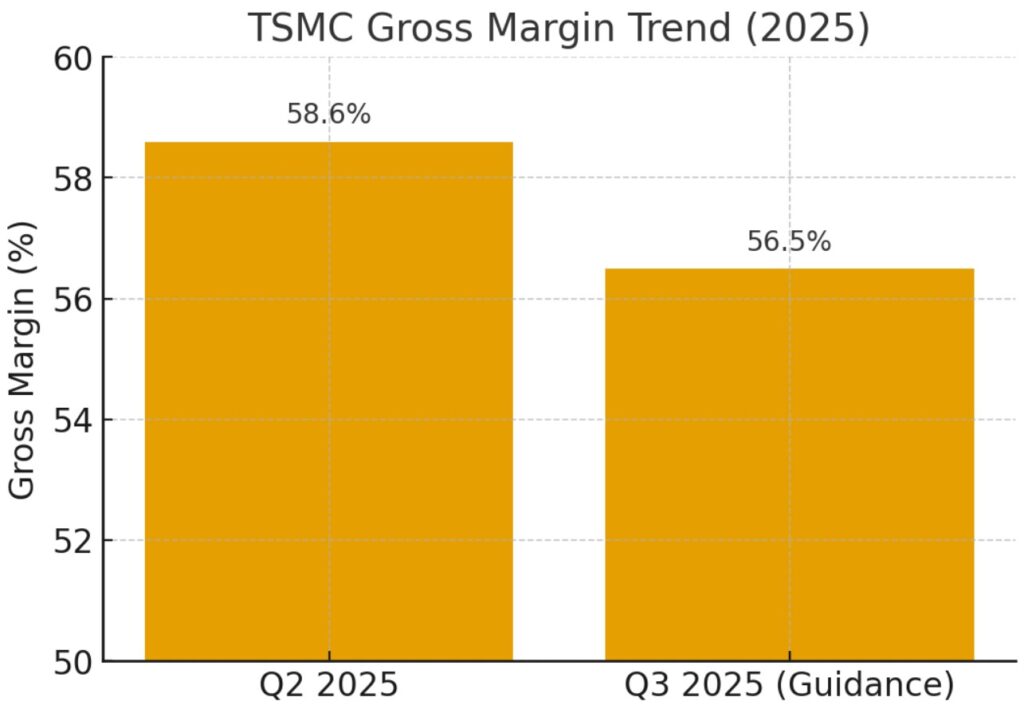

- For Q3 2025, TSMC guided gross margin to about 56.5%, down from 58.6% in Q2.

Heavy Capex and Free-Cash-Flow Concerns

- TSMC continues to invest aggressively in advanced nodes like N3, N2, and upcoming A16. While necessary for leadership, the high capex profile raises questions about free cash flow in the near term.

Short-Term Valuation Reset

- After a strong multi-quarter rally driven by AI demand, even small negative headlines can trigger profit-taking. The current pullback reflects this dynamic.

What Do the Fundamentals Say?

Despite policy headwinds, the core business remains strong:

- Q2 2025 Results: $30.1B revenue (+31% YoY), 58.6% gross margin.

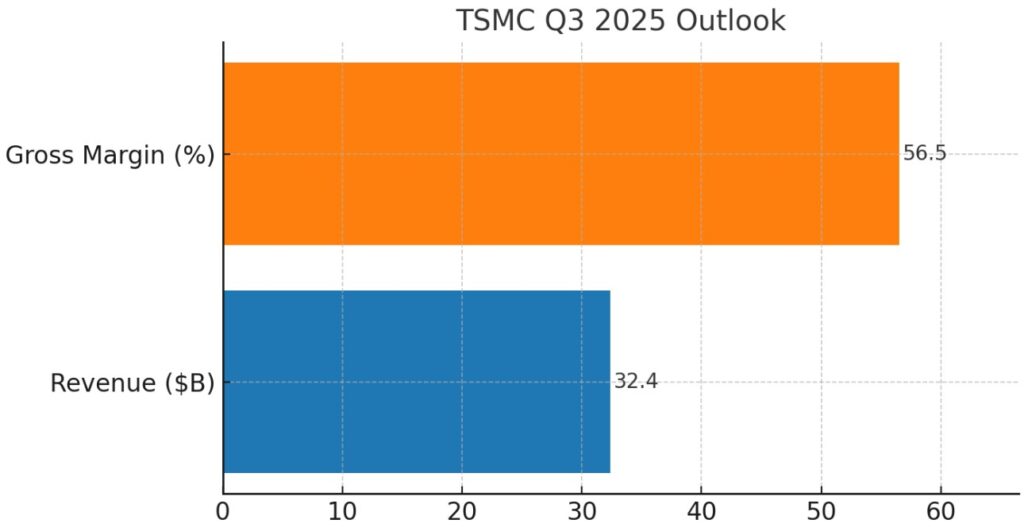

- Q3 2025 Outlook: $31.8B–$33.0B revenue, ~56.5% gross margin midpoint.

- AI Growth: Management confirmed AI chip demand is growing at a strong double-digit CAGR, with leading-edge nodes driving sales.

TSM Stock Price Prediction 2030: Scenario Analysis

This is not financial advice. These ranges are scenario-based projections using public data and industry growth estimates.

Base Case

- AI and HPC demand compounding at strong double-digits.

- Overseas fabs reach healthy utilization by late decade.

- Gross margin stabilizes in mid-50s%.

- Valuation: 18–22x earnings.

- ADR Range: $300–$420 by 2030.

Bull Case

- AI demand outpaces forecasts.

- Overseas fabs reach near-Taiwan efficiency.

- Geopolitical risks stabilize.

- Valuation: 22–26x.

- ADR Range: $420–$550.

Bear Case

- Prolonged export-license frictions.

- Overseas fabs under-utilized.

- AI demand cycles slower than expected.

- Valuation: 14–17x.

- ADR Range: $200–$280.

Key Risks to Watch

- U.S.–China export license approvals after Dec 2025.

- Overseas fab utilization in Arizona, Kumamoto, and Dresden.

- Gross margin trends as new fabs dilute profitability.

- Customer roadmaps in AI chips (Nvidia, AMD, Apple, etc.).

Conclusion

TSMC’s recent pullback highlights how policy headlines, seasonal sentiment, and margin guidance can move even the strongest semiconductor stock. While U.S. export-control changes add uncertainty for its Nanjing fab, the company’s long-term leadership in advanced nodes and AI demand remains intact.

For traders and investors, the lesson is clear: short-term volatility often masks long-term strength. That’s why staying informed and having the right tools matters. At Ultima Markets, we provide access to timely market insights and educational resources to help you navigate global equities, currencies, and indices with confidence

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.