Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What is Liquidity Sweep in Forex?

A liquidity sweep in forex occurs when the price quickly moves through areas of high liquidity, often triggering stop-loss orders or pending orders from retail traders. These zones, typically found around swing highs and lows, are targeted by institutional players or market makers to accumulate or distribute large positions with minimal slippage.

In simple terms, a liquidity sweep is a deliberate move to “grab” liquidity before the actual price direction begins. This technique exploits predictable trader behavior like placing stops just above resistance or below support.

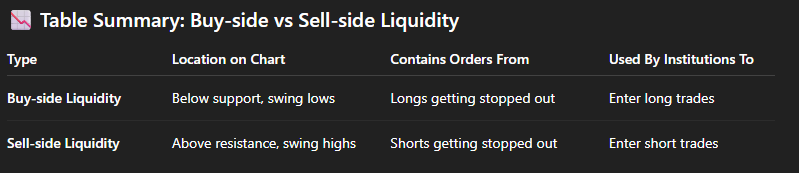

Types of Liquidity in Trading

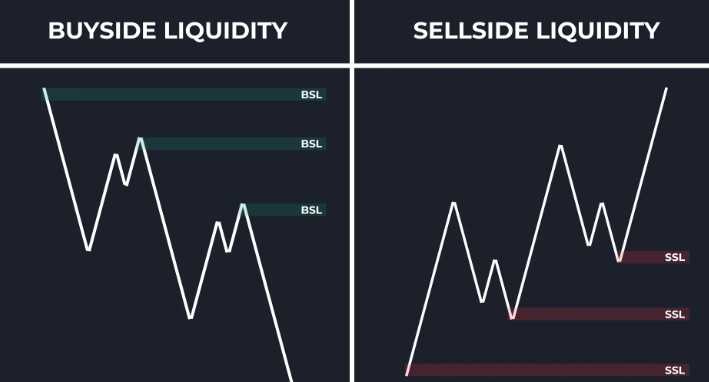

Buy-side Liquidity

Buy-side liquidity represents clusters of stop-loss or sell orders placed below support zones or previous lows. These are areas where institutions can buy from traders being forced to sell.

Examples of Buy-side Liquidity Zones:

- Below equal lows

- Under swing lows

- Just beneath order blocks or consolidation zones

- Below psychological levels (e.g., 1.0900)

Why It Matters:

- When price sweeps below these areas, it:

- Triggers stop-losses from long traders

- Activates breakout sell orders

- Provides institutions with buying opportunities

Sell-side Liquidity

Sell-side liquidity refers to clusters of stop-loss or buy orders placed above resistance levels or previous highs. These are zones where institutions can sell into buying pressure.

Examples of Sell-side Liquidity Zones:

- Above equal highs

- Above recent swing highs

- Just beyond breakout levels

- Above round numbers (e.g., 1.1000)

Why It Matters:

- When price reaches these zones, it:

- Triggers stop-losses from short sellers

- Lures breakout buyers into the market

- Allows large players to sell into demand

Why Do Liquidity Sweeps Happen?

Liquidity is essential for large market participants. To fill high-volume orders without causing sharp price moves, institutions seek out zones with dense pending orders, usually near key levels that retail traders often use.

Here’s why liquidity sweeps are common:

- Stop-Loss Hunting: Prices move to stop out retail traders, providing liquidity to institutions.

- Position Building: Banks and funds build or offload large positions with minimal risk.

- Market Rebalancing: Before large news releases or session opens, markets sweep liquidity to rebalance.

These actions are not random but are based on order flow and market psychology.

Liquidity Sweep vs Liquidity Grab: What’s the Difference?

Although both concepts revolve around exploiting clusters of stop-losses or pending orders, their scope and intention differ slightly, especially in how they’re used in Smart Money trading.

Key Difference:

- A liquidity sweep refers to a broader price action movement through a liquidity zone to trigger stops.

