Complete Guide to Trailing Stop: How Investors Use Trailing Stops to Protect Profits

1. Why Do You Need a Trailing Stop?

In the investment market, making profits is undoubtedly exciting, but how to preserve those profits is an even greater challenge. Suppose you buy Bitcoin at $30,000 at the end of 2024, and the price rises to $40,000, showing impressive paper profits. However, a sudden market drop brings the price back to $35,000, and your profits shrink instantly. Or, you hold TSMC shares in the Taiwan stock market, and the stock price rises from NT$600 to NT$700, but because you didn’t take profits in time, you miss the best selling point. These scenarios are common in investing, and “Trailing Stop” is the perfect tool to address such issues.

Simply put, a trailing stop is a dynamic stop-loss tool that automatically adjusts the stop-loss point as the price increases, allowing you to lock in profits when the market rises and exit timely when the market falls. For investors, whether trading forex, stocks, or cryptocurrencies, mastering trailing stops can improve trading efficiency and give you peace of mind, even when facing global market uncertainties (such as the US interest rate policy in early 2025 or fluctuations in the TWD exchange rate). This article will guide you through the basic principles and MT4 operations, providing practical examples of how to apply this tool across different assets.

2. Basic Principles and Setup of Trailing Stops

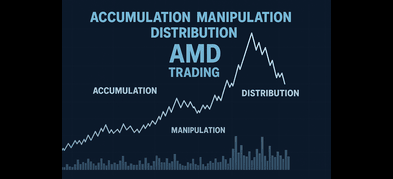

What is a Trailing Stop?

A trailing stop is an advanced stop-loss strategy. Unlike a fixed stop-loss, the stop-loss point dynamically adjusts with price increases (or decreases if it’s a short position). For example, if you buy a stock at NT$100 and set a trailing stop distance of NT$20, when the stock price rises to NT$120, the stop-loss point automatically adjusts to NT$100. If the price continues to rise to NT$130, the stop-loss point changes to NT$110. Once the price falls and hits the stop-loss point, the system automatically sells, ensuring you lock in at least part of the profit.

How to Set Up a Trailing Stop?

Trailing stops are typically set in two ways:

- Fixed Points: For example, in forex trading, you can set a trailing stop at 50 pips.

- Fixed Percentage: For example, in stock trading, you can set a trailing stop at a 5% pullback.

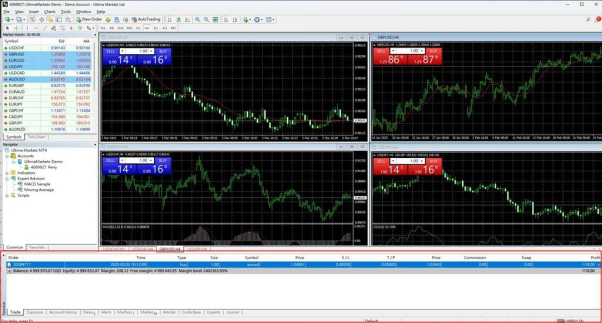

In practice, MetaTrader 4 (MT4) is a user-friendly platform and one of the most popular choices among traders. Below are the steps to set up a trailing stop in Ultima Markets‘ MT4:

- 1.Open MT4, log in to your Ultima Markets account (if you’re not a user yet, you can click here to register a real account), and select your trading asset (such as EUR/USD or Bitcoin CFD).

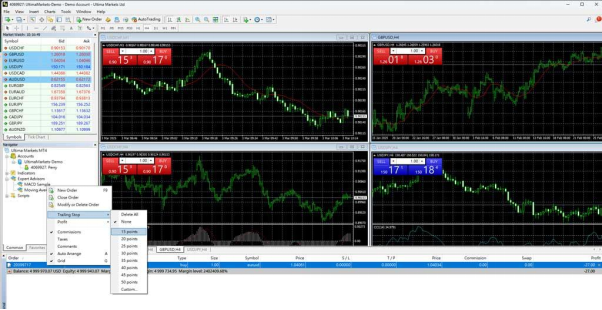

- 2.Right-click on the open position and select “Trailing Stop.”

- 3.In the pop-up menu, select the stop-loss distance (such as 15 pips, 30 pips), or customize the number of pips.

