Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What is LQD ETF?

The LQD ETF, officially the iShares iBoxx $ Investment Grade Corporate Bond ETF, is one of the largest and most liquid bond ETFs in the world. It tracks the Markit iBoxx USD Liquid Investment Grade Index, giving investors exposure to a broad range of U.S. dollar-denominated, investment grade corporate bonds.

- Launched: July 22, 2002

- Exchange: NYSE Arca

- Expense ratio: 0.14%

- Net assets: $28.69 billion (Aug 22, 2025)

- Holdings: 2,931 bonds

- Distribution frequency: Monthly

The fund is often used by traders and long-term investors seeking income, diversification, and lower credit risk compared with high-yield bonds.

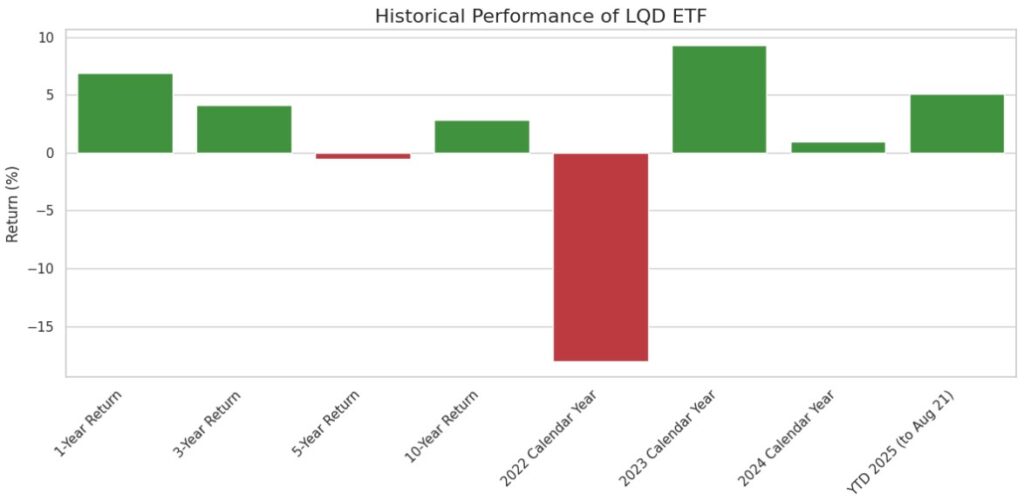

LQD ETF Historical Performance

Bond market conditions have heavily influenced LQD’s performance in recent years, especially with interest rate volatility.

- 1-Year Return: 6.92%

- 3-Year Return: 4.13%

- 5-Year Return: –0.50%

- 10-Year Return: 2.88%

- 2022 Calendar Year: –18.01% (driven by rapid Fed rate hikes)

- 2023 Calendar Year: +9.27% (partial recovery)

- 2024 Calendar Year: +0.99%

- YTD 2025 (to Aug 21): +5.11%

LQD fell –18% in 2022 because the Fed raised interest rates at the fastest pace in decades. the U.S. Federal Reserve raised interest rates very aggressively (from near 0% to over 4% within a year) to fight inflation .When rates go up, bond prices go down, because new bonds start paying higher interest, making older bonds with lower interest less attractive. Since LQD owns long-term corporate bonds, their prices plunged as investors demanded newer bonds with much higher yields.

What is the Dividend Yield of LQD?

Income is one of the main reasons investors consider corporate bond ETFs like LQD.

- 30-Day SEC Yield: 5.05% (Aug 21, 2025)

- 12-Month Trailing Yield: 4.45% (Aug 21, 2025)

These yields reflect both interest income from the bonds and fund expenses. Because of its monthly distribution schedule, LQD can provide a steady stream of income for income-focused portfolios.

What Does LQD Hold?

LQD invests in investment grade corporate bonds across multiple sectors.

- Effective Duration: 7.99 years

- Weighted Avg Maturity: 12.76 years

- Yield to Maturity: 5.14%

Top Issuers (as of Aug 2025)

- JPMorgan Chase

- Bank of America

- Morgan Stanley

- Goldman Sachs

- Wells Fargo

- Oracle

- UnitedHealth

- Citigroup

- AT&T

- Verizon

This diversification reduces single-issuer risk while maintaining exposure to U.S. corporate credit markets.

LQD ETF vs AGG, What’s the Difference?

Both LQD and AGG are bond ETFs, but they don’t invest in the same types of bonds.

What they hold

LQD ETF

- Focuses only on corporate bonds (IOUs issued by companies like JPMorgan, Verizon, Oracle, etc.).

- All bonds inside must be investment grade (BBB or higher credit rating = relatively safe).

- More income, but more tied to the health of corporations.

AGG ETF (iShares Core U.S. Aggregate Bond ETF)

- A “one-stop shop” bond fund. It includes:

- U.S. Treasuries (government bonds, safest)

- Mortgage-backed securities (bundles of home loans)

- Corporate bonds

- It’s like a mix of all major bond types in the U.S.

Yield (income)

- LQD pays a higher yield (around 5% SEC yield in 2025) because corporate bonds generally offer more interest than Treasuries.

- AGG pays a lower yield (around 4% in 2025) because it holds more government and mortgage bonds, which are safer but pay less.

Risk level

- LQD: More credit risk (if companies struggle, their bonds fall). Also more interest rate sensitivity because it holds longer bonds (avg duration ~8 years).

- AGG: Lower credit risk since about 40% of AGG is in U.S. government bonds (considered ultra-safe). Duration is shorter (~6 years), so less rate sensitivity.

Use cases

- Pick LQD if you want higher income and are comfortable with corporate exposure and bigger swings when interest rates move.

- Pick AGG if you want a safer, diversified bond core holding, with less volatility and broad exposure to all U.S. bonds.

Is LQD ETF a Good Investment?

Yes, LQD ETF can be a good investment for investors seeking steady monthly income from investment grade corporate bonds. It offers broad diversification, high liquidity, and a 5% yield in 2025. However, it carries risks from rising interest rates and credit spreads, so it suits income-focused, medium-risk portfolios.

Why LQD May Be a Good Investment

- Attractive yield: ~5% SEC yield (Aug 2025).

- Diversification: 2,900+ corporate bonds.

- Liquidity: Large fund size and tight bid-ask spreads.

- Low cost: 0.14% expense ratio.

Risks to Consider

- Interest rate sensitivity: Duration ~8 years means prices drop when rates rise.

- Credit risk: Corporate bond spreads can widen in downturns.

- Lower growth: Long-term returns are modest compared with equities.

LQD ETF is best for investors wanting reliable income and corporate bond exposure, but it is not ideal for those expecting rising interest rates or seeking high growth.

LQD ETF Risks

The main risks of the LQD ETF come from its sensitivity to interest rates and corporate bond spreads. With an average duration of about eight years, LQD’s price can fall sharply when interest rates rise, as happened in 2022.

It also faces credit spread risk, meaning that in times of economic stress, investors demand higher yields to hold corporate bonds. This widens spreads and reduces bond prices, even if government bond yields are falling. Together, these risks make LQD more volatile than government bond funds and important to evaluate before investing.

Conclusion

This year, the LQD ETF continues to be a go-to choice for investors who want reliable income and exposure to high-quality U.S. corporate bonds. Its monthly payouts and broad mix of issuers make it attractive, but the flip side is clear: bond prices can swing when interest rates climb or when markets get nervous about corporate credit.

If you want to approach these opportunities with confidence, Ultima Markets is here to back you up. From smart trading tools to clear market insights and hands-on education, we make it easier to understand the risks and seize the rewards. With us, you don’t just trade, you trade with purpose.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.