Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteCoffee Futures: Trading Arabica vs Robusta

Have you had your morning coffee yet? If you’re a coffee lover, you should know that your favorite cup of brew is more than just a drink—it’s a global commodity with a volatile market. Did you know that coffee is the second most traded commodity in the world, right after crude oil? As the most consumed beverage globally, coffee plays a significant role in international trade, and coffee futures are at the heart of this market.

Among the two main varieties of coffee—Arabica and Robusta—Arabica is the more traded and discussed variety, especially in futures markets.

As of 2025, the Arabica coffee market is experiencing high volatility and price fluctuations, largely due to supply constraints and climatic factors. This article will discuss coffee futures in detail, with a focus on Arabica coffee, and explain how traders can benefit from understanding its price movements.

What Are Coffee Futures?

Coffee futures are standardized contracts that allow traders to buy or sell coffee at a predetermined price on a specified future date. These contracts are traded on commodity exchanges, such as the ICE Futures US (Intercontinental Exchange), and are used by producers, exporters, and speculators alike to hedge against price fluctuations or profit from expected price changes.

Arabica futures prices have been fluctuating due to a combination of supply disruptions, trade tariffs, and weather-related issues. It is important to know that Arabica coffee futures are particularly sensitive to weather patterns in key growing regions like Brazil and Colombia.

Each contract specifies the delivery year and time period for settlement, which can impact price movements and trading strategies. Arabica is by far the most traded variety, and it generally commands higher prices compared to Robusta, due to its smoother taste and greater demand in global markets.

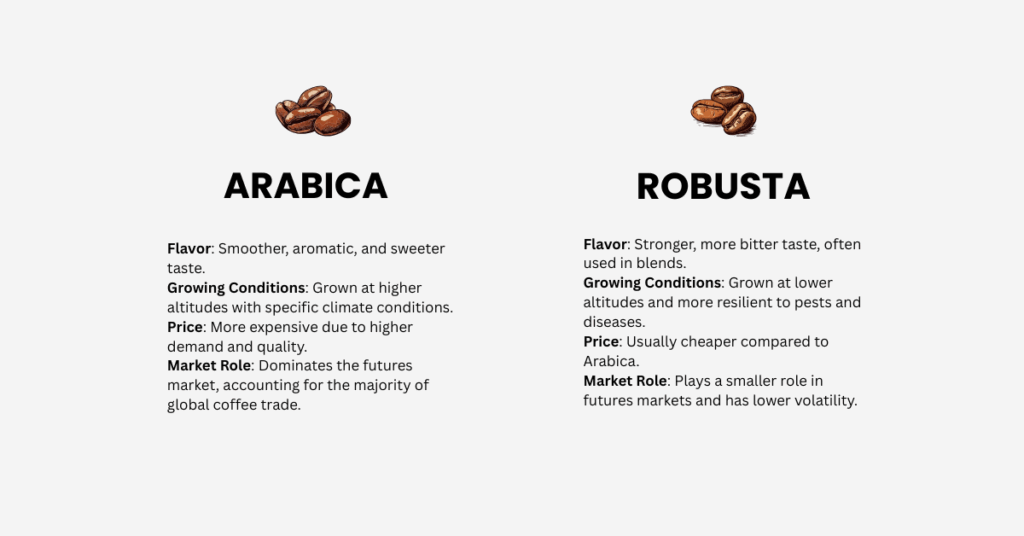

Arabica vs Robusta: A Key Difference in Coffee Futures

Arabica Coffee

Arabica coffee is known for its smooth flavor and aromatic qualities, making it the preferred choice for most coffee drinkers worldwide. It is grown at higher altitudes and requires more precise growing conditions. As a result, Arabica beans are generally more expensive than Robusta.

In 2025, the price of Arabica futures reached $4.2995 per pound, —a record high, driven by supply shortages in Brazil due to extreme weather conditions. Arabica futures typically experience greater price volatility than Robusta due to these weather dependencies.

