Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWho is Paul Tudor Jones?

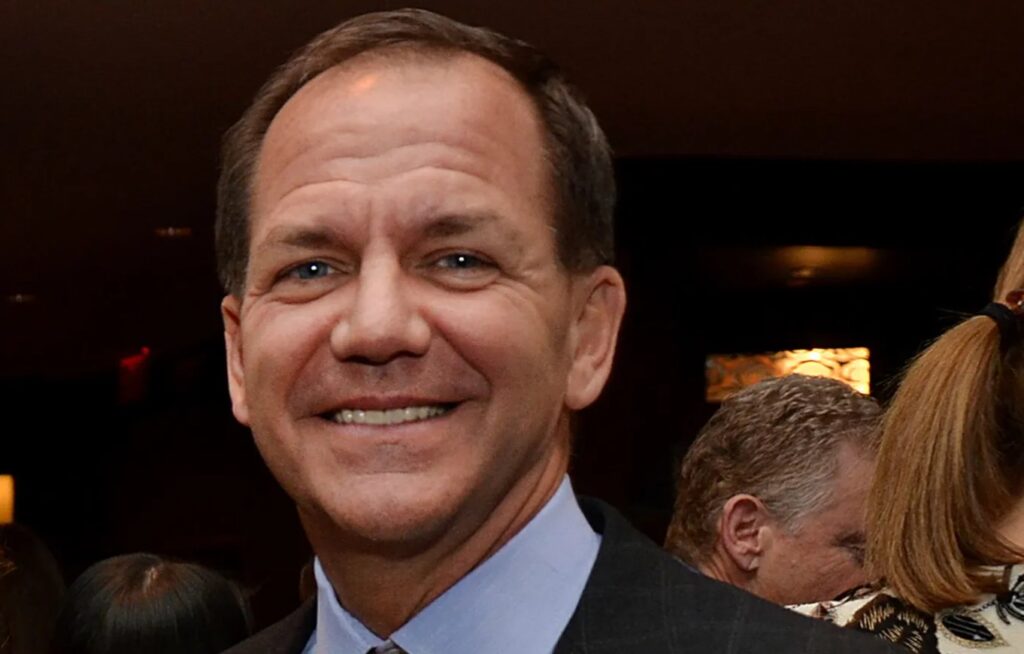

Paul Tudor Jones II is a renowned American hedge fund manager, trader, and philanthropist. Born in 1954, he founded Tudor Investment Corporation in 1980, a leading hedge fund specializing in discretionary global macro trading. In 1988, he co-founded the Robin Hood Foundation, one of the most prominent anti-poverty organizations in the United States.

Jones rose to international prominence after being widely credited with anticipating the 1987 Black Monday crash, where he profited significantly by shorting stock index futures. His reputation for risk control, trend recognition, and capital preservation has made him one of the most influential figures in modern trading.

Paul Tudor Jones Trading Strategy

A Global Macro Approach

Jones is best described as a global macro trader. His strategy focuses on broad economic themes such as interest rates, currencies, commodities, and geopolitical shifts. He studies the interplay between markets to anticipate turning points and allocates capital dynamically based on risk-adjusted opportunities.

Technical and Trend Analysis

While rooted in macro fundamentals, Jones often uses technical analysis to time trades. He has publicly emphasized the 200-day moving average (200 DMA) as a defensive tool, stating: “My metric for everything I look at is the 200-day moving average of closing prices.” This indicator helps him identify long-term trend direction and protect capital when markets weaken.

Risk Management Discipline

A hallmark of his strategy is capital preservation. Key principles include:

- Cutting losses quickly and avoiding “averaging down”

- Letting profitable trades run while scaling risk carefully

- Using mental, technical, and time-based stop levels

- Adjusting position size dynamically based on conviction and performance

Jones’ 1% Rule for Loss Limitation

Paul Tudor Jones is also known for the “1% Rule.” He limits risk on any single trade to no more than 1% of his capital, ensuring no loss is large enough to threaten his overall portfolio. This principle highlights his belief that defense is the best offense in trading, keeping him positioned to capture big opportunities when they arise.

How Jones Forecasts Market Movements

Paul Tudor Jones forecasts market direction through a multi-layered process:

- Macroeconomic trends: Interest rate policies, inflation data, fiscal policy, and capital flows

- Cross-asset signals: Movements in bonds, commodities, and currencies that provide leading clues

- Market sentiment: Assessing positioning and herd behavior to spot inflection points

- Technical confirmation: Applying moving averages and momentum indicators to validate trades

This holistic framework allows him to capture both structural trends and short-term reversals, giving him an edge in high-volatility markets.

Is Paul Tudor Jones a Swing Trader?

Although primarily a global macro trader, many of Jones’s tactical trades resemble swing trading. He often holds positions for days to weeks, aiming to capture momentum shifts around major economic events or trend reversals. His flexibility enables him to operate across timeframes, but his philosophy is rooted in macro themes rather than pure technical swing setups.

As a macro trader, Jones regularly incorporates key economic indicators such as inflation data, interest rates, and employment reports into his market outlook. While he does not rely on any single release as a trading system, these indicators help frame his broader analysis, which he then combines with technical tools like the 200-day moving average.

Paul Tudor Jones Net Worth

As of 2025, reputable financial sources estimate Paul Tudor Jones’s net worth at around $8 billion.

- Wikipedia (July 2024 update) reported $8.1 billion.

- Forbes lists him among the top hedge fund billionaires, confirming his wealth is in the multi-billion dollar range.

- In 2025, Institutional Investor ranked him in the annual Rich List, noting he earned $390 million in 2024, reinforcing his continued prominence.

Net worth estimates vary with financial markets, but Jones consistently ranks among the wealthiest hedge fund managers globally.

Why Paul Tudor Jones Matters to Traders Today

- Track record: Over four decades of successful trading across multiple market regimes

- Adaptability: Transitioned from discretionary macro to also incorporating quantitative tools

- Thought leadership: Publicly discussed inflation risks, ESG investing, and Bitcoin as a hedge against fiat currency debasement

- Philanthropy: Through the Robin Hood Foundation, he has donated hundreds of millions to social causes

For traders and investors, Jones’s career highlights the importance of risk discipline, flexibility, and long-term perspective in navigating volatile markets.

Conclusion

Paul Tudor Jones’s trading legacy shows the importance of discipline, risk management, and adaptability in navigating global markets. From the “1% Rule” to his use of macroeconomic indicators and technical confirmation, his approach offers timeless lessons for traders of every level.

At Ultima Markets, we share this philosophy by empowering traders with the tools, education, and insights needed to understand market trends and manage risk effectively. Just as Jones proves that knowledge and discipline are the keys to long-term success, we provide a trusted, regulated platform to help you trade with purpose and confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.