Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

The Indian rupee (INR) has been under pressure, slipping against the US dollar (USD) and raising concerns for businesses, investors, and everyday consumers. To understand why rupee is falling against dollar, we need to look at the key drivers shaping currency movements and what it means for the Indian economy.

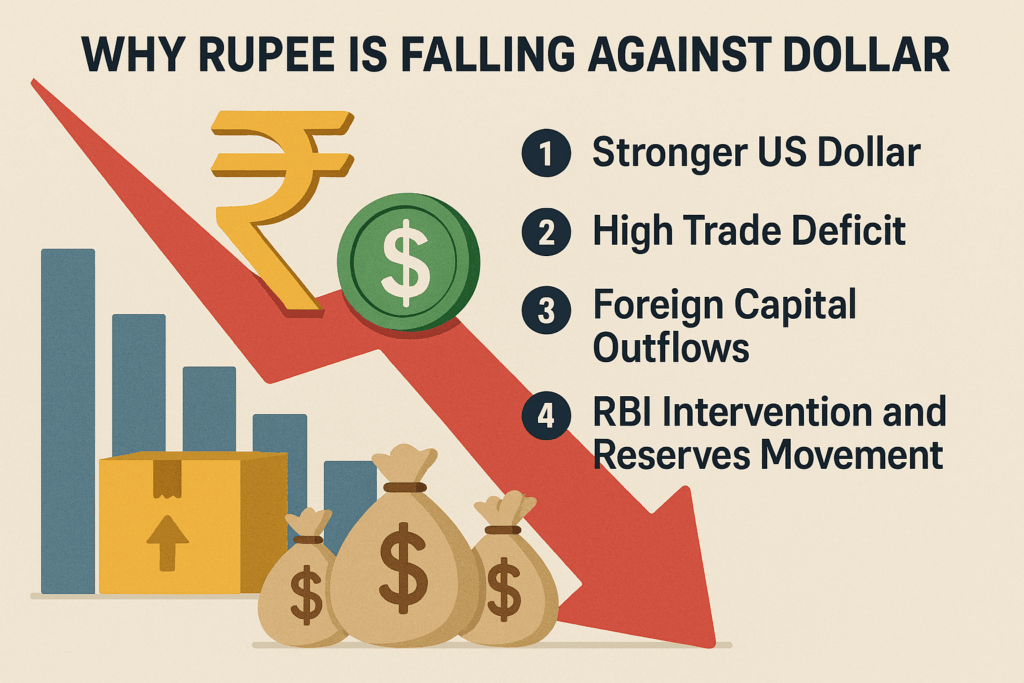

Why Rupee Is Falling Against Dollar

The rupee is falling against the dollar in 2025 due to India’s high trade deficit, foreign investor outflows, and stronger US interest rates. The Reserve Bank of India has intervened to slow volatility, but capital outflows of nearly $2 billion in July and a $27 billion trade gap have kept INR under pressure.

The rupee’s weakness this year is linked to both global and domestic pressures:

Stronger US Dollar

The US Federal Reserve held its policy rate at 4.25–4.50% (July 2025 meeting), keeping dollar yields attractive compared to emerging markets.

High Trade Deficit

India’s merchandise trade deficit widened to about $27 billion in July 2025, the highest in eight months.

Foreign Capital Outflows

FPIs sold nearly $2 billion in July, followed by outflows of around ₹21,000 crore in early August, adding pressure on INR.

RBI Intervention and Reserves Movement

To slow the rupee’s fall, RBI intervened in the spot and offshore markets. This coincided with a $9.3 billion fall in FX reserves in the week to Aug 1, though reserves recovered by $4.7 billion the following week due to revaluation gains.

What Drives Rupee Price?

The rupee’s value against the dollar is influenced by several factors:

- Interest Rate Differentials – US Federal Reserve policy keeps the USD attractive when US rates are higher than India’s.

- Trade Balance – India’s large oil import bill weighs on INR demand. In FY25 so far, India has imported nearly 88% of its crude oil needs.

- Capital Flows – Foreign portfolio investors (FPIs) shifting funds in or out of India directly impact INR vs USD.

- Reserve Bank of India (RBI) Intervention – The RBI sells or buys USD to prevent extreme volatility.

- Global Risk Sentiment – During geopolitical or financial stress, USD acts as a safe-haven currency.

How to Benefit from INR Falling Against USD

A weaker rupee benefits exporters, NRIs, investors in dollar assets, and forex traders. Exporters earn more when converting USD revenues, NRIs get higher value from remittances, investors holding US stocks or bonds see larger INR returns, and traders can profit from short-term INR vs USD volatility.

Who Benefits and Why?

- Exporters – Sectors like IT, pharma, and textiles that bill in dollars see higher rupee revenues when converting earnings, improving margins.

- NRIs Sending Remittances – With INR weaker, every $1 sent home converts into more rupees. India received a record $135.5 billion in remittances in FY25, highlighting this advantage.

- Investors in USD Assets – Those holding US equities, bonds, or ETFs benefit as USD-denominated assets appreciate in INR terms. This acts as a natural hedge against rupee depreciation.

- Forex Traders – Short-term traders can capture opportunities in INR vs USD swings, especially during periods of high volatility caused by RBI interventions, trade data releases, or Fed decisions.

INR vs USD Outlook – What’s Next?

The rupee’s outlook depends on a mix of global monetary policy, trade flows, and RBI support. While INR remains close to record lows around ₹88, several key factors will drive the next moves:

US Federal Reserve Policy

- The Fed held its rate at 4.25–4.50% in July 2025, but markets expect the first cut in September.

- A Fed cut could reduce USD strength, offering the rupee some breathing space.

India’s Trade and Current Account

- The July 2025 trade deficit widened to ~$27 billion, its highest in eight months.

- If oil prices remain steady in the mid-$60s per barrel, import pressures may ease, supporting INR slightly.

- Sustained deficits, however, keep downward pressure on the currency.

Foreign Portfolio Flows

- FPIs sold ~$2 billion in July and ₹21,000 crore in early August, showing risk aversion.

- If global risk appetite improves after Fed cuts, inflows could return and strengthen INR.

RBI Interventions and FX Reserves

- RBI has actively defended the rupee via spot and offshore markets.

- Reserves dropped by $9.3 billion in early August, then recovered by $4.7 billion the following week.

- Continued interventions suggest RBI is keen to cap INR near ₹88–₹89 levels.

Global Geopolitical & Market Risks

- Ongoing tariff disputes, regional conflicts, or sudden oil spikes could tilt sentiment back toward the dollar.

- In such scenarios, the rupee may weaken further unless RBI steps in aggressively.

Outlook Summary

- Short-term (Q3 2025): INR may stay in the ₹87.5–₹88.5 band, with RBI defending key levels.

- Medium-term (Q4 2025): If the Fed cuts and oil stays subdued, INR could stabilize or even strengthen modestly.

- Risk Factors: Any surge in oil above $80 or sharp FPI outflows could push INR past ₹89–90.

Conclusion

The rupee’s fall against the dollar in 2025 reflects global monetary tightening, widening trade deficits, and foreign investor outflows. While challenges remain, opportunities exist for exporters, NRIs, and traders who understand these shifts.

At Ultima Markets, we empower traders with advanced tools, timely market insights, and a secure platform to navigate INR vs USD volatility. With us, you trade with purpose, turning currency movements into informed opportunities.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.