Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is FXAIX?

FXAIX is the Fidelity 500 Index Fund, a mutual fund that tracks the S&P 500. Managed by Fidelity Investments, FXAIX offers exposure to 500 of the largest U.S. companies, making it a core holding for many retirement and brokerage accounts.

- Fund Type: Mutual Fund

- Expense Ratio: 0.015%

- Minimum Investment: $0 (for Fidelity accounts)

- Dividend Yield: ~1.5% (as of mid-2025)

- Assets Under Management (AUM): Over $400 billion

FXAIX is often used in employer-sponsored plans like 401(k)s due to its low cost and accessibility.

What is VOO?

VOO, or the Vanguard S&P 500 ETF, is an exchange-traded fund (ETF) that also tracks the S&P 500. Offered by Vanguard, VOO is structured differently from a mutual fund and is traded on stock exchanges like a regular stock.

- Fund Type: ETF

- Expense Ratio: 0.03%

- Minimum Investment: Price of 1 share (~$480 as of July 2025)

- Dividend Yield: ~1.5%

- AUM: Over $350 billion

VOO is popular among DIY investors and traders for its liquidity and intraday trading flexibility.

Difference Between FXAIX and VOO

While VOO and FXAIX both track the S&P 500, key differences lie in structure, tax treatment, and flexibility. Here’s a side-by-side breakdown:

| Feature | FXAIX | VOO |

| Type | Mutual Fund | ETF |

| Expense Ratio | 0.015% | 0.03% |

| Tradability | Once per day (end-of-day NAV) | Intraday, like a stock |

| Minimum Investment | $0 (Fidelity) | One share (~$480) |

| Dividend Treatment | Automatic reinvestment | Optional reinvestment |

| Tax Efficiency | Lower for frequent trades | Higher due to ETF structure |

For long-term passive investors, the cost savings in FXAIX may be slightly more favorable. However, for those needing real-time trades or using a non-Fidelity broker, VOO offers greater flexibility.

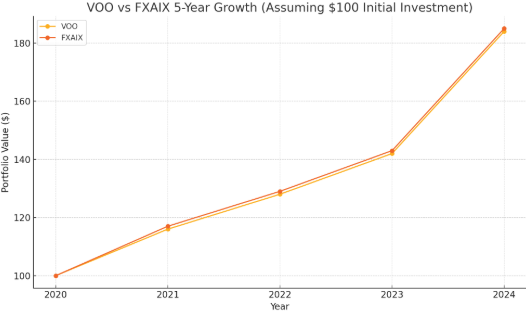

VOO vs FXAIX Performance

Both VOO and FXAIX closely mirror the S&P 500’s returns. Over the past 5 years (as of mid-2025), the performance differences are negligible:

- VOO 5-Year Return: ~84%

- FXAIX 5-Year Return: ~85%

These small differences are often due to timing of reinvestments, fund inflows, or slight tracking errors, not structural flaws. For all practical purposes, their returns are nearly identical over long periods.

FXAIX vs VOO: Which Is Better Investment?

When deciding between VOO vs FXAIX, there is no one-size-fits-all answer. Both funds offer low-cost, diversified exposure to the S&P 500, and long-term performance differences are minimal. The better choice depends entirely on the investor’s needs, platform, and strategy.

VOO may be better suited for those who value intra-day trading, tax efficiency, or want to use ETFs in a brokerage account.

FXAIX may be ideal for long-term investors using Fidelity accounts or retirement plans, where simplicity and automatic reinvestment are key.

In terms of historical returns, both funds have tracked the S&P 500 closely, with virtually identical performance over time. Ultimately, the “best” investment comes down to platform preference, tax considerations, and how actively you manage your portfolio.

FXAIX or VOO for Taxable Accounts?

For taxable brokerage accounts, VOO may have an edge due to the ETF structure’s built-in tax efficiency. ETFs like VOO use in-kind redemptions, which help reduce capital gains distributions. Mutual funds like FXAIX are generally less tax efficient, especially when managing large inflows/outflows.

However, in tax-advantaged accounts (e.g., IRAs, 401(k)s), this advantage is neutralized.

Investor Considerations:

| Investor Type | Better Option | Reason |

| Passive 401(k) Investor | FXAIX | Lower cost, automatic reinvestment |

| Active Trader | VOO | Intraday trading, option usage, flexibility |

| Tax-Sensitive Investor | VOO | More tax-efficient in brokerage accounts |

| Fidelity User | FXAIX | Seamless integration with no trade commissions |

| Vanguard User | VOO | Strong platform support and commission-free trading |

Conclusion

Both VOO and FXAIX are excellent S&P 500 index funds. The right choice depends on your investment platform, trading style, and tax situation:

Choose FXAIX if you prefer simplicity, automatic reinvestments, and ultra-low costs within Fidelity.

Choose VOO if you want trading flexibility, use Vanguard or other brokers, or plan to execute options strategies.

Over a 10–20 year horizon, both funds will likely deliver nearly identical returns. But the structure and user preference ultimately determine which is better for your portfolio.

At Ultima Markets, we equip investors and traders with market insights that help optimize their asset selection. Whether you’re building long-term wealth or actively managing a portfolio, understanding product structure is key to maximizing returns.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.