Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteHow to Trade USD to JPY: A Practical Roadmap

What is USD to JPY and Why Do Taiwanese Investors Care?

Definition and Market Position of USD to JPY

USD to JPY refers to the exchange rate between the US dollar and the Japanese yen. It is the second most traded currency pair in the global forex market, second only to the euro-dollar. With high liquidity and active price volatility, it offers numerous opportunities for traders.

How Policy Differences Between the US and Japan Affect the Exchange Rate

The USD to JPY exchange rate is heavily influenced by policy differences between the Federal Reserve and the Bank of Japan. When the US raises interest rates while Japan maintains a low-rate policy, the widening interest rate differential pushes USD to JPY higher. Conversely, a narrowing differential tends to drive the exchange rate downward.

Why Taiwanese Investors Pay Attention to USD to JPY

Taiwanese investors are drawn to USD to JPY due to its high transparency, strong volatility, and the ease of tracking global macro developments. Moreover, it suits various trading strategies, including short-term trades, arbitrage, and hedging approaches.

Historical Trends and Forecasts for USD to JPY

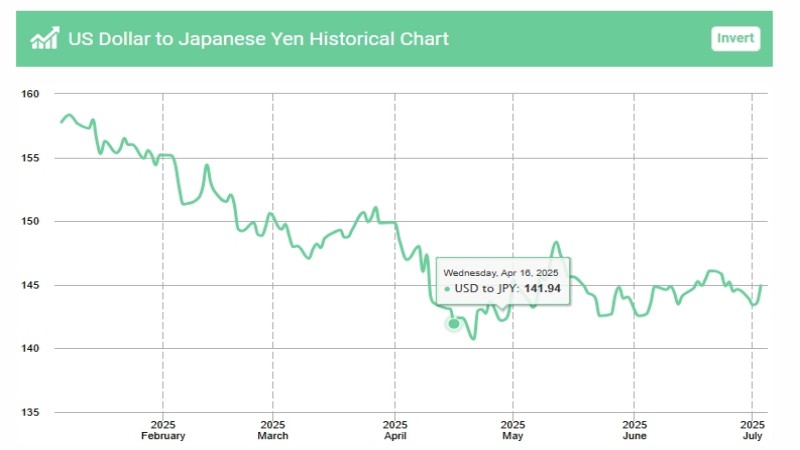

Historical Highs, Lows, and Key Turning Points

Looking back at USD to JPY history, it reached a peak of 147 in 1998 and surpassed 150 in 2022, marking a 32-year high. These significant turning points were driven by shifts in the global economy and central bank policies, offering useful reference points for investors.

The Correlation Between Interest Rate Hikes and Exchange Rate

Periods of US interest rate hikes typically result in dollar appreciation and a rise in USD to JPY. For instance, during the aggressive rate hikes by the Federal Reserve in 2022, USD to JPY surged by over 20%, bringing significant gains to many Taiwanese investors.

Summary Table: US vs Japan Key Economic Indicators

| Item | United States | Japan |

| Benchmark Interest Rate | 5.25% | -0.1% |

| Inflation Rate | 3.2% | 1.2% |

| GDP Growth | 2.5% | 0.9% |

USD to JPY Forecast for the Coming Year

Based on global financial conditions from late 2024 through Q2 2025, USD to JPY is expected to face multiple intersecting influences in the year ahead:

First, the Federal Reserve is expected to maintain a high interest rate policy through the first half of 2025, which will sustain the strength of the US dollar and put upward pressure on USD to JPY. However, if inflation cools faster than expected, markets may start pricing in early rate cuts, potentially leading to a correction in USD to JPY.

Second, expectations of a policy shift by the Bank of Japan are rising. Since Q4 2024, Japan’s core CPI has been gradually increasing. If the Bank further relaxes its yield curve control in the first half of 2025, market anticipation of a stronger yen may increase, limiting the upside for USD to JPY.

Third, geopolitical tensions and global risk sentiment should not be overlooked. If conflicts in the Middle East escalate or US-China tensions rise, capital may flow into the yen as a safe haven, putting downward pressure on USD to JPY.

In summary, USD to JPY is expected to fluctuate within the 135–152 range. Investors are advised to monitor key US economic data (especially non-farm payrolls and CPI) and Bank of Japan actions to adjust trading strategies flexibly.

