Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteTrailing Stop Loss: Guide for Newbies

Ever had a winning trade turn into a losing one because you didn’t exit in time? That’s where a trailing stop loss comes in. It is a smart way to protect profits while letting your trades run.

Before diving in, let’s quickly cover the basics: the most common order types in trading are market, limit, and stop orders. A trailing stop loss is a variation of a stop order, and it’s widely used by traders to manage risk and lock in gains automatically.

Let’s break it down in simple terms.

What is a Stop Order?

A stop order lets you set a trigger price at which you want to buy or sell a stock. Once the market hits that price, the order becomes a market order and is executed at the next available price.

Traders use stop orders to limit losses or protect profits, especially in fast-moving markets. Common types include:

- Stop-loss orders: Exit trades when the price moves against you.

- Stop-entry orders: Enter trades once the price breaks a certain level.

- Trailing stop-loss orders: Move with the market to lock in gains.

Note: Stop orders only execute during regular trading hours.

Understanding Limit Orders

A limit order lets you buy or sell at a specific price or better. Unlike a market order, it won’t be filled unless the market hits your chosen price.

Limit orders help you avoid overpaying or underselling, giving you more price control. For example:

- A buy limit order only executes if the price drops to your target.

- A sell limit order triggers only if the price rises to your goal.

While limit orders offer more precision, they aren’t guaranteed to be filled. They’re often used in strategies like day trading or swing trading, and can be paired with stop orders for smarter risk management.

What’s a Trailing Stop Loss?

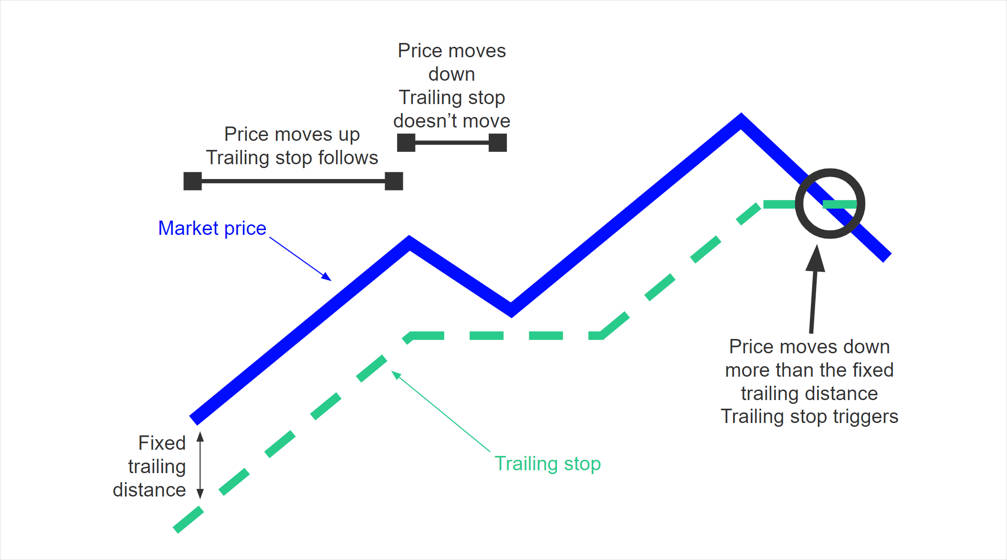

A trailing stop loss is a type of exit that automatically moves with the market when your trade is going well. It’s set at a fixed amount or percentage below the market price (for long positions), and it only adjusts when the price moves in your favour.

If the market keeps rising, the trailing stop loss moves up too as the price is moving higher. But if the market suddenly turns against you, the stop doesn’t move. The order triggers and closes your trade, helping you keep your profits before a reversal.

Traders often set their trailing stop loss a certain distance from their entry price to manage risk as the market moves higher.

Think of it as a safety net that follows you upwards but stays put if you start falling.

Why Use a Trailing Stop Loss?

Here’s why many traders love it:

- It locks in profits when the market moves in your favour

- It reduces stress—you don’t have to keep watching the screen

- It avoids emotional decisions when prices swing up and down

- It works automatically once you set it

Whether you’re trading stocks, forex, or crypto, this tool helps you stay in control, and traders can decide to use trailing stops based on their individual trading goals and risk tolerance.

A Quick Example

Let’s say you make a stock trade by buying a stock at $100, and you set a 10% trailing stop loss.

- If the price rises to $110, the stop loss moves up to $99, always trailing the current price of the stock.

- If the price drops to $99, your trade closes automatically, keeping most of your gains.

- If the price keeps going up, your stop keeps trailing behind it.

The execution of the stop order depends on the current price at the time the stop is triggered. Once a stop order is triggered, the resulting market order cannot be undone, leading to irreversible trades.

So you get to ride the trend and protect your profits. Win-win!

How’s It Different from a Regular Stop Loss?

