JGB Yields Soar as Election Uncertainty Fuels Fiscal Concerns

Yields on Japanese Government Bonds (JGBs) surged on Monday, reaching multi-year highs, as investors brace for heightened fiscal risk ahead of Japan’s Upper House election on July 20.

The sharp move in long-dated bonds highlights growing market concerns over potential policy shifts and increased government borrowing in the wake of a potentially changed political landscape.

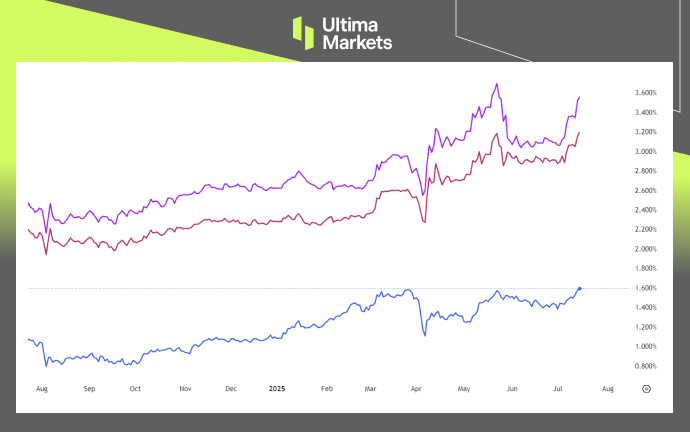

The benchmark 10-year JGB yield climbed to 1.59%, marking its highest level since 2008, while yields on 30-year and 40-year bonds again soared past 3.19% and 3.5%, respectively—levels not seen since before the global financial crisis.

JGB 10,30 & 40-Years Yields | Source: TradingView

The spike in yields comes amid speculation that the outcome of the upcoming election could lead to expanded fiscal stimulus, including consumption tax cuts and larger government spending, especially if the opposition gains ground.

Such moves would further inflate Japan’s already heavy public debt burden, which stands at over 250% of GDP.

BoJ Faces New Policy Dilemma

The sharp rise in yields places the Bank of Japan (BoJ) in a difficult position. While the central bank has gradually tapered bond purchases and signaled the start of policy normalization, the surge in yields could delay further tightening if it undermines financial stability or threatens the recovery.

BoJ officials have downplayed the immediate need for intervention but are reportedly monitoring the long end of the curve closely. Recent adjustments in the bank’s bond buying operations, particularly its reduced purchases of 20- to 40-year bonds, have added to market sensitivity.

Market Implications: Yen Remains Weaken

The rising yield has underscores investors nervousness, especially ass foreign funds become more cautious on Japanese debt. Higher domestic yield could weigh on the Japanese equities market, whole also being the major driver of recent Japanese Yen depreciation.

USDJPY, Day-Chart Analysis | Source: Ultima Market MT5

Despite a broadly weaker U.S. Dollar, the USDJPY extended its rally to a two-month high, nearing the key 148.00 resistance level as the Japanese Yen came under renewed selling pressure.

“The combination of fiscal risk, political uncertainty, and reduced Bank of Japan support is a recipe for continued volatility in both Japanese Government Bonds and the Yen,” said Ultima Market Analyst Shawn.

He added that until the political dust settles, the Yen may remain vulnerable—particularly against other major currencies.

With political stakes high and JGB volatility rising, investors are now closely watching this weekend’s Upper House election for clues on Japan’s future fiscal path. A decisive result—particularly one favoring opposition or populist platforms—could further spook bond markets and push yields higher and further weaken the Yen.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server