Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomEarnings Per Share (EPS): Meaning, Formula, and Importance

For investors, making informed decisions often comes down to understanding a company’s

profitability and earnings per share (EPS) is one of the most reliable tools for the job. More than just a

calculation, EPS is a window into how well a company converts its profits into value for shareholders.

Whether you’re evaluating potential returns or comparing companies, mastering EPS is essential for

navigating the financial markets.

In this guide, we’ll explore the meaning of earnings per share, break down the formula, and discuss its role in shaping investment strategies. By the end, you’ll have a clear understanding of why EPS matters

and how to use it effectively.

What Is EPS?

Earnings per share are a key indicator of a company’s profitability on a per-share basis. They reveal how

much net income is generated for every outstanding share of stock, offering a clear snapshot of

performance.

By dividing net earnings by the number of outstanding shares, EPS enables investors to gauge a

company’s ability to generate profit relative to its size. This metric is frequently used to compare

companies in the same industry or assess performance trends over time.

Why Is EPS Significant?

EPS holds a central place in financial analysis. Here are five reasons why earnings per share matters for

investors:

Measures Profitability

EPS highlights the efficiency with which a company turns its revenue into profit per share. A higher

EPS indicates stronger profitability, making it an attractive metric for investors.

Assesses Financial Health

By analysing earnings per share, investors gain insights into a company’s financial standing.

Companies with consistent EPS growth often exhibit sound financial stability.

Influences Investment Decisions

When selecting stocks, investors often prioritise companies with a rising EPS, as this indicates a

proven ability to generate shareholder value.

Drives Stock Valuation

EPS directly impacts valuation metrics like the price-to-earnings (P/E) ratio. A higher EPS often

results in more favourable stock valuations in the market.

Tracks Performance Over Time

By examining EPS trends, investors can determine whether a company’s profitability is improving

or declining, providing valuable context for decision-making.

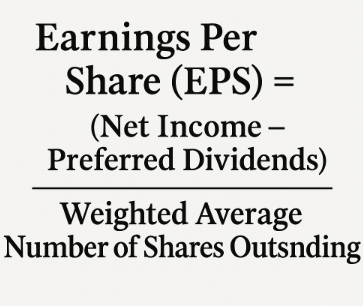

What Is the Earnings Per Share Formula?

The earnings per share formula is fundamental to financial analysis:

Earnings Per Share (EPS) = (Net Income – Preferred Dividends) / Weighted Average Number of Shares

Outstanding

This formula calculates the profit allocated to each share of stock by dividing the company’s net income

(after accounting for preferred dividends) by the average number of outstanding shares. Investors gain a precise measure of a company’s profitability by using this formula.

How to Calculate Earnings Per Share

To calculate EPS effectively, follow these steps:

- Identify Net Income: Locate the company’s net income from the income statement. For instance,

assume the net income is $1,500,000. - Subtract Preferred Dividends: If applicable, deduct preferred dividends. In this example, that

amount is $100,000. - Determine Weighted Average Shares: Identify the average number of shares outstanding, which

might be 250,000 shares.

Using the EPS formula, the calculation is:

EPS = ($1,500,000 – $100,000) / 250,000 = $5.60

The result shows that the company earned $5.60 per share during the reporting period.

Types of Earnings Per Share

There are two primary types of EPS that provide nuanced insights into profitability.

Basic EPS

Basic EPS focuses solely on the current number of shares outstanding. It is straightforward to

calculate and serves as the standard metric for profitability analysis.

Diluted EPS

Diluted EPS accounts for convertible securities, such as stock options or convertible bonds, which

could increase the total number of shares. This metric provides a more conservative estimate of

profitability.

| Feature | Basic EPS | Diluted EPS |

| Calculation Basis | Only considers current shares | Includes potential share dilution |

| Perspective | Focuses on existing earnings | Reflects a conservative view of profitability |

| Use Case | Standard metric in reports | Evaluates the worst-case dilution scenario |

How to Find EPS on an Income Statement

Locating earnings per share on a financial report is simple. EPS is typically listed near the bottom of the

income statement, often under the heading “Earnings Per Share” or “Net Income Per Share.” If you use a stock trading platform, this information is also readily available, allowing you to evaluate a

company’s performance quickly and effectively.

Master EPS for Smarter Investments

The value of earnings per share lies in its ability to connect a company’s financial performance with its

market perception. By analysing EPS alongside other metrics, investors gain a clearer view of profitability

trends, shareholder value, and growth potential. This makes EPS an indispensable tool for building a

strong investment strategy.

At Ultima Markets, we provide a powerful stock trading platform equipped with tools to help you evaluate key metrics like EPS. Whether you’re a beginner or an experienced trader, our platform supports informed decision-making for smarter investments. Start trading today and take control of your financial future.

Frequently Asked Questions (FAQs)

While EPS is a widely used metric, it can raise specific questions for investors. Let’s tackle some of the

most important queries to help you make confident decisions.

What are some limitations of EPS?

While EPS is a key metric, it doesn’t account for cash flow or debt levels, which can provide a

more comprehensive picture of financial health. Over-reliance on EPS alone may lead to

inaccurate assessments.

Can a company have negative EPS?

Yes, a negative EPS occurs when a company experiences a net loss, meaning its expenses

exceed its revenues. This often signals financial trouble and requires further investigation.

How does EPS compare to revenue or net profit?

Revenue measures total income, while net profit accounts for total earnings after expenses. EPS

narrows the focus to profitability per share, making it more specific for shareholders.

Why does EPS vary across industries?

Different industries have unique capital structures and profit margins, leading to varying EPS

levels. Comparing EPS across sectors may not yield meaningful insights without context.

What are some pitfalls when interpreting EPS?

One common mistake is ignoring the impact of share buybacks or dilutions, which can artificially

inflate or deflate EPS. Investors should always consider these factors when evaluating results.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.