Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteExchange Rate Converter|TWD Real-time Conversion Tool

Under the wave of globalized economies, exchange rates have become not merely a concern for forex traders but an integral part of daily life for Taiwanese citizens. Whether for overseas travel, international shopping, foreign investments, or corporate cross-border settlements, exchange rate fluctuations impact costs and profits. The “exchange rate converter” serves as an invaluable tool to swiftly calculate inter-currency values in rapidly shifting markets.

This article explores the applications of exchange rate converters, selection techniques, and how integrating Ultima Markets’ professional forex calculator allows traders to bypass tedious computations and focus on critical trading decisions.

What Is an Exchange Rate Converter? How It Help Users?

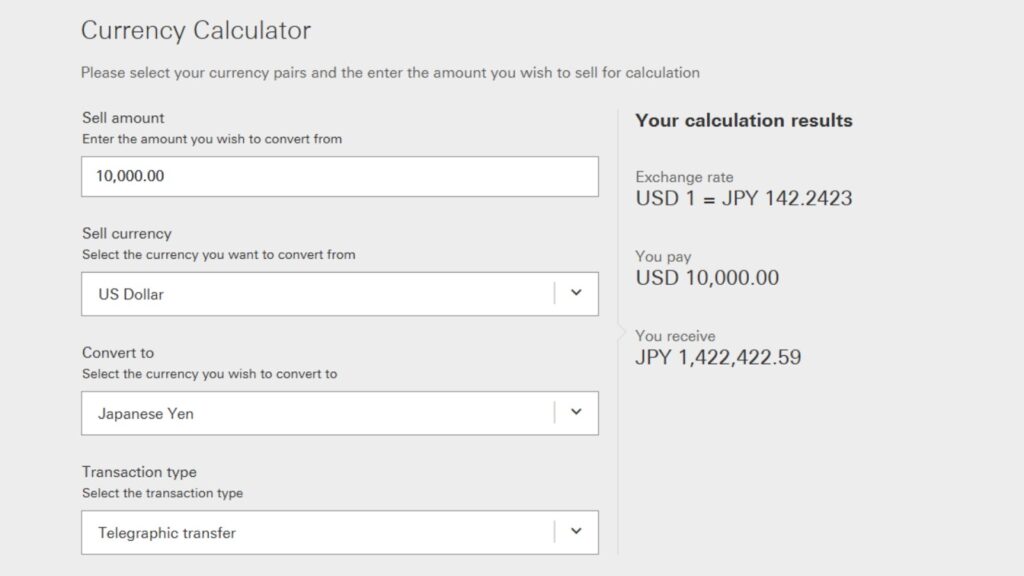

An exchange rate converter is an online tool that swiftly calculates exchange rates between two currencies. Compared to manual calculations, its key advantages are “timeliness” and “precision.” For example, when converting TWD to USD, simply input the amount and currencies to instantly receive real-time conversion results.

Currently, global forex market daily trading volume reaches USD7.5 trillion (approx. TWD225 trillion), reflecting growing participation from individuals and enterprises in international financial markets. For Taiwanese investors, whether trading forex, making cross-border purchases, or valuing overseas assets, using exchange rate converters has become routine.

Core Functions and Common Use Cases of Exchange Rate Converters

Real-Time Currency Conversion

Current mainstream exchange rate converters typically support at least 30 major currencies, including TWD (New Taiwan Dollar), USD (US Dollar), JPY (Japanese Yen), EUR (Euro), CNY (Chinese Yuan), and GBP (British Pound). This is vital for Taiwan’s export-oriented economy, particularly for export enterprises, purchasing agents, and cross-border e-commerce.

Cryptocurrency Conversion

With the rise of cryptocurrencies, more exchange rate converters now support Bitcoin (BTC), Ethereum (ETH), and other digital assets, enabling investors to track virtual asset valuations against fiat currencies.

Diverse Application Scenarios

- Before overseas travel: Calculate required TWD for foreign currency exchange

- International shopping: Assess purchase cost-effectiveness

- Foreign investments: Monitor forex investment costs and projected returns in real-time

- Cross-border e-commerce: Businesses compute multi-currency payments/receivables and pricing accuracy

These scenarios hinge on one critical need, a “real-time exchange rate converter”, whose live data minimizes losses from volatility.

How to Choose an Exchange Rate Converter?

Real-Time Updates and Reliable Sources

Exchange markets change rapidly, especially during major international events or central bank rate decisions, where fluctuations can reach 0.2% or more within seconds. For investors, even minutes of delay may determine profit vs loss. Thus, selecting an online exchange calculator offering “real-time updates” is critical.

Multi-Currency and Cryptocurrency Support

As cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) gain popularity, select exchange rate converters now support crypto conversions. For investors exploring digital assets, this is a critical feature.

Platform Security and Reliability

Choosing tools with official regulatory oversight ensures data accuracy and system stability, mitigating risks from unverified sources. Platforms like Ultima Markets, a regulated forex broker deliver secure, stable services while safeguarding user funds and information security.

