Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomBear Trap Stock: How to Spot and Avoid Them

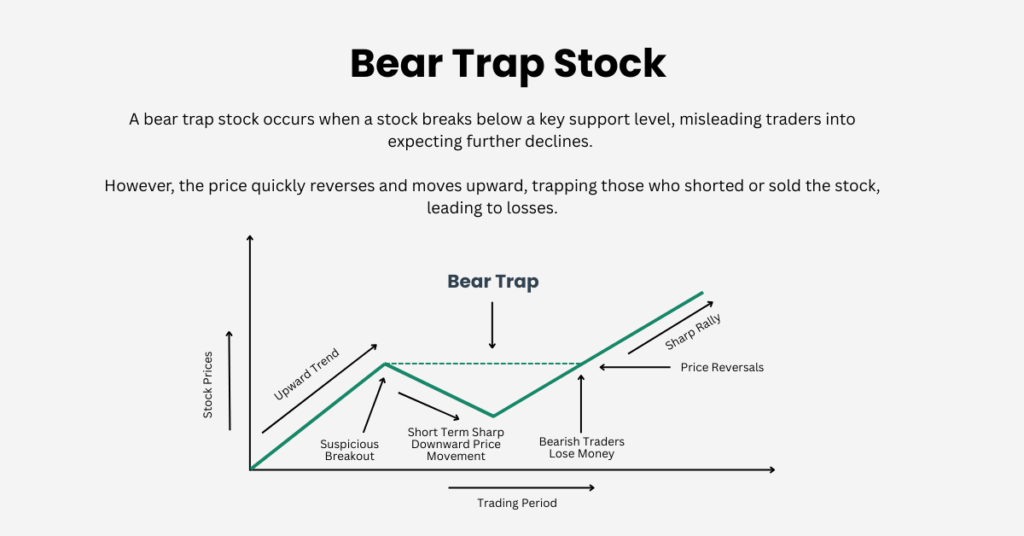

In stock trading, a bear trap stock refers to a situation where a stock or currency pair seems to be on a downward trend, causing traders to believe that prices will continue falling. However, instead of following through on the decline, the price quickly reverses and moves upward, trapping those who bet on further drops. This phenomenon can catch even experienced traders off guard.

In this article, we’ll dive into the concept of a bear trap stock, how to identify one, and strategies for avoiding being caught in the trap. We’ll also explore bull traps and discuss their similarities and differences with bear traps by using both real historical examples and video insights to help you understand these tricky market movements.

What Is a Bear Trap Stock?

A bear trap stock occurs when a stock appears to be in a downtrend, leading traders to believe the price will continue to fall. Traders may then sell off their positions or even short the stock. However, instead of continuing downward, the price sharply reverses and begins to rise, trapping those who anticipated further declines.

The term “bear trap” comes from the idea that the market sets a trap for bears (traders who bet on falling prices), forcing short sellers to buy back at higher prices, thus losing money as the price moves against them.

How Does a Bear Trap Stock Form for Short Sellers?

A bear trap stock forms when the price breaks below key support levels, misleading traders into expecting a continued downtrend. Traders may then sell or short the stock, but instead of continuing downward, the price quickly reverses and rises, trapping those who bet on further declines. This sudden price shift forces short-sellers to cover their positions, often pushing the price even higher.

