Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Is VWAP in Trading? Definition and Strategy Tips

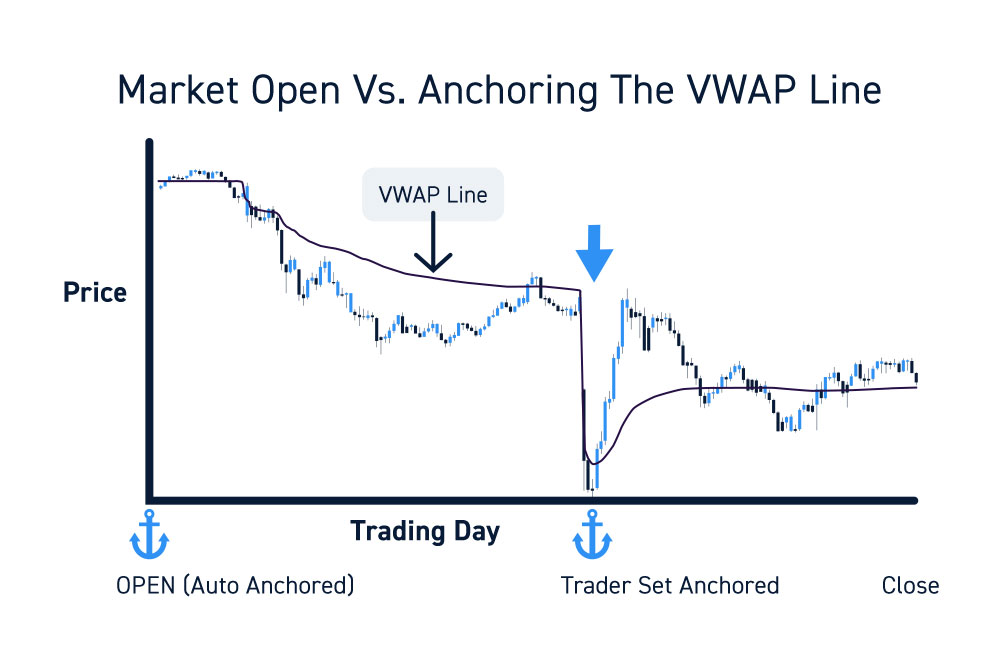

VWAP stands for Volume Weighted Average Price, a technical indicator that reflects the average price value of an asset throughout the trading day, stock weighted by trading volume. VWAP is displayed as a moving average line on intraday charts, helping traders analyze price trends over a specific time frame. It is calculated for each trading day and resets at the market open, making it a daily indicator. VWAP helps traders and investors understand whether a stock is trading above or below its average value during the trading session and is commonly used in stock trading, especially for stocks with high liquidity.

Key Features of VWAP Indicator

- Calculation Basis: Combines price and volume, weighting prices by trading volume.

- Reset Frequency: Resets at the market open each trading day.

- Display: Shown as a moving average line on intraday charts.

- Users: Widely used by institutional investors, institutional traders, institutional buyers, day traders, retail traders, and professional traders.

- Purpose: Assesses trade execution quality, identifies entry/exit points, determines market trends, and reflects stock liquidity.

Why VWAP Important in Trading Industry?

| Purpose | Description |

| Gauge Premium or Discount | Determines if a stock is trading above (premium) or below (discount) its average price. |

| Evaluate Trade Execution | Compares executed prices to VWAP to assess trade quality. |

| Measure Liquidity | Identifies fair value zones by showing where most trading volume occurs. |

| Confirm Technical Signals | Used alongside indicators like RSI or Bollinger Bands for stronger confirmation. |

| Support and Resistance | VWAP line and its upper/lower bands act as dynamic support and resistance levels. |