Robusta Coffee

On the other hand, Robusta coffee is typically grown at lower altitudes and has a stronger, more bitter taste. While Robusta is used in lower-cost coffee blends, Arabica remains the dominant coffee variety traded in futures markets due to its higher demand and quality. Robusta futures tend to have lower price volatility compared to Arabica but play a smaller role in the global coffee trade.

How Do Coffee Futures Work?

Coffee futures are traded in contracts that represent a specific quantity of coffee—usually 37,500 pounds (or 16,900 kilograms). These contracts are typically traded in cents per pound, and the price fluctuates depending on various market factors.

As of August 2025, the price for the September Arabica contracts (KCU25) closed at $413.20 per 60-kilogram bag, reflecting a 0.57% increase from the previous day. This price point is a recent high, with the contract previously reaching a 52-week high of $410.30. This reflects ongoing volatility and market dynamics in the Arabica coffee sector.

Key Factors Affecting Arabica Coffee Futures

- Weather Conditions: Arabica coffee is particularly sensitive to changes in weather, especially in Brazil and Colombia, two of the largest Arabica-producing regions. A frost in Brazil or a drought in Colombia can severely impact supply, leading to a price spike. Coffee grows on small trees and is sensitive to such changes, which can affect the global supply.

- Supply and Demand: Brazil produces 30% of the world’s coffee, with Vietnam, Colombia, Indonesia, and Ethiopia rounding out the top five producers. Global production for 2023-24 was estimated at 169.8 million bags, with an expected increase in 2024-25 to 172.4 million bags according to the International Coffee Organization. Any disruptions, such as reduced production or changes in consumption habits, can drive prices up.

- Currency Exchange Rates: Coffee is traded globally, and price fluctuations in currencies like the Brazilian real (Brazil being the largest producer of Arabica) or Colombian peso can affect the price of Arabica futures. For example, a stronger dollar makes Arabica coffee more expensive for international buyers, potentially affecting demand.

- Coffee Stock Levels: The amount of global coffee stock available, especially in warehouses monitored by exchanges, can affect futures prices. A high stock level suggests oversupply, which can lower prices, while a low stock level signals a tight supply and can push prices higher.

Why Trade Coffee Futures?

Coffee futures are a popular choice for traders looking to take advantage of price movements in the coffee market. There are several reasons why traders might choose to trade coffee futures:

- Hedging: Producers, roasters, and coffee traders use coffee futures to hedge against price fluctuations. If they are worried about prices rising or falling before their coffee shipments arrive, they can lock in a price today by buying or selling coffee futures contracts.

- Speculation: Speculators trade coffee futures based on predictions about supply and demand. They buy when they expect prices to rise and sell when they expect prices to fall, making profits from market fluctuations.

- Diversification: For investors, coffee futures provide a way to diversify their portfolios with a commodity that often behaves differently from stocks or bonds. Coffee futures are not typically correlated with broader financial markets, which can offer a hedge against stock market volatility.

Key Considerations for Trading Arabica Coffee Futures

When trading Arabica coffee futures, traders should keep in mind a few key considerations:

- Volatility: Arabica futures are often more volatile than Robusta due to weather-related factors and seasonal fluctuations. This creates opportunities but also increases risk.

- Global Events: Coffee prices can be highly sensitive to geopolitical events, changes in trade policy, and fluctuations in the global economy. For example, recent trade tariffs on Brazilian coffee imports have caused a spike in Arabica futures prices.

- Market Hours: Coffee futures are typically traded on ICE Futures U.S. during standard trading hours. Knowing the trading times and potential breaks in liquidity is key to executing profitable trades.

- Brokerage Fees and Spreads: Trading futures requires understanding the fees associated with opening and maintaining positions. Look for a reputable broker with competitive spreads to minimize trading costs.

Conclusion

Arabica coffee futures are an excellent tool for hedging, speculating, and gaining exposure to the global coffee market. Given the volatility and impact of global factors like weather and supply-demand dynamics, these futures provide unique trading opportunities. Understanding the factors influencing Arabica prices and how coffee futures operate will help traders make informed decisions.

For those interested in exploring the world of commodity futures and improving their trading strategies, understanding coffee futures is a valuable step towards broadening your market knowledge.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.