Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomDogecoin, once a meme-inspired cryptocurrency, has evolved into a notable player in the digital asset space. But with its meteoric rise in value and popularity, many are left asking, “Is Dogecoin worth it?” and “Is it a good investment?” Whether you’re a seasoned crypto investor or a curious newcomer, understanding the potential of Dogecoin as an investment is crucial.

Is Dogecoin Worth It?

It depends on your investment goals and risk tolerance. Dogecoin, initially created as a meme, has grown into a highly speculative cryptocurrency with a strong community backing. While its high volatility offers potential for short-term gains, its limited use cases and reliance on trends make it a high-risk investment. If you’re comfortable with these risks, Dogecoin could offer rewards, but its uncertain long-term value means it may not be suitable for everyone.

What is Dogecoin?

Dogecoin (DOGE) is an open-source, peer-to-peer digital currency introduced on December 6, 2013, by software engineers Billy Markus and Jackson Palmer. Initially created as a parody of the cryptocurrency boom, Dogecoin features the Shiba Inu dog from the “Doge” meme as its logo.

Unlike Bitcoin, Dogecoin has an unlimited supply, which means there is no fixed limit on the number of coins that can be mined. This is in contrast to Bitcoin, which has a fixed supply of 21 million coins. Dogecoin’s low transaction fees and fast processing times have made it particularly popular for online tipping and microtransactions.

History of Dogecoin

From Meme to Mainstream

When Dogecoin was first launched, it was seen as little more than a joke. However, its active community of supporters quickly pushed it into the mainstream. In its early years, Dogecoin was used primarily for tipping content creators online, thanks to its low fees and faster transaction speeds compared to Bitcoin.

Dogecoin’s 2021 Surge

In 2021, Dogecoin experienced a massive surge in popularity, driven largely by viral social media campaigns and endorsements from high-profile figures like Elon Musk. Dogecoin’s market value soared, and it reached an all-time high of $0.7376 in May 2021.

