Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

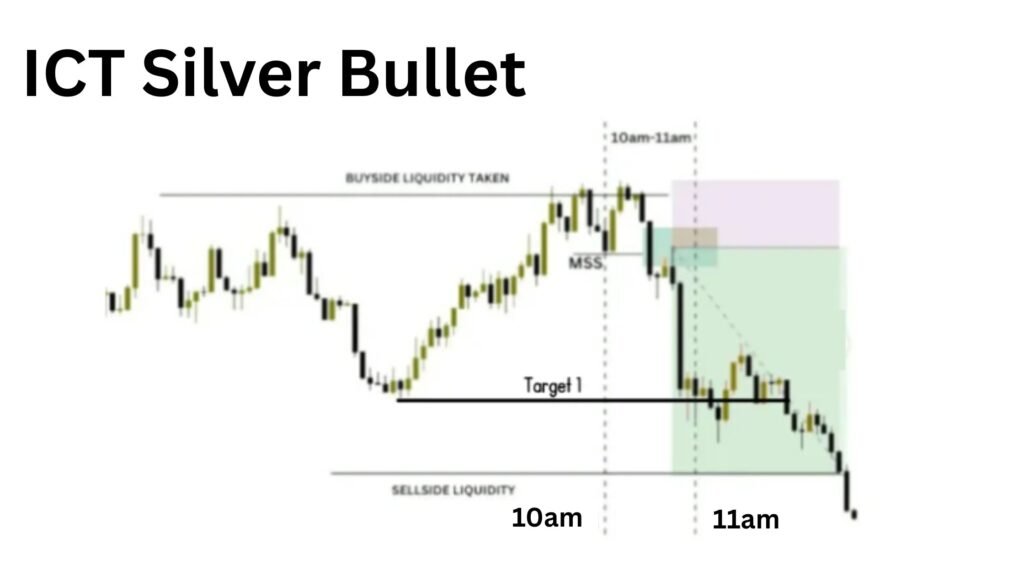

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomICT Silver Bullet Times to Trade

The best time to trade the ICT Silver Bullet strategy is between 10:00 AM and 11:00 AM EST, inside the New York Killzone. This 1-hour window is when institutional algorithms are most active—often causing sharp liquidity grabs and clean reversals.

What Is the Best Timeframe for ICT Silver Bullet?

The best timeframes for the ICT Silver Bullet strategy are the 1-minute (M1) and 5-minute (M5) charts. These lower timeframes allow you to spot precise entries during the ICT-defined time windows, offering high-probability setups when combined with market structure shifts and liquidity grabs.

- M1 Chart: Best for scalping and pinpoint entries.

- M5 Chart: Ideal for clearer structure and slightly wider stop losses.

The ICT Silver Bullet strategy works best on the 1-minute (M1) and 5-minute (M5) charts because these lower timeframes offer:

Precision for Institutional Moves

The strategy is designed to catch short, high-probability setups during specific institutional time windows mainly 10:00–11:00 AM EST. Price moves fast during this hour, and the M1/M5 charts reveal the exact displacement, imbalances, or liquidity sweeps that higher timeframes may hide.

Better Risk-to-Reward

Lower timeframes allow for tighter stop losses and more precise entries, which improves your overall risk-to-reward ratio, key for funded account trading and prop firm challenges.

Cleaner Confirmation

Because Silver Bullet trades often unfold quickly, M1 and M5 provide clearer confirmations of FVG entries, BOS (Break of Structure), and quick retests. These are often missed or lag on higher timeframes like H15 or H30.

What Time Is the ICT Trading Session?

Michael J. Huddleston (ICT) focuses on two main trading sessions:

- London Killzone: 2:00 AM – 5:00 AM EST

- New York Killzone: 9:30 AM – 11:30 AM EST

The Silver Bullet strategy specifically targets a high-probability setup that occurs within a 1-hour window inside the New York session:

- Silver Bullet Window: 10:00 AM – 11:00 AM EST

ICT Silver Bullet Checklist

Use this step-by-step checklist to filter only high-probability Silver Bullet setups. Following these criteria improves consistency, reduces overtrading, and aligns with ICT’s methodology.

Determine Higher Timeframe Bias

- Start from H1 or H4 chart.

- Use market structure, Fair Value Gaps (FVGs), and Order Blocks to define bullish or bearish bias.

