Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Definition and Classification of Forex Brokers

Forex brokers play a crucial role in the forex market, acting as a bridge for traders to access the global currency market. In simple terms, a forex broker is similar to a stockbroker in the stock market. They facilitate the matching of buyers and sellers, provide trading platforms, and ensure the smooth execution of trades.

1.Core Functions of Forex Brokers

The primary functions of forex brokers include:

- Providing Trading Platforms: Offering online trading software such as MetaTrader 4/5 (MT4/MT5) or proprietary platforms, enabling traders to buy and sell forex currency pairs.

- Market Connectivity: Accessing quotes through liquidity providers (banks or large financial institutions) to ensure traders can execute trades at fair market prices.

- Leveraged Trading: Forex brokers provide leverage, allowing traders to control larger trading volumes with small capital, enhancing investment flexibility.

- Trade Execution and Risk Management: Depending on the execution model, brokers may directly handle trade orders or route them to larger markets for execution, ensuring smooth trade completion.

2.Main Types of Forex Brokers

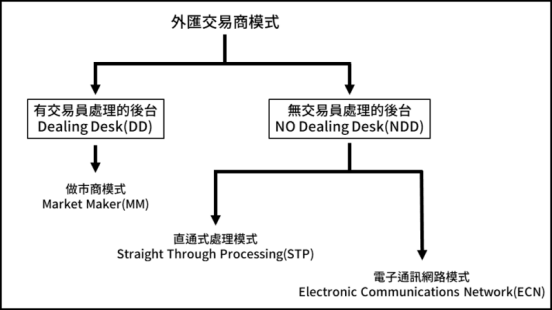

Based on trade execution methods, forex brokers are primarily divided into the following two types:

(1) Dealing Desk (DD) Forex Brokers

These brokers, also known as **Market Makers**, act as the counterparty to traders in transactions. They provide fixed bid and ask prices, waiting for traders to place orders based on their settings. Essentially, DD brokers profit by buying low, selling high, and utilizing the bid-ask spread.

(2) No Dealing Desk (NDD) Forex Brokers

These brokers do not participate in traders’ buy and sell orders. Instead, they send orders directly to the market or liquidity providers, matching opposite trades (long and short) to bridge these orders, including banks, funds, etc. The NDD model can be further divided into:

- STP (Straight Through Processing) Brokers: Directly send orders to liquidity providers, typically offering floating spreads.

- ECN (Electronic Communication Network) Brokers: Match traders’ orders through an electronic network, allowing market participants to freely bid and offer, providing the most accurate market prices.

How to Choose the Right Forex Broker?

Selecting a forex broker is crucial for trading success, as it not only affects trading costs but also impacts fund security. Here are key factors to consider when choosing a broker:

- Trading Costs: Compare spreads and commissions, and check for additional fees such as withdrawal fees or inactivity fees.

- Regulation and Fund Security: Choose brokers regulated by authorities like FCA, ASIC, or CySEC to ensure fund safety.

- Trading Platform and Technical Support: Look for stable platforms like MT4/MT5, equipped with technical analysis tools and mobile trading support.

- Range of Trading Products: Ensure the broker supports major currency pairs, precious metals, indices, etc., to meet your trading needs.

- Deposit and Withdrawal Convenience: Opt for brokers that support multiple payment methods, offer fast withdrawals, and have no additional fees.

- Customer Service: Ensure 24/5 or 24/7 multilingual support to resolve trading issues promptly.

Choosing a regulated broker with transparent fees and a stable trading environment, and testing with a demo account, ensures the best trading experience.

Advantages of Trading Forex with a Broker

Trading forex through a broker offers investors more convenience and opportunities, with key advantages including:

- Access to the Market: Forex brokers provide a gateway to the market, offering platforms and liquidity to ensure smooth execution of trades.

- Leverage Trading: Most brokers offer leverage, allowing traders to control larger positions with smaller capital, potentially increasing profits (but also risks).

- Low Trading Costs and Flexibility: Brokers primarily profit from spreads, with some offering low or even zero spreads. Traders can choose between fixed or floating spreads to suit their strategies.

- Diverse Trading Products: In addition to major currency pairs, brokers offer products like precious metals, commodities, and indices, allowing flexible portfolio adjustments.

How to Open an Account with a Forex Broker

After selecting a suitable broker, opening an account is the first step to entering the forex market. For example, **Ultima Markets**, a leading forex trading platform, offers a quick and easy online account opening process.

Three Simple Steps to Start Trading:

- Register an Account: Visit the Ultima Markets website, fill in basic personal information (name, email, phone number), set a password, and submit the application.

- Verify Identity and Fund the Account: Upload identification documents (e.g., passport, driver’s license) and proof of address. Once verified, fund your account via bank transfer, credit card, or e-payment.

- Start Trading: After funding, log in to the Ultima Markets platform to trade forex, gold, crude oil, indices, and more, leveraging professional tools for an efficient trading experience.

Ultima Markets offers an intuitive interface, fast order execution, and multiple trading tools, helping investors seize market opportunities and making forex trading more efficient and convenient!