Fed Holds Steady, Signal Uncertain Path in September

The Federal Reserve kept its benchmark interest rate unchanged at 4.25%–4.50% during its July policy meeting, marking the fifth consecutive hold in line with broad market expectations.

However, the meeting was notable for a rare internal split among policymakers, resulting in the first multi-member dissent since 1993, highlighting growing divisions over the next policy move.

FOMC July Policy Statement: Key Highlights

With rates left unchanged for a fifth straight meeting, investor focus turned sharply to the language of the policy statement. The Fed struck a more neutral tone, saying that “risks to the economic outlook are roughly balanced,” suggesting no strong directional bias.

Inflation Language Softens

In a notable shift, the Fed removed prior references to “elevated inflation risks”, indicating a diminishing concern over price pressures. Policymakers now state that “inflation is moving gradually toward 2%,” adopting a more dovish tone compared to previous months. While inflation remains above target, Chair Jerome Powell emphasized that recent data show signs of cooling, but it remains to be seen.

“Higher tariffs have begun to show through more clearly to prices of some goods, but their overall effects on economic activity and inflation remain to be seen,” Powell noted during the post-meeting press conference.

Labor Market Still Resilient

The Fed reiterated that the labor market remains strong, with solid job growth and low unemployment. However, officials acknowledged signs of moderating wage growth, which supports the dovish argument for patience. The Fed also flagged rising uncertainty around how recent U.S. tariffs may influence employment and wage dynamics.

“We’re seeing a notable shift in the Fed’s tone on inflation, largely because tariff-related uncertainties have begun to ease following recent successful trade negotiations—potentially reducing inflationary pressures ahead,” said Shawn, Senior Analyst at Ultima Market.

Growing internal Split: First Dissent Since 1993

The most significant development was the emergence of a growing internal split within the Federal Open Market Committee (FOMC).

Fed Governors Michelle Bowman and Christopher Waller both voted in favor of a 25 basis point rate cut, breaking from the majority and marking the first dual dissent in decades.

Despite the disagreement, Powell described the divergence as “constructive” and reaffirmed the central bank’s data-dependent approach, avoiding any firm commitment on the timing of future moves.

During the press conference, Fed Chair Jerome Powell stated there has been no decision made on how the central bank will proceed at its September meeting, emphasizing that the Fed will “wait to see” the tariff impact on inflation in coming months.

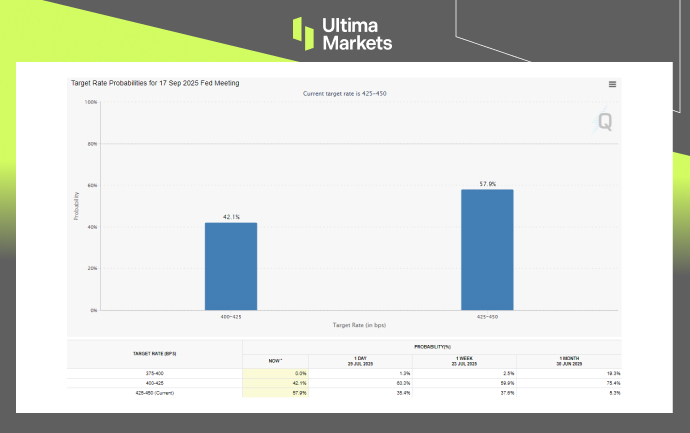

According to the CME FedWatch Tool, market expectations have shifted notably. As of now, 57.9% of traders anticipate no change in the target rate in September—a sharp reversal from a month ago when 75.4% were pricing in a 25bps rate cut.

CME FedWatch Target Rate Probabilities for September | Source: CME Group

July FOMC Meeting: What’s Next?

The Fed’s median projections still point to two rate cuts by the end of 2025, assuming inflation continues to ease. However, the exact timing remains uncertain, especially with inflation only gradually moving toward the 2% target and geopolitical risks still in play.

The July decision underscores the Fed’s balancing act between easing price pressures and lingering uncertainty, with markets now turning their attention to incoming data and the September FOMC meeting, where the next move could hinge on inflation and labor trends.

Market Reaction: US Dollar Regained 99-Mark

In the currency market, the U.S. Dollar rebounded following the Federal Reserve’s July meeting, as the Fed offered no clear signal on a potential rate cut in September. Markets responded by repricing expectations, helping the Dollar regain strength and push back above the key 99-mark—signaling a potential bullish reversal.

U.S. Dollar Index (USDX), 4-Hour Chart | Source: Ultima Market MT5

From a technical perspective, the U.S. Dollar Index appears poised for a potential bullish reversal. The market’s shift in expectations regarding the Fed’s policy path, combined with renewed confidence from recent U.S. trade negotiations—which many view as a win for the U.S.—has provided fresh support for the Dollar’s recovery.

Read more on our technical analysis in Dollar Index.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server