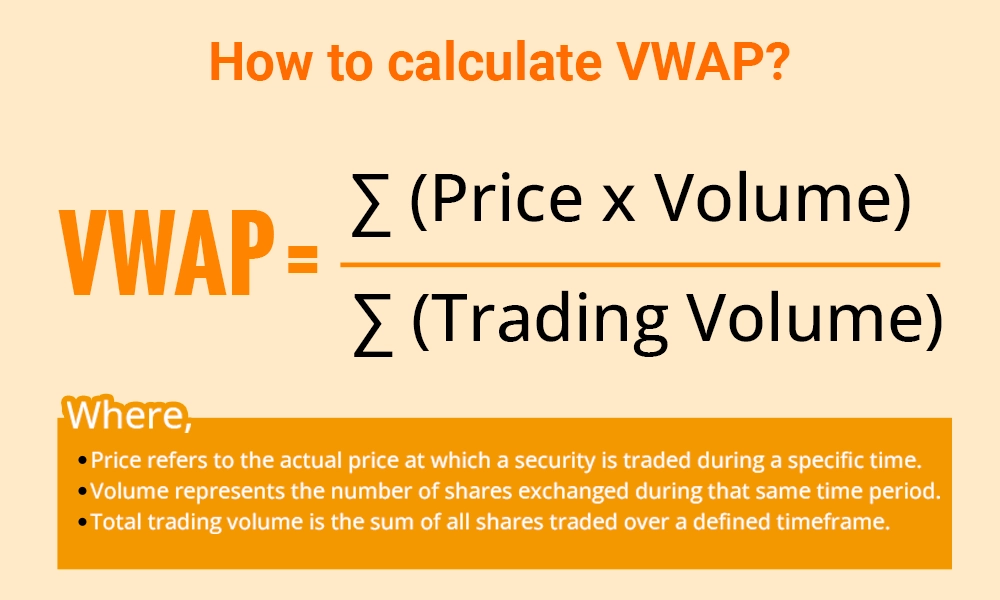

How VWAP is Calculated?

VWAP calculation uses intraday data and resets each trading day, based on the following steps:

- Calculate Typical Price for Each Interval

- Typical Price = (High + Low + Closing Price) / 3

- Multiply Typical Price by Volume

- Total Value Traded (per interval) = Typical Price × Volume

- Sum Total Values

- Cumulative Total = Sum of (Typical Price × Volume) across intervals

- Sum Volumes

- Total Volume = Sum of Volume across intervals

- Apply VWAP Formula

- VWAP = Cumulative Total / Total Volume

Note: Time intervals can vary (e.g., 5-minute, 15-minute) depending on intraday analysis needs.

VWAP Comparing to Other Indicators

| Indicator | Calculation Basis | Purpose/Use |

| VWAP | Price weighted by volume | Reflects average price considering trading volume, ideal for intraday trading and liquidity assessment. |

| Simple Moving Average (SMA) | Average of prices over time | Tracks price trends without volume consideration. |

| Relative Strength Index (RSI) | Measures speed and change of price movements | Identifies overbought or oversold conditions. |

Combining VWAP with other indicators such as RSI or moving averages enhances trading decisions by confirming trends and entry/exit points.

How to Use VWAP in Your Trading Strategy

VWAP can be used alone or combined with other indicators in a trading strategy:

- Trend Validation: Confirm bullish or bearish trends by comparing price to VWAP.

- Entry and Exit Points: Initiate long positions above VWAP anticipating upward moves; take short positions below VWAP anticipating downward trends.

- Track Institutional Activity: Institutional traders use VWAP to minimize market impact and execute large trades efficiently.

- Support/Resistance Levels: Upper and lower VWAP bands indicate overbought or oversold conditions, helping set stop losses and take profits.

VWAP Limitations and When to Be Cautious

- Lagging Indicator: VWAP relies on historical price and volume data, which can delay reaction to sudden market changes.

- Time Period Sensitivity: Different intraday periods or anchor periods affect VWAP interpretation.

- Volume Impact: Large or irregular trades can distort VWAP values.

- Best Use: Most effective in high-volume, liquid markets; less reliable for illiquid stocks or assets.

Conclusion

VWAP is a strategic technical analysis tool that blends price action with volume context. Whether for retail traders or institutional investors, understanding VWAP enhances market insight and improves trade execution decisions.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.