Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What Does YTD Mean in Finance?

In finance, YTD (Year to Date) refers to the cumulative total of an account or metric such as revenue, expenses, net income, or stock returns from the beginning of the year to the current date.

For example:

- In trading, YTD helps track how much a stock, ETF, or portfolio has gained or lost so far this year.

- In corporate finance, companies use YTD data to compare performance across quarters and forecast future outcomes.

- For employees, YTD on a paystub shows total earnings, deductions, and taxes paid since January 1.

Key Uses:

- Performance comparison

- Earnings tracking

- Tax estimation

- Budgeting and forecasting

What Does YTD Mean on Paystubs and Paychecks?

YTD on a paystub stands for “Year to Date” and shows the total amount you’ve earned or paid in taxes from the beginning of the year to the current pay period. It typically includes gross pay, net pay, and tax withholdings. For example, if you earn $5,000/month, after 6 months your gross YTD would be $30,000.

Fiscal Year vs Calendar Year: Which One Does YTD Follow?

Understanding the difference between a fiscal year and calendar year is essential when interpreting YTD figures:

| Type | Starts | Ends | Example |

| Calendar Year | January 1 | December 31 | Most personal finance tools |

| Fiscal Year | Varies by organization | 12 months later | Oct 1, 2024 – Sep 30, 2025 (U.S. Federal Government) |

How to Calculate YTD (Year to Date)

To calculate YTD:

- Identify the start date (usually January 1 or start of fiscal year)

- Sum the total values (income, returns, expenses) from that date to today

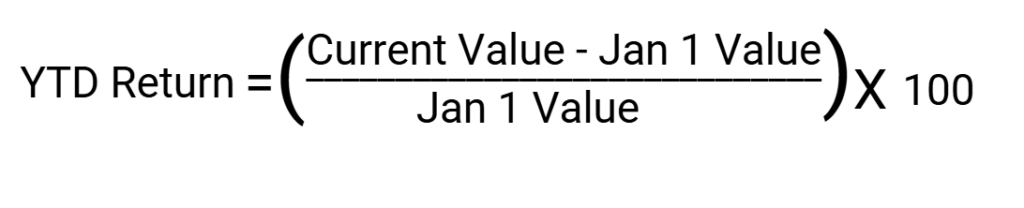

YTD Formula

To calculate YTD return, subtract the value of the investment on January 1 from its current value. Then divide the result by the January 1 value. Finally, multiply by 100 to get the percentage.

Step-by-step:

- Subtract: Current Value – Value on January 1

- Divide: Result ÷ Value on January 1

- Multiply: That number × 100 = YTD return %

Example:

If a stock was $100 on Jan 1 and is now $125:

(125 − 100) ÷ 100 × 100 = 25% YTD return

Real World Example: Trader Analysis

Let’s say Tesla (TSLA) started the year at $240, and the current price is $280. Here’s how to calculate the YTD return step by step:

Find the change in price:

$280 (current price) – $240 (price on Jan 1) = $40 gain

Divide the gain by the starting value:

$40 ÷ $240 = 0.1667

Convert to a percentage:

0.1667 × 100 = 16.67%

So, the YTD return for Tesla is 16.67%.

A trader uses this YTD return to:

- Compare TSLA’s performance with S&P 500 or sector peers

- Adjust portfolio allocation based on outperformance or underperformance

- Make data-driven trade entries based on momentum

YTD helps provide context, not just for individual stocks, but for entire portfolios and index performance.

Month to Date vs Year to Date

Month to Date (MTD) and Year to Date (YTD) serve similar functions but differ in scope:

| Metric | Timeframe | Use |

| YTD | Jan 1 (or fiscal start) to today | Long-term performance |

| MTD | 1st of current month to today | Short-term tracking |

Why YTD Matters for Traders and Investors

YTD (Year to Date) data is a powerful metric for traders and investors to measure performance, spot trends, and manage risk across portfolios. It provides a real-time snapshot of how a stock, index, or asset class has performed since the beginning of the year.

Key Reasons YTD Is Important:

Performance Benchmarking

Traders use YTD returns to compare individual stocks or ETFs against market indices like the S&P 500, NASDAQ, or sector averages.

Risk Management

A sharp YTD loss may signal elevated volatility or trend reversal, prompting portfolio adjustments or tighter stop-loss strategies.

Momentum Analysis

Positive YTD performance often reflects strong momentum or investor sentiment, helping traders identify trending assets for swing or position trades.

Rebalancing Decisions

Investors use YTD data to assess overperformers and underperformers before reallocating capital or rebalancing portfolios.

Macro Insights

In global markets, YTD metrics help traders spot rotation between sectors, regions, or asset classes valuable in a volatile macro environment.

Example: If tech stocks show strong YTD returns while energy lags, it may indicate a risk-on market environment favoring growth over value.

Conclusion

Understanding what YTD means in finance isn’t just for accountants, it’s a key tool for traders and investors looking to stay ahead in fast-moving markets. Whether you’re analyzing your paycheck, evaluating stock performance, or comparing YTD returns across sectors, this metric provides critical insights for smarter financial decisions.

At Ultima Markets, we equip traders with real-time YTD data, advanced charting tools, and macroeconomic insights, so you can make better-informed trades backed by data, not guesses.

Track your performance. Measure your edge. Trade with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.