Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Tata Motors, one of India’s largest automotive companies, is undergoing a major corporate restructuring in 2025. While often described as a “stock split,” the move is technically a demerger that separates the company’s businesses into two distinct listed entities. This development has significant implications for investors, analysts, and traders.

What Is Happening: Demerger vs. Stock Split

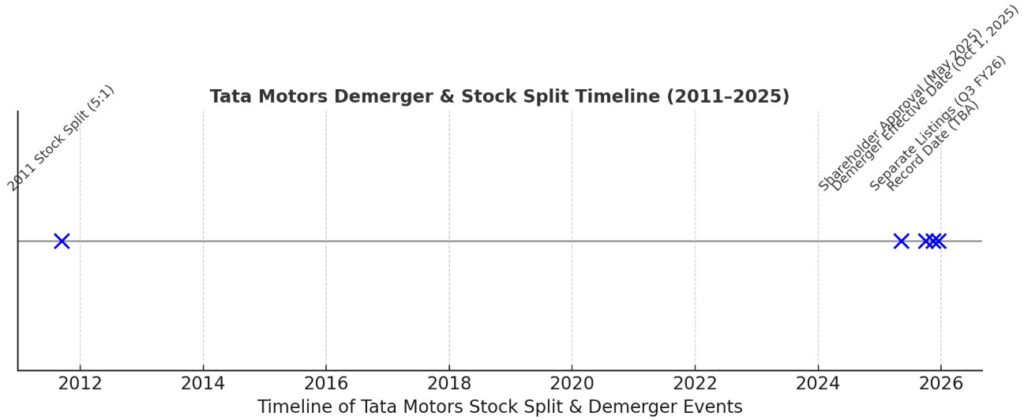

A traditional stock split increases the number of shares while reducing their face value, with no change to total market capitalisation. Example: Tata Motors’ 5:1 stock split in 2011.

The 2025 move is a demerger, not a classic split. Tata Motors will separate its Commercial Vehicle (CV) business into a new listed entity.

Shareholders will retain identical ownership:

- 1 share of Tata Motors (Passenger Vehicles + Jaguar Land Rover + EVs).

- 1 share of the newly created Tata Motors Commercial Vehicles (TMLCV).

This is about strategic focus and value unlocking, not reducing face value.

Tata Motors Demerger: Key Dates & Timeline

| Event | Details |

| Effective Date | October 1, 2025 |

| Record Date | Yet to be announced, will be notified via exchange filings |

| Completion Target | Q2 FY26, Jul-Sep 2025 |

| Separate Listings Expected | Q3 FY26, Oct-Dec 2025 |

| Shareholder Approval | 99.9995% votes in favour (May 2025) |

| Share Distribution Ratio | 1:1 no dilution, identical holding in both entities |

Entities After Demerger

Tata Motors Passenger Vehicles Ltd (TMPV)

- Passenger vehicles, Electric Vehicles (EVs), Jaguar Land Rover (JLR).

- Retains legacy Tata Motors name initially.

Tata Motors Commercial Vehicles Ltd (TMLCV)

- Trucks, buses, and commercial mobility solutions.

- May later assume the Tata Motors Ltd name.

This structure mirrors global best practices, where businesses with different cycles and capital needs are listed separately.

Why Is Tata Motors Stock Split?

Tata Motors’ “stock split” is about creating two stronger, more focused companies.

Key Reasons Behind the Split

Strategic Focus

PV/EV and CV businesses have different capital requirements, growth cycles, and competitive landscapes. Separation allows each to pursue independent strategies.

Unlocking Shareholder Value

Investors will be able to value each entity separately, often leading to a re-rating and potential price appreciation.

Operational Agility

Independent boards and management can make faster, tailored decisions. CV business can focus on infrastructure growth, while PV/EV can scale in the green mobility race.

Global Expansion

The €3.8bn Iveco acquisition bolsters Tata’s global CV footprint, which benefits from being housed in a dedicated listed company.

Investor Confidence

The demerger received 99.9995% shareholder approval in May 2025, a clear sign that investors see long-term value.