Ultima Markets Forex Trading Calculator

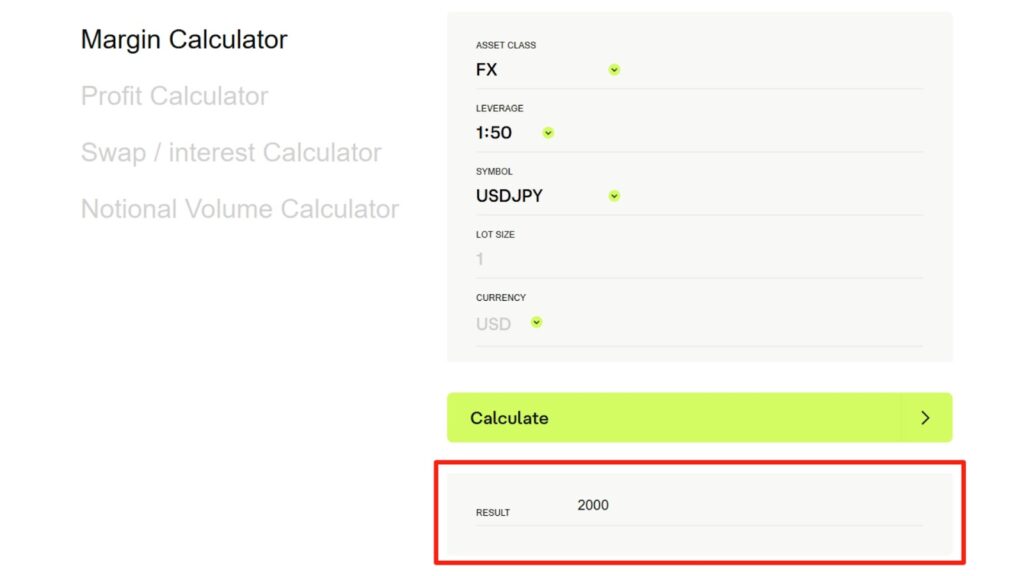

Ultima Markets, founded in 2016 and regulated by CySEC, ASIC, and FSC, is headquartered in Australia and ranks among globally recognized forex brokers. Its “Trading Calculator” directly streamlines trading processes for investors free to use, no software download required. Unlike basic exchange calculators, UM’s calculator suite targets traders’ practical needs, delivering key order metrics within seconds.

UM’s Four Professional Calculator Functions

- Margin Calculator:

Quickly calculates required margin per trade, preventing misjudged capital needs after leverage amplification. - Profit Calculator:

Estimates potential profit/loss per transaction, clarifying risk-reward ratios before entry. - Overnight Interest Calculator:

Ideal for positions held beyond one day, evaluating potential long/short position interest costs. - Nominal Trading Volume Calculator:

Helps to confirm total order value and actual position scale impact, avoiding misorders or margin calls.

These tools drastically reduce manual calculation time and error rates, letting users focus solely on trading decisions not computational details.

Ready to experience firsthand? UM offers demo accounts with leverage up to 1:2000. Register now to practice in simulated environments and experience professional-grade trading workflows.

How to Combine Exchange Rate Converters and Forex Calculators to Boost Trading Efficiency?

Strategy 1: Pre-Trade Cost Analysis

Use exchange rate converters to calculate currency conversion costs, then pair with UM’s Profit Calculator to estimate post-entry potential profits. This helps evaluate whether trades warrant execution.

Strategy 2: Multi-Market Leverage Assessment

Taiwanese investors participate not only in USD markets but also JPY, EUR, CNY, and others. Use exchange rate converters to calculate cross-currency ratios first, then apply UM’s Nominal Trading Volume Calculator to evaluate position distribution across multi-currency markets.

Strategy 3: Risk Control

Utilize Margin Calculators and Overnight Interest Calculators to maintain control over leverage and interest costs, preventing underestimation of actual risks due to sole reliance on exchange rate data.

FAQ for Taiwanese Users

Is Exchange Rate Converter Data Accurate?

Platforms like Ultima Markets with regulatory backing source exchange data from major global liquidity providers (e.g., JPMorgan, Citi, Barclays), ensuring high precision and rapid updates to meet professional trading demands.

What’s the Difference Between Exchange Rate Converters and Forex Trading Calculators?

Exchange rate converters calculate direct currency conversion values, while forex calculators address traders’ practical order execution needs by computing complex metrics like margin, profit, and overnight interest. Combining both tools comprehensively enhances trading efficiency.

Are UM’s Trading Calculators Free?

Yes. Ultima Markets’ trading calculators are free to use. Whether you hold a demo account or trading account, online access is available anytime.

How to Transition from Conversion Tools to Live Trading?

Using exchange rate converters is merely step one. Users seeking deeper market engagement should open a UM demo account to practice strategies and familiarize themselves with the trading environment. Proceed to a trading account for live investment once confident.

Conclusion

Whether you’re a forex novice or seasoned trader, exchange rate converters and professional forex calculators are indispensable tools. Traditional converters assist with daily currency exchange and price comparisons, while professional-grade calculators like Ultima Markets’ enable precise calculations and swift decisions in real financial markets, capturing greater opportunities.

Leverage these trading tools to embark on your global trading journey, experience limitless possibilities with professional exchange converters and forex trading!

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.