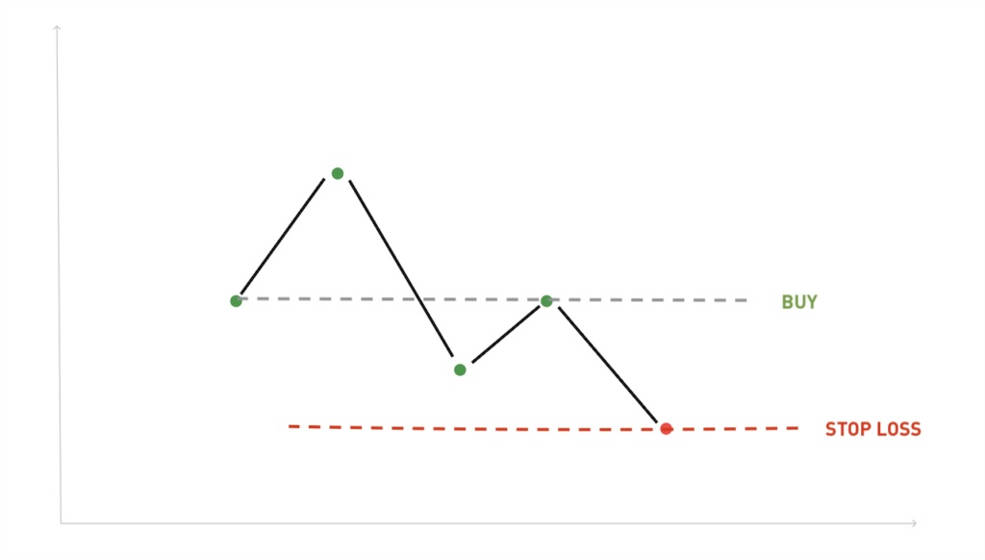

A normal stop loss, also known as a stop loss order, stays at the same price no matter what.

A stop limit order is another variation. It only executes if the order can be filled at your specified limit price or better, rather than allowing for immediate execution at the current market price. In contrast, a regular stop loss order triggers a market order for immediate execution once the stop price is reached, while a stop limit order provides more control but may not always be filled if the price moves past your limit.

A trailing stop loss, on the other hand, moves up as the price rises (or down if you’re shorting). It only ever moves in your favour—never against.

Trailing Stop Loss vs Regular Stop Loss

| Feature | Trailing Stop Loss | Regular Stop Loss |

| Moves with the market? | Yes | No |

| Locks in profits? | Yes | No |

| Set once & forget? | Yes | Yes |

| Helps in trending markets? | Perfect fit | Less effective |

How to Set One Up

Most trading platforms let you set a trailing stop with just a few clicks. You can usually choose:

- A percentage (e.g., trail 5% behind the market price)

- A fixed amount (e.g., $2 below the highest price)

- A technical indicator (e.g., below a moving average)

Some online brokers offer a trailing stop-loss order function on their trading platforms, making it easier for traders to automate their strategies.

Just make sure you understand how your trading platform handles it. Some brokers only trigger trailing stops after the price moves a minimum amount.

Wait, Trailing Stop Loss the Same as a Trailing Stop Order?

Good question. The terms are often used the same way, but here’s the difference:

- A trailing stop loss is the strategy, setting a stop that moves with the market. The primary goal of using a trailing stop order is to protect profits while still allowing for further gains.

- A trailing stop order is the actual order you place with your broker to make it happen. Trailing stop orders are a type of stop order, which is one of the main market orders used by traders.

A buy stop order is another type of stop order, used to enter a trade when the price moves above a certain level.

So when you set a trailing stop on your platform, you’re placing a trailing stop order to follow the trailing stop loss strategy. Simple as that.

Best Practices for Using Stop and Limit Orders

To get the most out of your trading, it’s smart to use stop orders and limit orders together as part of your risk management strategy. Start by setting realistic stop-loss levels based on your risk tolerance and careful market analysis—this helps you avoid emotional decisions and keeps your losses in check. Some investors may choose to use options as an alternative to stop-loss orders for better control over exit points.

Use limit orders to enter trades at your ideal price, and stop orders to exit if the market moves against you. A trailing stop-loss can help lock in profits as the price rises, but be cautious — sharp swings can trigger it unexpectedly.

Keep an eye on your trades and adjust stop levels as the market shifts. Watch out for slippage (price differences when orders fill) and gaps (prices jumping past your stop), especially in volatile conditions or after hours.

By using these tools together, you can trade with more confidence, protect your capital, and stick to your strategy.

Final Thoughts

A trailing stop loss is one of the easiest ways to let your profits run while still managing risk. It automates your exit strategy and protects you from emotional decisions.

Whether you’re a beginner or an experienced trader, learning how to use trailing stops can help you trade with more discipline and less stress.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.