Tata Motors Stock Share Prices & Market Reaction

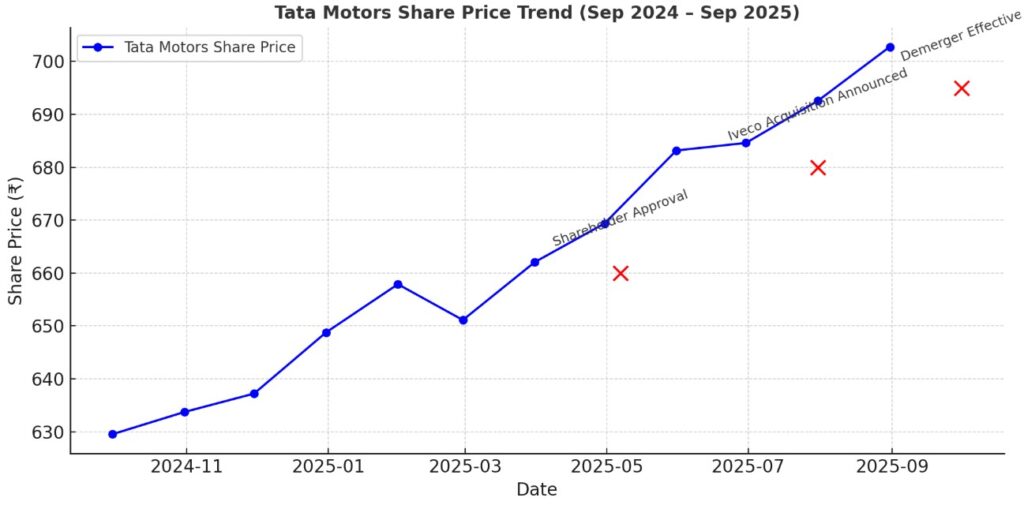

As of early September 2025:

- Share price: ₹693–₹700 range.

- Performance: +11.6% in the past six months.

- Market sentiment: Bullish, driven by demerger optimism and strong CV sales.

Latest Monthly Sales Snapshot (August 2025)

- Total Sales: 73,178 units (+2% YoY).

- Commercial Vehicles: +10% YoY.

- Passenger Vehicles: -3% YoY.

This performance underscores the resilience of the CV division, justifying the decision to spin it off.

Why Tata Motors Stock Is Rising

Tata Motors’ share price has gained strong momentum in 2025, recently trading near the ₹693–₹700 range. The stock has climbed more than 11% in the past six months, and investor sentiment remains bullish. Let’s break down the main reasons behind this rally.

Key drivers behind:

- Demerger optimism: Investors expect value unlocking post-split.

- Strong CV growth: 10% YoY in August 2025, beating expectations.

- Global expansion: Iveco acquisition adds €16bn revenue pipeline.

- EV momentum: TMPV’s focus on electric passenger vehicles aligns with India’s green mobility push.

- Favourable macro backdrop: Infrastructure growth in India supports long-term CV demand.

Is It Good to Buy Tata Motors Stock?

Yes, Tata Motors stock is considered a good buy for long-term investors because the October 2025 demerger unlocks value, the company shows strong commercial vehicle growth, and its EV expansion supports future earnings. However, short-term volatility is expected.

Pros (Bull Case)

- Two focused companies, easier valuations, targeted strategies.

- Growing EV demand globally supports TMPV.

- CV spin-off strengthens India’s infrastructure-linked growth.

- Nearly unanimous shareholder support.

Cons (Risks to Watch)

- Short-term volatility post-demerger.

- Execution risks in listing and operational separation.

- Global headwinds: commodity price volatility, slowing demand in Europe/China.

- Jaguar Land Rover (JLR) remains exposed to cyclical luxury demand.

For long-term investors, the demerger is a value unlocking event. For short-term traders, volatility around the record date and initial listings will offer tactical opportunities.

Historical Context: Tata Motors Past Stock Split

Tata Motors has a history of rewarding shareholders through stock splits that improved liquidity and widened retail participation.

2011 Stock Split

- Date: September 12, 2011 (ex-split).

- Ratio: 5-for-1, the face value of each share was reduced from ₹10 to ₹2.

- Impact: Increased the number of outstanding shares fivefold, making the stock more affordable for small investors.

- Result: Boosted market liquidity and broadened retail investor base at a time when Tata Motors was expanding globally through Jaguar Land Rover (JLR).

Unlike the 2011 stock split, which was purely about affordability and liquidity, the 2025 corporate action is a demerger, designed to create two independently listed entities with distinct strategies.

Investors should understand this difference:

- 2011 split = cosmetic, price per share reduction.

- 2025 demerger = structural, value unlocking through separation of CV and PV/EV businesses.

Conclusion

The Tata Motors demerger is one of India’s most important corporate moves in 2025. With the effective date locked at October 1, 2025, and listings scheduled for late 2025, shareholders gain exposure to two powerful, focused entities.

At Ultima Markets, we believe such corporate restructuring events highlight why active monitoring and smart execution are essential in modern forex trading and equity investing. By combining market insights, risk management tools, and real-time data, investors can navigate these transitions with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.