- 4.After confirming, the system will automatically activate the trailing stop feature without the need for manual adjustments.

Investor Practical Advice

When using MT4, traders need to pay attention to the currency units. For example, in forex trading, the value is quoted in USD, and pips must be converted into the local currency’s price movement; in stock trading, traders must consider whether the broker supports the trailing stop feature. If the platform does not support it, it can be simulated manually or through a script.

3. Application Scenarios and Cases of Trailing Stop

Trailing stops are applicable to a variety of assets. Below are three common scenarios:

Forex Trading: EUR/USD

Suppose you go long on EUR/USD at an exchange rate of 1.0800, setting a trailing stop of 50 pips (stop-loss at 1.0750). If the exchange rate rises to 1.0900, the stop-loss point automatically adjusts to 1.0850. If the market rises to 1.1000 due to expectations for the European Central Bank’s 2025 policy, the stop-loss point changes to 1.0950. If the price eventually falls back to 1.0950, triggering the stop-loss, you lock in a profit of 150 pips.

Stock Trading: TSMC

You buy TSMC stock at NT$600, setting a 5% (NT$30) trailing stop. When the stock price rises to NT$700, the stop-loss point adjusts to NT$670. In early 2025, as semiconductor demand picks up, the stock price rises to NT$750, and the stop-loss point changes to NT$712.5. Later, the market adjusts and falls to NT$710, triggering the sale. You make a profit of NT$110 per share.

Cryptocurrency: Bitcoin

At the end of 2024, you buy Bitcoin at $30,000, setting a trailing stop of 10% ($3,000). When the price rises to $40,000, the stop-loss point changes to $36,000. If, due to the halving effect in early 2025, the price rises to $50,000, the stop-loss point adjusts to $45,000. Eventually, the price falls back to $45,000, triggering the sale, and you make a profit of $15,000.

These cases show that trailing stops can be flexibly applied in volatile markets, especially for Taiwanese investors dealing with TWD exchange rate fluctuations or global economic changes.

4. Advantages, Disadvantages, and Alternatives to Trailing Stop

Advantages

- Automated Management:No need to monitor the market constantly, suitable for busy Taiwanese professionals.

- Lock in Profits: The stop-loss point is gradually raised as the price increases.

- Wide Applicability: Can be used across different asset classes, from forex to cryptocurrencies.

Disadvantages

- Premature Exit Risk:Short-term fluctuations might trigger the stop-loss, such as intraday volatility in Bitcoin.

- Platform Limitations:Some Taiwanese brokers do not support trailing stops for stocks.

- Cost Consideration:In small trades, transaction fees may offset profits.

Alternative Solutions Comparison

- Fixed Stop-Loss: Suitable for stable markets, but it cannot lock in profits.

- Manual Stop-Loss:Flexible but requires constant monitoring, not ideal for beginners.

- Psychological Stop-Loss: Relies on personal discipline and is easily influenced by emotions.

Recommendation: Adjust the trailing stop distance based on your risk tolerance. For high-volatility assets (like cryptocurrencies), set a wider range (e.g., 10%), and for low-volatility assets (like ETFs), set a tighter range (e.g., 3%).

5. Practical Tips and Precautions

- Combine Technical Indicators:Use Moving Averages (MA) or Bollinger Bands in MT4 to confirm trends before setting the trailing stop.

- Test with a Demo Account:Practice first on an MT4 demo account to avoid real-money mistakes.

- Avoid Too Tight Stop-Loss:For example, setting 10 pips in forex trading might trigger a stop-loss due to normal fluctuations.

- Taiwan Market Considerations: Pay attention to trading hours (Asian sessions tend to be more stable) and broker fees.

6. Conclusion and Call to Action

Trailing stops are an essential tool for Taiwanese investors in 2025 to navigate market uncertainties. Whether you’re a forex beginner, a long-term stock investor, or a cryptocurrency trader, this tool helps balance risk and reward. From simple MT4 setup to multi-asset applications, take action now and test your strategy with a demo account! Want to learn more? Click here to download the MT4 version from Ultima Markets and apply for a free demo account to start your wealth protection journey.