Central Bank in Focus: Fed & BoC Decisions Awaited

In the upcoming sessions, global markets are closely watching the U.S. Federal Reserve and the Bank of Canada (BoC), both of which are set to announce their July policy decisions. With global trade tensions easing, investors are eager to gauge how these central banks will respond to shifting macroeconomic conditions.

Federal Reserve: Holding Steady Amid Internal Tensions

The Federal Reserve is widely expected to maintain its benchmark rate at 4.25%–4.50% during its July 29–30 meeting, marking its fifth consecutive hold. While core inflation recently edged up to 2.7%, other economic data remain mixed. Policymakers appear cautious—balancing the evolving economic picture with growing political pressure from President Trump, who continues to call for rate cuts.

Chair Jerome Powell’s post-meeting remarks will be closely scrutinized for clues on when rate cuts might begin. Markets currently expect the first move to come as early as September or December.

Internal Divergence Emerges

A growing divide has emerged within the Fed. Governors Christopher Waller and Michelle Bowman have openly supported immediate rate cuts, citing soft labor conditions and the view that tariff-driven inflation is likely temporary. On the other hand, Chair Powell and other officials remain committed to a “wait-and-see” approach. This divergence could result in rare dissenting votes at the upcoming meeting.

Despite the divide, Fed projections still point to two 25bps rate cuts before year-end, with inflation expected to slow only gradually toward the 3% target.

Political Pressure from Trump

Another key theme is the increasing political pressure from President Trump, who has repeatedly criticized Powell and even threatened to remove him. With Powell’s term ending in May 2026, high-profile dissent and political interference could heighten uncertainty around the Fed’s leadership and independence. The IMF has warned that political pressure could undermine the credibility of U.S. monetary policy, emphasizing the need to protect the Fed’s autonomy.

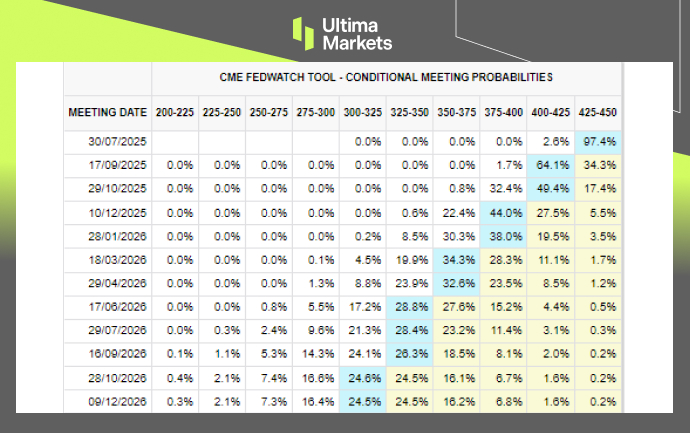

CME Fedwatch Rate Probabilities | Source: CME Group

According to the CME FedWatch Tool, markets are currently still pricing in two rate cuts in 2025, although this outlook remains uncertain and far from guaranteed, as evolving economic conditions could cloud the path ahead.

Bank of Canada: Hold Rate, But with Cautious tone

The Bank of Canada is also scheduled to announce its decision on July 30, with markets expecting it to hold the overnight rate at 2.75%—the third consecutive pause following 225 basis points of cuts since mid-2024. While inflation and labor data have moderated, lingering uncertainty over U.S. tariffs continues to cloud the outlook.

Governor Tiff Macklem has described the current rate as near-neutral, and signaled that any further cuts will be gradual and data-dependent.

“We are still expecting one to two more cuts in 2025, potentially bringing the rate down to 2.25% or 2.50%,” said Shawn Lee, Senior Analyst at Ultima Market. “If U.S. tariffs continue to weigh on Canada’s economy, a two-cut scenario becomes increasingly likely,” he added.

Markets will be watching closely for any shift in tone in the BoC’s forward guidance, particularly in the Monetary Policy Report released alongside the decision.

Market Focus Ahead

Both the Fed’s and BoC’s post-meeting communications will be critical, particularly regarding their views on inflation, labor market health, and trade spillovers. The ongoing development in U.S.–Canada trade policy is also likely to shape both central banks’ future messaging.

Beyond the central bank meetings, attention will shift to upcoming inflation and jobs data in both countries, which could influence policy paths for the remainder of the year.

At present, the U.S. Dollar Index hovers near the key psychological level of 99, reflecting ongoing strength in the greenback. Meanwhile, USD/CAD trades around 1.3770, with technical support emerging near 1.3570, suggesting the pair may be forming a near-term consolidation range.

USDCAD, Day Chart | Source: Ultima Market MT5

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server