Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

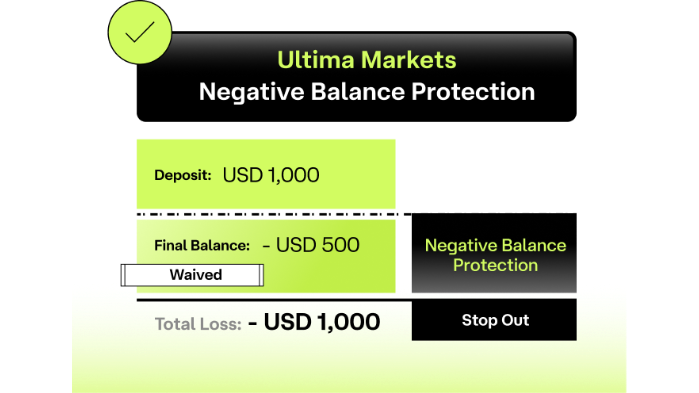

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat Is Short Selling? Master Stock Shorting in 5 Minutes

In the first week of April 2025, a sudden US “reciprocal tariff” policy triggered a global stock market crash. On April 7, the Taiwan stock market opened with a 9.7% plunge, marking a record single-day drop of 2,065 points. Amid the panic, traders well-versed in the concept of short selling capitalized on the volatility of the USD/TWD exchange rate, seizing the opportunity as safe-haven demand for the US dollar drove the rate to the 32.8 level, achieving contrarian gains.

This crisis underscored a key lesson: when markets spiral into irrational turbulence due to policy shifts, mastering two-way trading mechanisms and short selling strategies becomes the essential survival skill to weather the storm.

What Is Short Selling?

Traditionally, investors associate profits with “buying low and selling high,” but this notion is no longer comprehensive. As we move into 2025, market volatility continues to intensify, especially amid unresolved global inflation and rising international trade tensions. Consequently, more traders are turning their attention to the meaning and strategic application of short selling.

Also known as bearish positions, selling short, or short trades, short selling involves anticipating a decline in an asset’s future price and profiting from the price difference by “selling high first through borrowing, then buying low to cover the position.” This strategy dispels the myth that profits are only possible in rising markets, enabling investors to operate flexibly in both bullish and bearish conditions.

How to Short Sell?

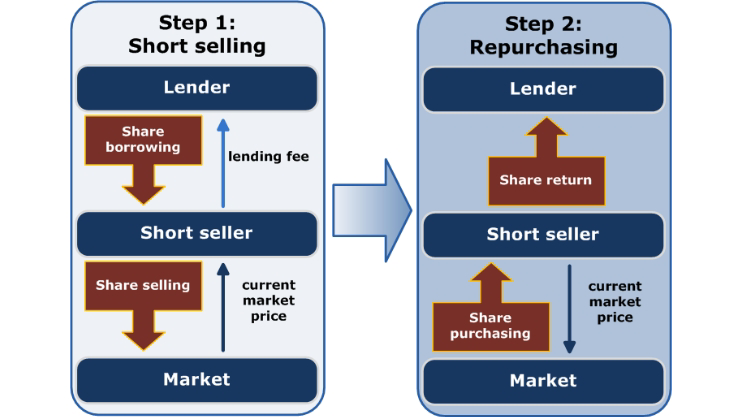

Short selling is an investment strategy based on the expectation that the market will decline. The specific process is as follows:

- Borrow the Asset: Borrow the asset you expect to decline in value (such as a currency or stock) from a broker.

- Sell at a High Price: Immediately sell the asset at the current market price.

- Wait for a Decline: The asset’s price drops as anticipated.

- Buy Back Low and Return: Repurchase the same quantity of the asset at a lower price and return it, thereby earning the price difference.

Difference Between Going Long and Short

| Item | Long (Buy) | Short (Sell) |

| Market Expectation | Price Increase | Price Decrease |

| Method of Operation | Buy First, Sell Later (Buy Low, Sell High) | Sell First, Buy Later (Sell High, Buy Low) |

| Profit Mechanism | Profit from Price Increase | Profit from Price Decrease |

| Potential Risk | Loss from Price Decrease | Loss from Price Increase (Theoretical Unlimited Loss) |

| Investment Mindset | Optimistic, Bullish | Cautious, Bearish |

Case Study:

Take the JPY/USD pair in the forex market as an example. In Q1 2025, the Japanese yen continued to appreciate due to policy adjustments by the Bank of Japan. If you anticipate a relative weakening of the US dollar, you could short the pair at 130.00. When the price falls to 125.00 and you close the position, you would earn a 5-yen profit per unit traded.

Where Can Short Selling Be Applied?

The flexibility of short selling strategies is extremely high and can be applied across nearly all highly liquid markets:

Forex Market

Currency pairs such as EUR/USD and GBP/JPY allow leveraged trading, making forex one of the most common markets for short selling.

