Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomIs JOBY A Good Stock To Buy?

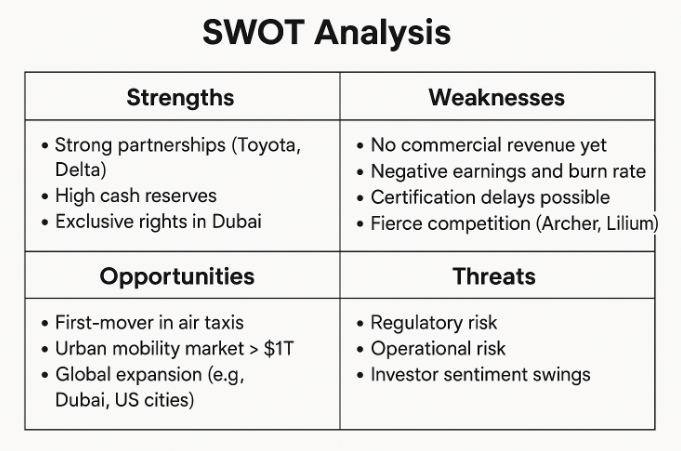

Yes, JOBY can be a good stock to buy for high-risk investors seeking long-term growth in the urban air mobility sector. Backed by strong partnerships with Toyota and Delta, Joby Aviation has secured exclusive operating rights in Dubai and recently acquired Blade’s air taxi business, strengthening its market position. However, it remains a pre-revenue company with high volatility and execution risks. Investors should be prepared for significant price swings and a long timeline to profitability.

Short-Term Outlook

From a trading perspective, JOBY is volatile with high momentum potential. Price movements around news events like the Blade acquisition, create actionable opportunities for momentum traders.

Long-Term View

For long-term investors, Joby Aviation is a high-risk, high-reward play. Its success depends on certification, infrastructure, consumer demand, and successful execution of its business model.

If Joby delivers on its commercial goals by 2026 and captures early market share, it could become a dominant name in urban air mobility. But if certification or adoption is delayed, downside risk remains significant.

What Does Joby Aviation Do

Joby Aviation is a U.S.-based aerospace company that designs, manufactures, and plans to operate electric vertical takeoff and landing (eVTOL) aircraft for use as air taxis. Founded in 2009 and headquartered in California, Joby aims to revolutionize urban transportation by offering fast, quiet, and zero-emission flights.

The company’s aircraft is designed to carry one pilot and four passengers, flying at speeds of up to 200 mph with a range of approximately 100 miles on a single electric charge. Joby Aviation is vertically integrated, managing every aspect from aircraft design and production to flight software and future operations. Backed by partners like Toyota and Delta, and having acquired Uber Elevate and Blade’s passenger business, Joby is preparing to launch commercial air taxi services in cities like Dubai and key U.S. markets as early as 2025–2026.

Joby Aviation Stock Price Performance (as of August 2025)

As of August 6, 2025, Joby Aviation stock price closed at $18.93, reflecting a strong monthly gain of 77.58%. The stock reached an intraday high of $20.80 and a low of $18.53, with an opening price of $20.06. In after-hours trading, the price slightly declined to $18.43, down 2.64%.

Joby Aviation currently holds a market capitalization of approximately $15.93 billion. The stock has surged significantly over the past month, driven by strong investor interest and strategic developments, such as the acquisition of Blade’s passenger air mobility business. Joby’s 52-week price range spans from a low of $4.70 to a high of $20.95, underscoring its volatility and potential for high returns. This upward momentum strengthens the bullish outlook for those evaluating Is JOBY a good stock to buy in 2025.

Why Is Joby Stock Going Up?

Acquisition of Blade’s Passenger Business

On August 4, 2025, Joby announced the acquisition of Blade Air Mobility’s U.S. air-taxi operations for up to $125 million. This strategic move provides access to Blade’s established customer base, urban terminals, and aviation infrastructure in key cities like New York, Los Angeles, and Miami.

This news led to a 16% spike in Joby’s stock price as markets reacted positively to the expanded market footprint and increased readiness for commercialization.

Strong Institutional Backing

Joby is supported by major partners:

- Toyota (strategic investor and manufacturing partner)

- Delta Air Lines (commercial partner for urban routes)

- Uber Elevate (acquired in 2020)

Exclusive Rights in Dubai

Joby has secured exclusive rights to operate air taxis in Dubai for six years, following successful test flights. This strengthens its international footprint ahead of a 2026 commercial launch.

Joby Stock Price Prediction 2025

Looking ahead to 2025, analysts expect Joby Aviation’s performance to remain highly dependent on execution milestones such as FAA certification, the integration of Blade’s infrastructure, and the expansion of manufacturing capabilities. If these milestones are achieved on schedule, the market believes Joby stock could continue its upward trend, potentially remaining in the $16 to $20 range.

However, the outlook is not without risk. Some analysts warn of potential downside scenarios, especially if regulatory delays or operational challenges emerge. In a bearish case, Joby’s stock price could retreat toward the lower end of its previous trading range, given the company is still pre-revenue and highly speculative. Overall, market sentiment remains cautiously optimistic, with the stock’s near-term movement likely tied to milestone updates and investor confidence.

Joby Stock Price Prediction 2030

By 2030, the long-term outlook for Joby Aviation stock is closely tied to the adoption of electric vertical takeoff and landing (eVTOL) technology and the growth of the urban air mobility industry. Market analysts forecast the global air taxi market could exceed $1 trillion by 2040, and Joby is well-positioned to capture a share if it maintains its current pace of development and execution.

If Joby successfully commercializes its operations by 2026 and scales effectively through partnerships and global expansion, the stock could see substantial upside by 2030. However, projections vary widely depending on factors such as certification timelines, competitive pressures, regulatory shifts, and customer adoption. The market currently views Joby as a high-risk, high-reward long-term investment, with significant growth potential but also considerable uncertainty.

Conclusion

Joby Aviation stock offers a compelling yet speculative opportunity for investors looking to gain early exposure to the rapidly growing eVTOL and urban air mobility market. With strong backing from global players like Toyota and Delta, exclusive operating rights in Dubai, and the recent acquisition of Blade’s passenger business, Joby has positioned itself as a potential leader in this space. However, the stock remains volatile and revenue-free, meaning it carries high execution and regulatory risks.

At Ultima Markets, we emphasize the importance of data-driven decision-making and risk management when trading emerging tech stocks like Joby. Investors should closely monitor certification updates, earnings results, and industry developments before making any move. While Joby’s vision is promising, success will depend on its ability to turn innovation into sustainable profitability.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.