Historical Examples of Bear and Bull Traps

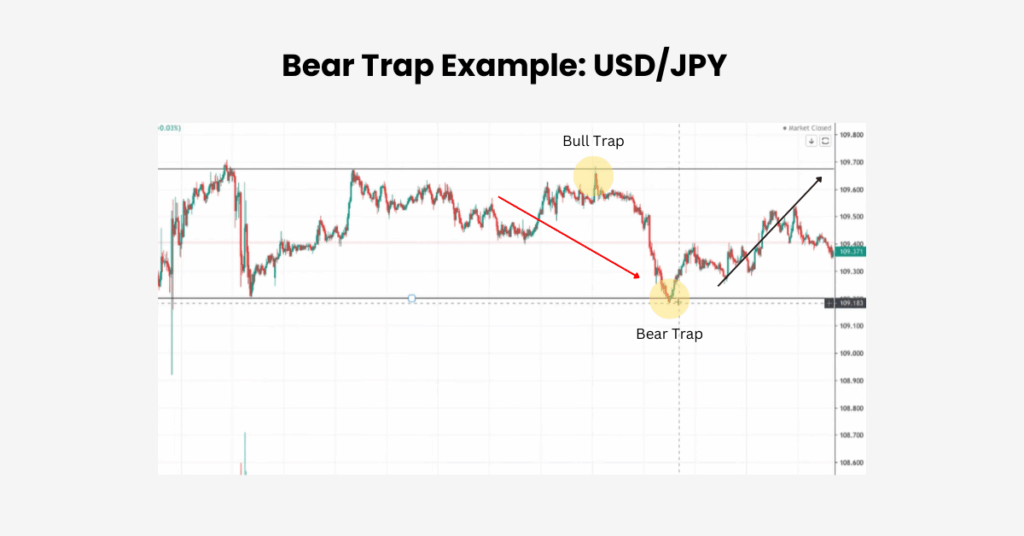

In the example, the USD/JPY currency pair demonstrates a clear example of a bear trap on the chart. The price initially breaks below a key support level, tricking bearish investors into thinking the price will continue to fall.

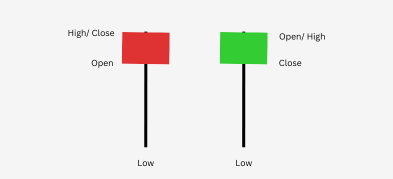

However, after briefly dipping below $109.00, the price quickly reverses and surges upwards, catching short-sellers off guard. Notably, the price action relative to the opening price can signal a reversal, especially if a bullish candlestick forms with a close above the opening price.

In a true bear market move, a significant portion of previous gains would typically be retraced and critical support levels broken, but in this bear trap, the recovery was swift. Bear traps like this can occur in any financial asset, and sometimes institutional buyers or institutional investors absorb the selling pressure, leading to a sharp reversal.

How to Spot a Bear Trap Stock

Recognising a bear trap stock in time can save you from making poor decisions. Identifying bear traps and understanding market sentiment are crucial to avoid being misled by a false signal. Here are a few key signs to look for:

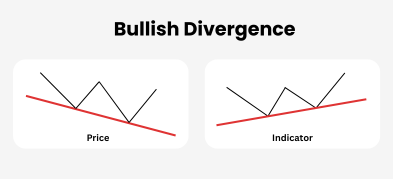

- Volume Divergence: A bear trap often occurs when a stock breaks below key support levels, but the trading volume doesn’t support the move. A break below key support levels can be a potential bear trap if not confirmed by other indicators. Low volume during a breakdown might indicate the price move is weak and could reverse.

- Rapid Recovery After Breakdown: If the stock price breaks support but quickly recovers and starts moving higher, this is a bear trap in the making. The sudden reversal may signal a trend reversal rather than a genuine breakdown, so it’s important to confirm with additional analysis.

- Overextended Indicators: Use technical indicators like the Relative Strength Index (RSI) or Moving Averages to spot overbought or oversold conditions. Overextended indicators can help identify bear traps and avoid acting on a false signal. If a stock is oversold and breaks below a key support level, it could indicate a reversal — signaling a bear trap stock.

- False News or Earnings Reports: Negative news or earnings reports can trigger panic selling, leading traders to believe the stock will continue to fall. However, if the company’s fundamentals remain strong, this could be a sign of a bear trap.

How to Avoid Getting Caught in a Bear Trap Stock

- Use Stop-Loss Orders: Set stop-loss orders to automatically sell your position if the stock moves against you. This helps protect your capital in case a bear trap forms.

- Monitor Volume: Watch for low volume during price breakdowns. If the price is falling but volume is weak, it could be a sign of a false move that may quickly reverse.

- Wait for Confirmation: Instead of entering a position right after a breakdown, wait for the price to confirm the trend. A price retest of the new support or resistance level could provide a safer entry point.

- Avoid Emotional Trading: Emotional reactions can cause traders to act too quickly. Stick to a disciplined trading strategy and analyse the market carefully before making decisions.

- Use Proper Position Sizing: Manage your risk by using appropriate position sizing for each trade. This limits your exposure and helps prevent outsized losses, especially during volatile market conditions.

Conclusion

Whether you’re trading stocks or forex, mastering the ability to spot and avoid bear traps and bull traps can give you a significant edge in the market. By understanding how these traps form, identifying the signs, and using proper risk management, you can protect yourself from significant losses. Stay patient and make informed decisions to successfully navigate the markets.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.