How Taiwanese Investors Can Trade USD to JPY

Banks vs Forex Platforms: Trading Differences

| Item | Bank Trading | Forex Platform Trading |

| Spread | Higher (typically 3+ pips) | Lower (as low as 0.1 pip) |

| Leverage | None or very low | High flexibility (up to 1:500) |

| Trading Hours | Limited to business hours | 24/7 trading |

| Fees | Higher service fees | Mostly commission-free, transparent pricing |

| Suitable For | Long-term, conservative investors | Active traders, short- to mid-term investors |

Explanation of CFD Trading and Leverage Use

CFD contracts can be used to trade USD to JPY, offering the advantages of low cost and high leverage. Leverage can effectively improve capital efficiency, but it is recommended to set appropriate stop-loss levels to manage risk.

Trading Features of the Ultima Markets Platform

- Supports both MT4 and MT5 platforms, with an intuitive interface and full functionality

- Extremely low spreads, with major currency pairs as low as 0.1 pip, effectively reducing trading costs

- Various leverage options available for flexible strategy deployment

- Customer support available in Traditional Chinese with real-time assistance

- Convenient deposits and withdrawals, supporting multiple e-wallets and banking channels

- Comprehensive educational resources including UM Academy to help beginners get started quickly

How Beginners Can Start Trading USD to JPY

Demo Account and Trading Account

Beginner investors should start with a demo account to practice and become familiar with the platform interface and USD to JPY trading rules before using real funds. After gaining experience with demo trading, they can open a trading account on the Ultima Markets platform by completing identity verification and making a deposit to start trading officially.

Tax Reporting and Compliance Under Taiwan’s Tax System

In Taiwan, profits from forex trading are classified as overseas income and must be self-reported to the tax authority for taxation. Investors should take the initiative to understand the relevant tax rules in detail.

Technical Analysis Strategies for USD to JPY Trading

Applying MACD and RSI to USD to JPY Trading

MACD and RSI are commonly used technical indicators in USD to JPY trading. MACD divergence or RSI overbought/oversold signals can offer clear entry and exit cues.

Bollinger Bands and Price Breakouts

Bollinger Bands are used in USD to JPY trading to identify breakout trends. For example, a price breakout above the upper band may indicate the start of a new trend, allowing investors to follow the momentum.

Combining Technical Analysis with Trading Psychology

Technical analysis is not 100% accurate, so maintaining a stable trading mindset and proper capital management is equally important. When trading USD to JPY, it’s advisable to remain calm and strictly adhere to trading discipline.

USD to JPY as a Hedge and Arbitrage Opportunity

Principle of Interest Rate Arbitrage

The USD-JPY interest rate arbitrage strategy involves borrowing low-interest yen to buy high-yield US dollars in order to earn interest income. Taiwanese investors can use this strategy to enhance overall returns.

Safe-Haven Capital Flows During Geopolitical Tensions

The yen is considered a safe-haven currency. When market risk intensifies, investors tend to shift into yen-denominated assets, causing USD to JPY to decline. During such times, one may consider shorting USD/JPY or holding yen ETFs.

Correlation Between USD to JPY, Gold, and the Nikkei

USD to JPY has a certain inverse correlation with gold and the Nikkei index. Generally, a stronger US dollar may suppress the performance of both gold and the Nikkei, which is worth investor attention.

Key Factors Affecting USD to JPY in 2025

US Economic Data and Policy Expectations

In 2025, US employment data and inflation figures will be major drivers of USD to JPY. Investors should closely monitor monthly non-farm payroll reports, CPI, and related data.

Possible Policy Shifts by the Bank of Japan

Whether the Bank of Japan adjusts its ultra-loose monetary policy will directly affect the yen’s trend and the USD to JPY exchange rate. Investors should pay attention to central bank statements and changes in market expectations.

Market Signals Taiwanese Investors Should Watch

Taiwanese investors should monitor global stock, bond, and currency market developments. Changes in global risk sentiment may quickly impact USD to JPY price movements.

FAQ

What Is the Best Time to Trade USD to JPY?

The US trading session (evening in Taiwan) is when USD to JPY is most volatile, making it suitable for short-term trading.

Is USD to JPY Trading Taxable and How to Report It?

Forex trading gains must be reported as individual overseas income and declared to the tax authority accordingly.

Can I Use ETFs to Hedge Yen Exposure?

Yen ETFs can be used for hedging, but short-term fluctuations and ETF-related costs must be considered.

How to Avoid Forced Liquidation When Trading USD to JPY?

It is recommended to set stop-loss orders and limit leverage to between 1:20 and 1:50 to avoid forced liquidation during market volatility.

Conclusion

USD to JPY offers strong liquidity, transparent information, and ample volatility, making it a key currency pair for Taiwanese investors engaged in medium- to short-term trading. Trading through platforms like Ultima Markets not only provides a low-cost, efficient execution experience, but also offers professional educational support and a demo environment, allowing beginners to get started with confidence. Understanding the trends of USD to JPY can help Taiwanese investors allocate assets flexibly and manage forex risk effectively.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.