Stock Market

Individual stocks in markets like Taiwan or the US are suitable for short selling, especially when earnings reports fall short of expectations or negative news impacts a company.

Commodity Market

Assets like gold, silver, and crude oil may experience price pullbacks during periods of macroeconomic weakness, offering short selling opportunities.

Cryptocurrency Market

Highly volatile assets such as Bitcoin (BTC) and Ethereum (ETH) continue to fluctuate sharply in 2025, making them hotspots for speculative short trades.

Advantages and Risks of Short Selling

Advantages

- Capture Downtrends: Profit from price declines without being limited to bullish markets.

- Enhance Trading Flexibility: Short selling can effectively balance portfolio risk and hedge long-term positions.

- Flexible Use of Leverage: Amplify returns through platform-provided leverage (requires careful risk management).

Risks

- Theoretical Unlimited Losses: The greatest risk in short selling is unlimited asset price increases, which may lead to margin calls.

- Borrowing Costs and Interest: Some assets may incur interest or fees for borrowing.

- Regulatory and Market Interventions: Restrictions such as short-sale bans or temporary prohibitions can impact operational flexibility.

At the beginning of 2025, the US stock market experienced a short-term surge in multiple tech stocks due to the expanding AI bubble, causing many short sellers to suffer forced buybacks and losses, highlighting the importance of risk management.

Short Selling Procedure (Using UM Platform as an Example)

Executing short selling on the Ultima Markets trading platform is simple and fast, suitable for both beginners and professional traders:

- Open an Account and Deposit Funds: UM supports multiple currencies and deposit methods, including credit cards and cryptocurrencies.

- Select an Asset: Choose from gold, euro, bitcoin, etc., and select the appropriate leverage ratio (up to 1:2000).

- Analyze Market Trends: Use built-in Trading Central technical analysis or the economic calendar to track data direction.

- Place a Short Sell Order: Select the sell (SELL) option and execute the order.

- Set Stop Loss/Take Profit: Protect risk management with UM’s one-click setup.

- Close the Position for Profit: When the market moves as expected, close the position to realize gains.

UM’s minimum trade size is 0.01 lots, ideal for flexible small-capital trading, and supports EA automated trading strategies to help capture short-term downward opportunities quickly.

Who Is Short Selling Suitable For?

- Advanced Traders: Possess basic technical analysis skills and can anticipate short-term price movements.

- Risk-Conscious Investors: Understand how to set stop losses and manage capital allocation.

- Strategic Traders: Skilled in using hedging strategies to reduce overall risk.

If you are a beginner, it is recommended to practice short selling using UM’s Demo Account, which offers up to USD 100,000 in virtual funds for risk-free training in judgment and execution.

How to Reduce Short Selling Risks?

To reduce short selling risks, strictly set stop-loss levels to limit losses, control leverage ratios to avoid excessive risk amplification, and diversify trading instruments to minimize single-market impact. Closely monitor market trends and major events, avoiding trading during high-volatility periods. Maintain sufficient margin to respond to price reversals, regularly assess positions, and promptly adjust strategies. Choosing the right platform is crucial to short selling success.

UM provides a range of risk control and protection measures:

- Segregated Funds System: Client funds are held at Australia’s Westpac Bank, separated from company operating capital.

- Dual Protection Mechanism:

- Join membership in The Financial Commission, offering users dispute compensation up to EUR 20,000.

- Additional insurance coverage of USD 1 million (underwritten by Willis Towers Watson).

- Margin Call Level at Only 50%: Helps users control losses early and avoid total loss.

- Advanced Risk Management Tools: Built-in technical analysis indicators and real-time risk alerts.

These safety measures enhance confidence in short selling operations and help prevent significant losses caused by sudden market reversals.

Common Q&A: Questions About Short Selling

Q1: Is interest charged on short selling? A: Depending on the asset and holding period, overnight interest (swap) may apply, but UM offers highly competitive rates.

Q2: Which assets does UM support for short selling A: Forex, gold, crude oil, cryptocurrencies, global indices, and CFD stocks all support two-way trading

Q3: Is short selling illegal?A: Legal short selling is permitted in most markets. However, regulators may temporarily ban short selling during crisis periods.

Q4: Can beginners short sell? A: It is recommended to first practice with a Demo Account before trading live and to learn basic risk management methods.

Conclusion

Mastering the concept of short selling means gaining the ability to profit in both rising and falling markets. With market pace accelerating and volatility increasing in 2025, only flexible trading can help you stand out amid intense price movements. Whether you are a beginner or an advanced trader, Ultima Markets offers high leverage, low costs, security protections, and professional tools to support you in executing every short selling strategy with confidence.

Open your UM Demo Account now to practice your short selling skills and seize every market opportunity!

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.