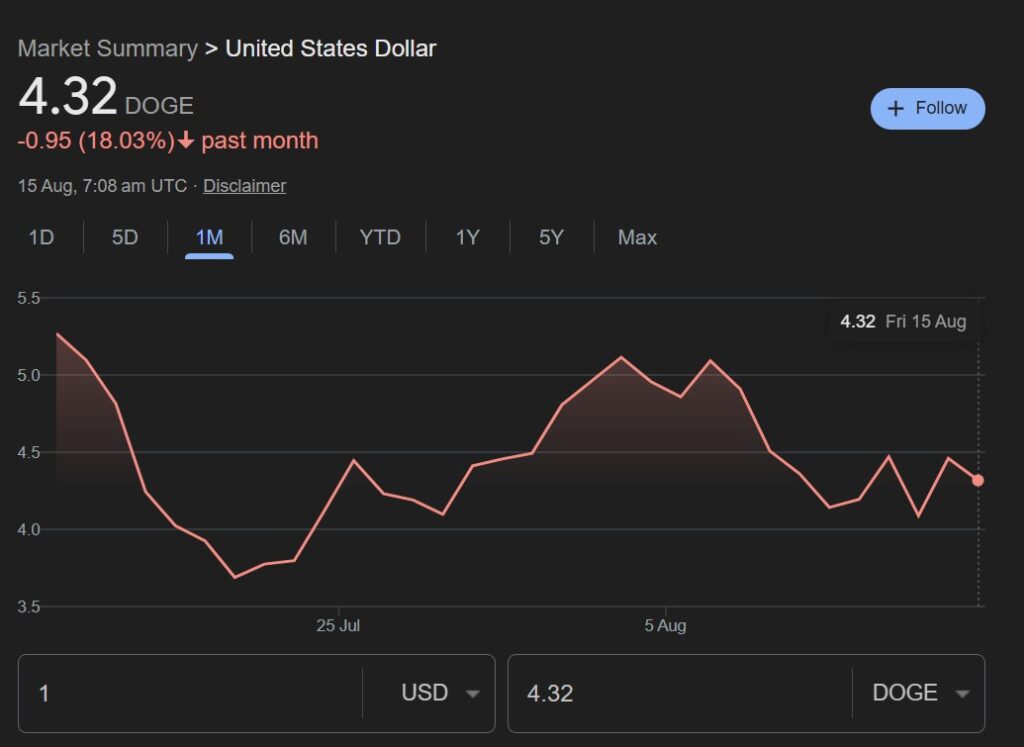

Current Market Status

As of August 2025, Dogecoin’s price has stabilized around $0.23 with a market cap of about $34.9 billion. Its value continues to fluctuate, but it remains one of the top 10 cryptocurrencies by market capitalization.

Dogecoin Use Cases

Despite being known as a “memecoin”, Dogecoin has practical uses in the cryptocurrency space.

Tipping and Donations

Dogecoin is widely used for online tipping and charitable donations due to its low transaction fees and fast transfer times. It has become a popular choice among content creators on platforms like Reddit and Twitter.

Payments and Transactions

Several businesses now accept Dogecoin as payment for goods and services. However, it is still not as widely adopted as Bitcoin or Ethereum.

Community and Memecoin Culture

Dogecoin’s strong community continues to drive its success. The memecoin culture behind Dogecoin has made it a symbol of internet-driven financial movements, helping it maintain its relevance in the crypto space.

Is Dogecoin Good Investment?

Volatility and Speculation

Dogecoin is a highly volatile asset, subject to price fluctuations based on market trends, social media trends, and endorsements. Investors should expect significant volatility, especially with Dogecoin’s price swings being highly influenced by events such as Elon Musk’s tweets or trending online movements.

The Role of the Community

What truly sets Dogecoin apart from many cryptocurrencies is its active and passionate community. Unlike Bitcoin and Ethereum, which have clear technological use cases, Dogecoin’s value is driven largely by its community and internet culture. This can be both a strength and a risk for potential investors.

Is Dogecoin a Long-Term Investment?

Dogecoin doesn’t have the same technological advancements or clear utility as Ethereum or Bitcoin, but its community-driven value has allowed it to maintain a significant presence in the crypto market. However, its speculative nature means it might not be suitable for long-term investment unless future developments occur that enhance its utility.

Should You Invest $1000 in Dogecoin Now?

Bullish Short-Term Outlook

Analyst Ali Martinez suggests that Dogecoin is forming a “double bottom” pattern, a technical indicator that could signal a trend reversal. If this pattern holds, Martinez predicts Dogecoin could rise to $0.42 by September, marking an 80% potential increase from current levels.

The Times of India

Moderate Long-Term Projections

Some analysts anticipate that Dogecoin could reach $0.40 within the next year. Factors contributing to this outlook include increased institutional interest, potential ETF approvals, and ongoing support from high-profile figures like Elon Musk.

Cautious Long-Term Outlook

Other experts advise caution, highlighting Dogecoin’s inflationary nature and lack of fundamental utility. They suggest that while short-term gains are possible, long-term investment in Dogecoin may not be prudent compared to more established cryptocurrencies like Bitcoin or Ethereum.

Conclusion

Investing $1,000 in Dogecoin presents a blend of exciting opportunities and considerable risks. Here’s what analysts are saying:

- Short-Term Gains: Some experts predict significant short-term price surges, driven by factors like social media trends and support from influential figures like Elon Musk. However, such investments come with high volatility.

- Moderate Long-Term Outlook: While some analysts believe Dogecoin could reach around $0.40 within a year, its lack of technological innovation compared to other cryptocurrencies like Bitcoin makes it a more speculative investment.

- Caution for Long-Term: Many experts advise caution, as Dogecoin’s inflationary supply and reliance on social trends make it less suitable for long-term investment strategies.

Before investing in Dogecoin, carefully assess your risk tolerance and investment goals. While it may offer quick gains, the volatility and speculative nature of Dogecoin require careful consideration.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.