- A liquidity grab is a specific maneuver within that sweep, typically a sharp, fake breakout before immediate reversal.

| Feature | Liquidity Sweep | Liquidity Grab |

| Definition | A general move through liquidity zones (highs/lows) to trigger pending orders | A sharp, intentional false breakout to trap traders before quick reversal |

| Scope | Broader price action concept; includes both sweeps and continuation moves | Specific entry/exit pattern, often occurs near structural highs/lows |

| Intent | Accumulate large institutional orders efficiently | Trap retail breakout traders and absorb their stop losses |

| Structure | Can end in either reversal or continuation | Usually results in an immediate reversal |

| Visual Pattern | Long wicks or large candles that penetrate previous highs/lows | One strong spike above/below a key level followed by fast rejection |

| Common Context | Seen around session opens, news, liquidity voids | Occurs at key swing highs/lows, equal highs/lows, or order blocks |

| Example Price Behavior | Price pushes above a previous high, then either continues or reverses | Price breaks a resistance by 10–20 pips, reverses instantly, and leaves a wick |

| Trader Application | Used to spot zones where price will seek liquidity before big moves | Used to identify entry traps and position against false breakouts |

Best Timeframe to Trade Liquidity Sweeps

The best timeframe to trade liquidity sweeps depends on your strategy and trading style:

| Timeframe | Ideal for | Description |

| M15 – M30 | Intraday Traders | Quick sweeps before London/NY session opens. Often aligned with news events. |

| H1 – H4 | Swing Traders | More reliable structure, clearer liquidity zones, fewer false signals. |

| D1 | Position Traders | Identifying macro liquidity zones around highs/lows for major reversals. |

For precision entries, some traders use multi-timeframe analysis, identifying the sweep on H4, confirming with M15, and executing on M5.

Liquidity Sweep Strategy: How To Trade Stop Hunts

A liquidity sweep strategy is designed to capitalize on price manipulation, where institutions push price into stop-loss zones (liquidity pools) before reversing. Rather than being victims of these sweeps, smart traders use them as high-probability entry signals.

Identify Liquidity Zones

Look for areas where retail liquidity is likely concentrated:

- Equal highs/lows

- Obvious swing highs or lows

- Round numbers (e.g., 1.1000, 1500.00)

- Breakout levels or previous session highs/lows

These are likely stop clusters or pending orders.

Wait for a Sweep (Fake Breakout)

Price should:

- Break above/below the identified liquidity level

- Form a wick or aggressive spike, often with a large volume candle

- Reject quickly, showing that the move was a trap, not a true breakout

This is where liquidity is “taken”, the sweep.

Confirm Rejection / Market Reversal

Look for confirmation that the sweep is over:

- Break of Structure (BOS): Price breaks the opposite direction’s recent low/high

- Engulfing Candle: Strong rejection pattern

- Fair Value Gap (FVG) or Imbalance: A sign institutions filled orders

This confirms the reversal, don’t enter too early.

Entry on Retest

Once rejection is confirmed:

- Wait for price to return (retest) the swept zone or imbalance area

- Enter a limit or market order with clear stop-loss

Stop-Loss Placement:

- Just above/below the wick/sweep

- Keep it tight — your invalidation is clear

Target:

- Opposite side of the range

- 2R–3R minimum or next liquidity zone

Example Entry Setup:

- Pair: EUR/USD

- Zone: Price breaks London session high (equal highs)

- Sweep: Quick spike above resistance

- Rejection: Bearish engulfing on M15 + BOS

- Entry: Retest of sweep candle or FVG

- Stop-Loss: 10 pips above the sweep

- Take Profit: Back to NY session low (risk-reward 1:3)

When Do Liquidity Sweeps Typically Occur?

Liquidity sweeps often occur during:

- Session Opens (London and New York)

- High-impact News Events

- End of Week/Month Positioning

- Low Liquidity Periods (e.g., pre-Asia close)

These times are ideal for large participants to manipulate price and grab liquidity efficiently.

Conclusion

Liquidity sweeps in forex are not random; they reflect how the market operates at a structural level. By understanding how and why these moves occur, traders can shift from being stop-hunted to trading with the smart money.

Instead of chasing breakouts, focus on where retail liquidity lies and how price reacts around those zones. That’s where the real edge begins.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.