Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomRGTI Stock Forecast 2025: Analyst Targets

Analyst forecasts for Rigetti Computing in 2025 remain broadly optimistic, pointing to meaningful upside from current levels. Many analysts rate the stock as a Buy or Strong Buy, with one-year price targets generally clustering between the mid-teens and high-teens per share.

Average forecasts suggest values around US$16.50 to US$18.50, while more bullish scenarios place the stock as high as US$20. These projections imply potential gains of roughly 20 to 30 percent compared with the latest closing price. Marketers note that the path toward these higher valuations will likely depend on Rigetti’s ability to meet technical milestones, such as scaling its quantum systems beyond 36 qubits and demonstrating real-world applications.

Overall, sentiment in the market suggests cautious optimism, with expectations that RGTI could deliver solid returns if its technology roadmap continues to advance as planned.

RGTI Stock Forecast 2030

Long-term forecasts for Rigetti Computing are far more uncertain than short-term projections, and estimates for 2030 vary widely. Some market outlooks suggest the stock could trade in the mid-teens to high-teens range, pointing to moderate gains over current levels. Others present more cautious scenarios, with potential prices falling into the single digits if adoption of quantum computing proves slower than expected. This divergence highlights the difficulty of predicting the performance of an early-stage technology company over a five- to ten-year horizon.

Investors should therefore treat 2030 forecasts as broad scenarios rather than precise predictions, recognizing that the stock’s trajectory will depend heavily on Rigetti’s ability to scale its systems and achieve meaningful commercial demand for quantum computing.

What Is RGTI Stock?

RGTI is the ticker for Rigetti Computing, Inc., a quantum-computing company founded in 2013 by Chad Rigetti and headquartered in Berkeley, California. The company builds full-stack quantum systems, integrating:

- Superconducting qubit chips (designed and fabricated in-house at Fab-1).

- Control electronics.

- Cloud-based software via Rigetti Quantum Cloud Services (since 2017).

Rigetti began offering on-premises quantum systems in 2021 with 24- to 84-qubit chips and introduced the Novera™ 9-qubit QPU in 2023. In July 2025, Rigetti announced its 36-qubit modular system and confirmed it remains on track to deliver a 100+ qubit chiplet-based system by year-end.

