Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomIntroduction

Foreign exchange, popularly known as forex or FX, forex trading is converting one currency into another. Anyone, including central banks, corporations, or individuals, can trade forex.

Forex trade is crucial as it facilitates international trade between countries and cross-country investments. Retail traders can also trade currency pairs to earn from their movement. Speculative traders never take delivery of the physical currency.

Since one currency trades against another, some of the most traded forex pairs include:

- GBP/USD – British pound against the US dollar

- EUR/USD – Euro against US dollar

- USD/JPY – US dollar against Japanese yen

- USD/CHF – US dollar against Swiss franc

(We will discuss forex pairs in detail later in this chapter)

Forex market structure and forex trading timing

Unlike global stock markets, the forex market lacks a centralised exchange for trading currencies. Instead, transactions happen : one party directly sells currencies to another party.

Anyone can trade forex pairs using a desired broker that deals in currency pairs.

The world has four primary forex hubs: London, New York, Tokyo and Sydney. Thus, the forex market is open around the clock – from around 21:00 or 22:00 (UK time) on Sunday to 21:00 or 22:00 (UK time) on Friday, every week. This time varies by an hour due to daylight savings time changes in the UK, US and Australia.

When trading in one forex hub ends, another continues, thus making trading feasible for almost around the week (except for the weekend).

Open times (in GMT, Monday to Friday) of the four markets are the following:

London: 8 am to 5 pm

London: 8 am to 5 pm Tokyo: 12 am to 9 am

Tokyo: 12 am to 9 am Sydney: 8 pm to 5 am

Sydney: 8 pm to 5 am New York: 1 pm to 10 am

New York: 1 pm to 10 am

However, trading volumes might vary during some hours, as London and New York often handle higher volumes of orders than Tokyo and Sydney.

The size of the forex (FX) market

The forex market is massive compared to stocks and bonds. Traders exchange nearly worth of currencies daily worldwide, far surpassing the daily volumes of the New York Stock Exchange, London Stock Exchange, and Tokyo Stock Exchange.

The average share of trades in each of these top currencies is the following (according to the 2022 BIS Triennial Central Bank Survey):

- US dollar (USD): The most dominant currency in the forex market, involved in 88% of all trades globally.

- Euro (EUR): The second most traded currency, present in 31% of all trades.

- Japanese yen (JPY): Accounts for 17% of trades, making it the third most traded currency.

- British Pound (GBP):Maintains a 13% market share.

- Chinese Renminbi (RMB):The fifth most traded currency with a presence in 7% of the global trades.

(As two currencies are involved in every trade, the total sum of the forex trading market percentage of share of individual currencies is 200%, not 100%)

Forex market (FX) drivers

Forex trading is practical in international commerce and many other areas. However, traders also speculate on forex pairs to gain from the movements of one currency against another.

So, the question is: what drives the forex market changes?

- Some of the factors that impact the valuation of a currency against another are:

Inflation rates

Inflation rates

A low inflation rate increases a country’s purchasing power against other currencies and thus boosts its currency’s value. A higher inflation rate does the opposite. Interest ratesThe

Interest ratesThe

decision of any country’s central bank to change interest rates directly impacts the forex rates. A higher interest rate leads to a higher return to the lender in that currency. Government Policies

Government Policies

Government policies: Economic policies, mostly involving decisions around debts, directly impact a country’s currencies. Decisions to suddenly take on debts often negatively affect the currency value. Demand for imports and exports

Demand for imports and exports

The currency of any import-heavy country is often stressed and easily influenced by price fluctuations in the international commodities market. Economic Outlook

Economic Outlook

Economic outlook: If a country’s economy is doing well with impressive growth figures, its currency often gains in terms of exchange rates.

Many other macroeconomic factors directly impact the movement of the forex market.

Understanding a forex symbol and pair

This guide has already introduced you to forex symbols and pairs. Now, let’s dive into them and understand them better.