- Mark premium and discount zones using the Fibonacci retracement.

Confirm Silver Bullet Time Window

- Trade only between 10:00 AM – 11:00 AM EST (New York session).

- Avoid setups before or after to filter out low-probability trades.

- Watch for algorithmic activity around this window.

Identify Liquidity Pools or Sweeps

- Look for equal highs/lows, recent swing highs/lows, or stop hunts.

- Price should sweep liquidity before showing reversal signs.

Find Entry Within Imbalance or FVG

- Entry should be on M1 or M5 chart.

- Use Fair Value Gaps, Order Blocks, or displacement candles as entry zones.

- Wait for a Break of Structure (BOS) or Market Shift (MS) for confirmation.

Define Stop Loss and Take Profit

- Stop Loss: Just beyond the wick of the liquidity sweep or invalidation level.

- Target: Opposite liquidity pool, internal range low/high, or discount/premium zone.

- Use minimum Risk-to-Reward (RRR) of 1:2.

Check Entry Confluence

- Does the setup align with:

- Higher timeframe bias?

- Time window (10–11 AM EST)?

- Market structure and liquidity sweep?

- If not—skip the trade.

Document the Trade

- Log in a journal with: Entry/ Exit time, Setup conditions, Win or Loss, Lessons learned

ICT Silver Bullet Strategy Example

The ICT Silver Bullet strategy is one of the most talked-about concepts in smart money trading. Created by the Inner Circle Trader (ICT), it focuses on specific time windows where institutional activity is at its peak. This guide will cover ICT Silver Bullet times to trade, the best timeframe, a complete checklist, and high-probability setups.

Let’s say you’re trading EUR/USD on a Thursday.

- H1 Bias: Bearish due to a Break of Structure (BOS) and Fair Value Gap (FVG) above current price.

- M5 Chart: Around 10:20 AM EST, price rallies into a bearish FVG.

- Liquidity Grab: Price sweeps the previous session’s high, triggering stop-losses and inducing late buyers.

- Displacement: A sharp bearish move follows, confirming institutional rejection.

- Entry: You enter a short position on the return to the imbalance (FVG) created by the displacement.

- Stop Loss: Set just above the liquidity high that was swept.

- Take Profit: Target the nearest sell-side liquidity or the 62%-100% retracement level in the discount zone.

This example checks every box on the Silver Bullet checklist and perfectly aligns with smart money concepts. It demonstrates how to pair higher timeframe bias with a real-time execution window using ICT principles.

ICT Silver Bullet Strategy Win Rate

While no strategy guarantees results, the ICT Silver Bullet strategy boasts a high win rate when rules are followed strictly:

- Backtested win rates: 60–75% (with strong discipline)

- Risk-to-reward potential: 1:2 to 1:4

- Best used on high-liquidity pairs (e.g., EUR/USD, NASDAQ, GBP/USD)

Note: Your results depend on discipline, proper journaling, and sticking to Killzone hours.

Is Silver Bullet a Good Strategy?

Yes, but only if used correctly.

Pros:

- High-probability setups during peak volume.

- Precise timing increases win rate.

- Simple, repeatable execution process.

Cons:

- Requires strict discipline.

- Can be overtraded if not filtered properly.

- Depends heavily on timing and market conditions.

ICT Silver Bullet vs Power of Three (Po3)

The ICT Silver Bullet is a time-based strategy focused on the 10–11 AM EST window for fast intraday setups, often on M1–M5 charts.

In contrast, the Power of Three (Po3) analyzes full-session price behavior accumulation, manipulation, and distribution and is best used on M5–H1 timeframes for more extended moves. Use Silver Bullet for quick scalps and Po3 for swing-style setups.

| Feature | Silver Bullet | Power of Three (Po3) |

| Time Specific | Yes (10-11AM EST) | No (Full session bias) |

| Entry Style | Quick rejection/ retest | Accumulation-break-run |

| Best Timeframe | M1/M5 | M5/M1 |

| Speed of Setup | Fast | Moderate |

Conclusion

The ICT Silver Bullet strategy is powerful, but its full potential shines when paired with a reliable trading platform. At Ultima Markets, we provide the ultra-fast execution, precision charting tools, and institutional-grade liquidity you need to capitalize on time-sensitive strategies like Silver Bullet.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.