Latest Stock Performance

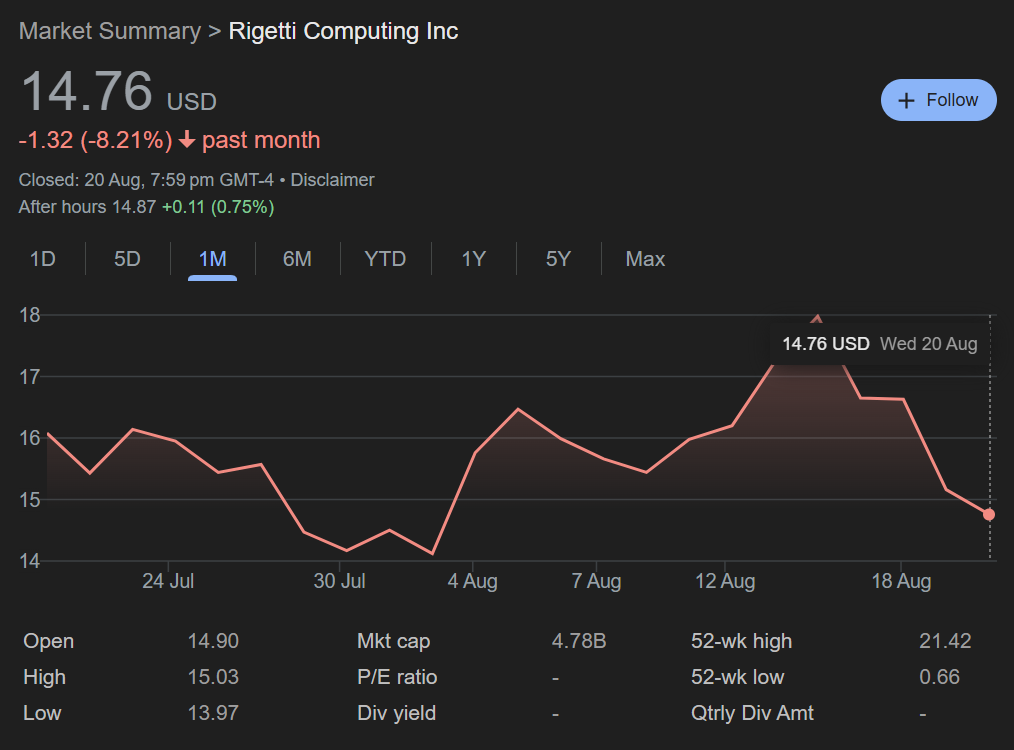

At the close of trading on 20 August 2025, Rigetti Computing’s share price stood at US$14.76, with after-hours trading edging slightly higher to US$14.88. Over the past 52 weeks the stock has swung dramatically between US$0.66 and US$21.42, a range that underscores the high volatility often seen in early-stage technology companies.

Financial Outlook

Analysts expect Rigetti Computing to remain unprofitable in the near term, but the company’s financial outlook points to potential improvement as it scales. Revenue in 2024 came in at $10.79 million, and projections for 2025 suggest a decline to about $8.85 million before rebounding sharply to $23.40 million in 2026, representing year-over-year growth of roughly 164 percent.

Earnings per share are also expected to improve over the forecast period, narrowing from a loss of –$1.09 in 2024 to –$0.19 in 2025 and –$0.18 in 2026. While Rigetti is still burning cash to fund its research and development, analysts believe these figures indicate the company is gradually moving toward greater efficiency and setting a foundation for long-term growth.

How High Could RGTI Go?

The potential upside for RGTI stock is tied closely to how well Rigetti can deliver on its technology plans and prove real-world applications for quantum computing. In the short term, many market watchers believe the stock could climb toward the US$20 level, which represents the higher end of current forecasts. Achieving this would likely depend on the successful rollout of Rigetti’s 100+ qubit chiplet-based system, continued progress on improving fidelity, and growing adoption by enterprise and government clients.

Looking further ahead, the ceiling becomes harder to define. If Rigetti can scale its systems and secure meaningful commercial demand, the stock could trade well above today’s levels over the next decade. On the other hand, setbacks in development or stronger competition from established tech players could limit its growth.

In simple terms, the near-term upside appears capped around US$20, but the long-term path remains wide open with outcomes ranging from modest gains to much larger valuations if Rigetti becomes a key player in the quantum computing industry.

Is RGTI Stock a Good Buy?

RGTI is generally viewed as a speculative opportunity rather than a traditional safe investment. Analysts remain optimistic, with many giving the stock positive ratings and projecting moderate upside over the next year. The company has made important strides in advancing its technology, including launching multi-chip systems and achieving higher fidelities, while also securing strategic partnerships that support its growth plans.

At the same time, Rigetti continues to operate at a loss, faces intense competition from larger rivals, and must prove that commercial demand for quantum computing will materialize. For investors who believe in the long-term potential of quantum technology and are comfortable with volatility, RGTI may offer attractive upside. For those seeking stability or predictable earnings, however, the risks may outweigh the rewards.

Conclusion

Rigetti Computing remains one of the more speculative names in the fast-evolving quantum computing industry. The stock has shown extreme volatility, swinging from under a dollar to above twenty within a year, but analysts still see room for upside if the company can deliver on its ambitious roadmap. Near-term projections generally point to prices in the mid- to high-teens with potential highs around US$20, while long-term forecasts vary widely depending on how quickly quantum computing achieves commercial adoption.

For investors, RGTI offers exposure to a cutting-edge technology with significant potential, but it also carries high risk given its unprofitable operations and competitive landscape. Those considering an entry should balance optimism about Rigetti’s milestones with caution about the challenges ahead.

At Ultima Markets, traders can stay informed about opportunities like RGTI by combining market insights with advanced trading tools. Whether monitoring high-growth tech stocks or diversifying into other asset classes, having access to professional analysis and a trusted trading platform can help investors navigate volatility and trade with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.