Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat Currency Does El Salvador Use?

El Salvador uses the United States Dollar (USD) as its official currency. The U.S. dollar has been in use since 2001, replacing the Salvadoran colón. Bitcoin was briefly legal tender from 2021 to early 2025, but it is no longer officially recognized.

A Brief History: From Colón to Dollar

Before adopting the U.S. dollar, El Salvador used the Salvadoran Colón (SVC) from 1892 to 2001. Due to inflation and economic instability, the government passed the Monetary Integration Law, officially replacing the colón with the U.S. dollar on January 1, 2001.

- The exchange rate was fixed at 8.75 colones per USD.

- The colón is still technically legal tender but no longer circulates in the economy.

The main goal of dollarization was to reduce inflation, attract foreign investment, and provide economic stability, essentially anchoring the country’s economy to the strength of the U.S. financial system.

Does El Salvador Use the US Dollar?

Yes, El Salvador uses the US dollar as its only active and official currency.

- All salaries, taxes, goods, and services are priced in USD.

- Local banks, ATMs, and businesses operate entirely in U.S. dollars.

- The government no longer mints its own currency.

The use of the dollar gives El Salvador greater access to international trade and financial markets but also removes its ability to control monetary policy through a central bank, making it dependent on decisions from the U.S. Federal Reserve.

Is El Salvador Using Bitcoin as a Currency?

No, El Salvador is no longer using Bitcoin as legal tender.

- In September 2021, El Salvador became the first country in the world to make Bitcoin legal tender alongside the U.S. dollar.

- By early 2025, under IMF pressure, the government officially revoked Bitcoin’s legal tender status.

Although Bitcoin can still be used voluntarily, businesses are no longer required by law to accept it. The government-backed Chivo Wallet and various incentives failed to spark widespread adoption, with the majority of Salvadorans preferring the stability of the U.S. dollar.

How Much Is El Salvador’s Bitcoin Worth?

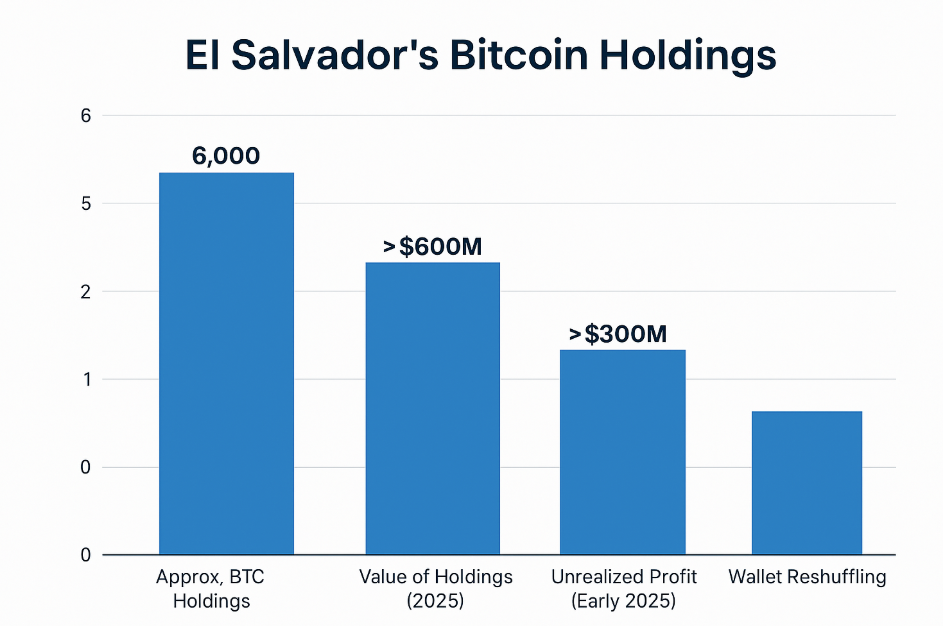

Despite Bitcoin no longer being legal tender, El Salvador continues to hold approximately 6,000 BTC in its national reserves.

- As of 2025, this is worth over $600 million, depending on the market price.

- The country reported unrealized profits of over $300 million during Bitcoin’s bull run in early 2025.

However, reports suggest that many of these holdings are due to wallet reshuffling rather than new acquisitions. The IMF and financial watchdogs have questioned the transparency of these transactions.

Why Did El Salvador Adopt Bitcoin as Legal Tender?

The Bitcoin Law was introduced under President Nayib Bukele to address key economic challenges:

- Financial inclusion: Over 70% of Salvadorans lacked access to traditional banking services.

- Lower remittance costs: El Salvador heavily depends on remittances, which make up over 20% of GDP.

- Innovation and tourism: The government promoted projects like Bitcoin Beach and proposed a futuristic Bitcoin City powered by volcanic energy.

However, low adoption rates (only 7–15% used Bitcoin) and extreme volatility made it unsuitable for everyday use. Public pushback, international pressure, and limited merchant participation led to the rollback in 2025.

Trader’s Perspective: Currency Stability vs. Speculation

From a trading and macroeconomic standpoint:

- USD provides liquidity, stability, and global acceptance, making it ideal for trade and investment.

- Bitcoin, while offering upside potential, introduced volatility, fiscal uncertainty, and regulatory challenges.

The El Salvador Bitcoin experiment functioned more as a speculative asset strategy than a genuine currency alternative. With the revocation of its legal status, El Salvador has returned to a dollar-only economy, reinforcing investor confidence and re-aligning with traditional financial systems.

Conclusion

El Salvador’s experiment with Bitcoin may have attracted global attention, but in practice, the U.S. dollar remains the only widely accepted and stable currency in the country. After revoking Bitcoin’s legal tender status in early 2025, the government reaffirmed its commitment to monetary stability and investor confidence.

At Ultima Markets, we monitor these shifts closely to help traders navigate the macroeconomic impact of currency decisions. Whether you’re trading USD-based forex pairs or tracking crypto volatility, understanding how countries like El Salvador handle legal tender is critical to informed decision-making.

Stay ahead of currency trends with Ultima Markets, your trusted partner in global trading insights.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.