Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomIs Platinum Better Than Gold?

Platinum is generally not performing better than gold at the moment. Gold is currently more expensive, more widely held by central banks, and used primarily as a store of value. Platinum is less expensive, more volatile, and primarily driven by industrial demand, especially in the automotive and clean energy sectors.

If you’re wondering is platinum better than gold, this guide breaks down the key differences to help you make an informed decision.

Is Platinum More Expensive Than Gold Today?

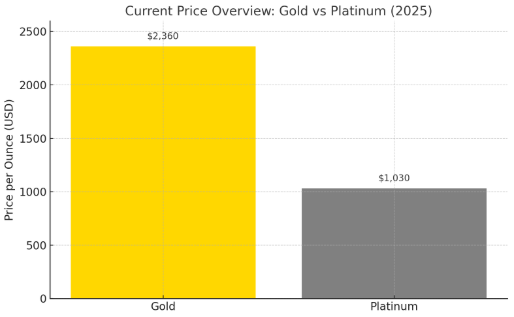

No. As of July 2025, gold is more expensive than platinum. Gold continues to maintain a higher market price, reflecting its strong demand as a safe-haven asset and investment vehicle, whereas platinum remains priced lower due to its dependence on industrial applications.

As of July 2025,

- Gold Price: Approximately $2,360 per ounce

- Platinum Price: Approximately $1,030 per ounce

Gold is trading at roughly 2.4 times the price of platinum today. This reflects gold’s role as a preferred safe-haven asset and its high global demand, while platinum remains more tied to industrial usage and has not reached gold’s premium.

The price gap between the two metals has remained wide throughout 2025, with gold leading due to strong investment flows and geopolitical uncertainty, and platinum reflecting its industrial dependency and limited diversification demand.

Current Price Overview for Gold vs Platinum (2025)

In 2025, gold price is around $2,360 per ounce, and platinum price is around $1,030 per ounce. This means gold is currently more expensive than platinum, a reversal from historical norms where platinum often traded at a premium.

Historical Price Trends of Gold and Platinum

Now that you know the current prices of gold and platinum, it’s important to understand how their values have shifted over time. Here’s a breakdown of their historical price behavior:

Gold’s Long-Term Stability

- Gold has consistently been a store of value for thousands of years.

- Historically used as a hedge against inflation and currency devaluation.

- Maintains upward momentum during geopolitical or economic uncertainty.

Platinum’s Volatility and Industrial Role

- Platinum prices were higher than gold before 2011 due to its scarcity, higher industrial demand, and use in the automotive industry.

- Demand dropped due to shifts in the automotive industry (diesel engines vs EVs).

- Prices are more volatile due to dependence on industrial consumption.

What Drives the Price of Gold?

Now that you understand the historical price trends of both metals, you might be wondering: what actually drives the price of gold, and why is it so expensive?

Gold prices are primarily driven by:

- Inflation and interest rates: When inflation rises or interest rates fall, gold becomes more attractive as a store of value, leading to increased demand and higher prices.

- Central bank policies: Central banks hold significant reserves of gold. Their decisions to buy or sell gold, or to adjust interest rates and liquidity, can directly impact gold’s price.

- Geopolitical tensions: During periods of war, political instability, or financial crises, investors tend to move funds into gold as a safe-haven asset, pushing prices higher.

- Currency fluctuations (especially USD): Gold is priced in US dollars. When the dollar weakens, gold becomes cheaper for international buyers, increasing demand. A strong dollar often puts downward pressure on gold prices.

- Investment demand (ETFs, sovereign funds, retail investors): Institutional and retail investor interest in gold-backed exchange-traded funds (ETFs) and physical gold also significantly influence price trends. Higher demand from these segments supports price gains.

Gold is considered a safe-haven asset, especially in times of crisis.

What Drives the Price of Platinum?

Platinum’s price movements are tied more closely to:

- Industrial demand (automotive, chemical, medical sectors): A large portion of platinum is consumed by industrial applications. It’s a key material in catalytic converters for vehicles, various chemical manufacturing processes, and even medical devices. Changes in industrial output or technology directly affect demand.

- Supply constraints (primarily mined in South Africa and Russia): Around 70% of the world’s platinum supply comes from South Africa. Political instability, labor strikes, power outages, or logistical challenges in these regions can severely limit global supply and increase prices.

- Substitution trends (palladium vs platinum in catalytic converters): Platinum competes with palladium in the auto sector. Automakers may switch between the two metals based on cost-efficiency, which causes price shifts. When palladium becomes too expensive, demand for platinum can increase.

- Green technology (hydrogen fuel cells may boost future demand): Platinum plays a vital role in hydrogen fuel cells, a promising technology for clean energy. As governments and companies invest in zero-emission solutions, demand for platinum could rise significantly in the long term.

Advantages and Disadvantages of Trading Platinum and Gold

When evaluating the pros and cons of trading gold, it’s important to consider its historical performance, global recognition, and role as a financial safe haven. Gold is often favored by long-term investors seeking capital preservation, but it also plays a role in short-term trading strategies, especially during periods of market uncertainty. This section outlines the key benefits and limitations that traders should keep in mind when dealing with gold.

Trading Gold: Pros and Cons

| Advantages | Disadvantages |

| High liquidity | Slower price movement may limit short-term profit potential |

| Well-understood by markets | Vulnerable to Fed policy and USD strength |

| Stable store of value |

Trading Platinum: Pros and Cons

| Advantages | Disadvantages |

| More volatility = higher short-term profit potential | Thin market = wider spreads |

| Potential for long-term upside if industrial demand rebounds | Prone to supply disruption and industrial cycles |

Gold Price Versus Platinum: Which Is the Better Investment?

Deciding whether gold or platinum is the better investment comes down to your specific investment goals and risk tolerance. Gold is typically favored for long-term wealth preservation and portfolio stability, while platinum may appeal to those seeking speculative opportunities tied to industrial and technological growth. Here’s a general breakdown:

- For stability and long-term wealth preservation: Gold is often better.

- For speculative gains and industrial growth exposure: Platinum has more upside potential—but also more risk.

FAQs

Is platinum more expensive than gold?

Currently, no. Gold trades significantly higher than platinum.

Why is platinum cheaper than gold?

Because of declining diesel demand, limited investment interest, and supply reliability issues.

Will platinum ever be worth more than gold again?

Potentially, especially if green energy applications like hydrogen fuel cells gain traction.

Conclusion

Platinum is not better than gold in all scenarios but it can outperform during specific market conditions. Gold remains the go-to for wealth preservation, while platinum offers speculative opportunity tied to industrial innovation. If you’re looking to trade gold or platinum, Ultima Markets offers a professional trading platform with access to both metals via CFDs.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.