Forex symbols

The three-letter symbols of currencies – USD, EUR, JPY, etc. – are based on the ISO 4217 standard. These alphabetic codes are recognised internationally as currency representations to enable clarity and avoid confusion.

There are standard codes for every government-recognised currency, from the major ones like the US dollar and euro to even the rare ones like Afghanis and Zambian kwacha.

The usually used alphabetic code contains three letters from the Latin scripts for every currency: The first two letters of the ISO 4217 three-letter code match the country code for the country name, while the third letter, when feasible, aligns with the currency’s initial letter.

- Based on the ISO 4217 standard

- Standard codes for every government-recognised currency

The following are some examples:

- USD: ‘US’ is the country code for the United States of America, while ‘D’ stands for dollar.

- JPY: ‘JP’ is the country code for Japan, while ‘Y’ stands for yen.

- INR: ‘IN’ is the country code for India, while ‘R’ stands for the rupee.

- VND: ‘VN’ is the country code for Vietnam, while ‘D’ stands for dong.

ISO 4217 also has three-digit numeric codes for every currency alongside the alphabetic codes. These numeric codes are usually used in countries that do not use Latin scripts and for computerised systems. Three-letter alphabetic codes are the standard for the general forex trading market.

Forex pair

In forex trading, two currencies are involved: a trade takes a position (buy or sell) in one currency against another. Each forex trading pair is represented by two currency symbols: EUR/USD, USD/JPY, and GBP/USD.

In a forex trading currency pair, the first currency is called the base or primary currency. The second currency is the quote or counter currency. The forex pair shows the value of the quote currency against the base currency, i.e., how much one unit of the base currency will buy of the quote currency.

In the pair EUR/USD:

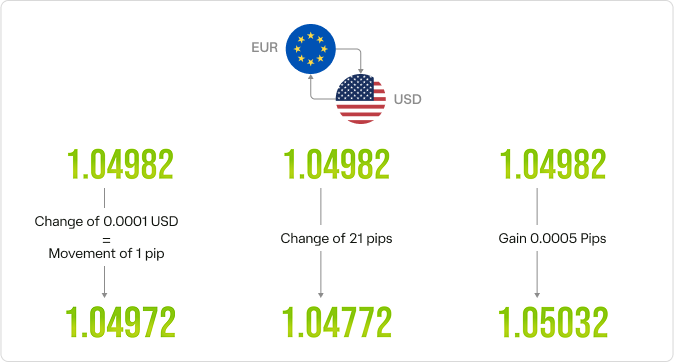

- “EUR/USD = 1.04982” indicates one EUR is worth 1.04982 USD.

Forex currency pair categorisation: Major, minor and exotic

Theoretically, as a trader, you can exchange any currency against another as long as they are recognised globally. However, the reality is different.

Some forex pairs are widely traded, while others have limited trading volumes. None of the brokers list the available forex pairs worldwide; only the popular ones with tradable liquidity are often offered.

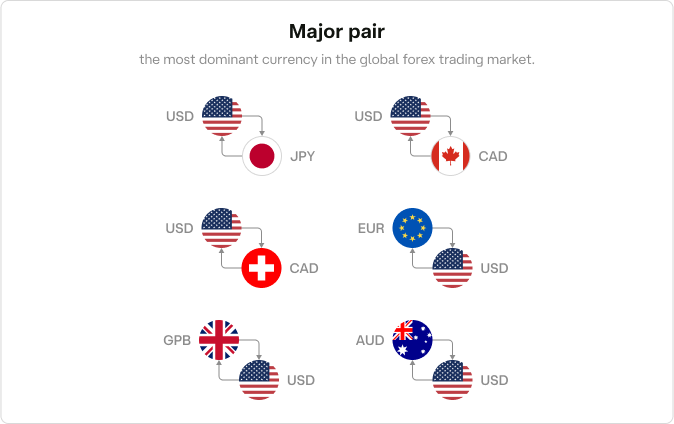

Major forex currency pairs

Most forex trading occurs with a few selected currencies called major forex pairs or majors.

However, there are no officially recognised forex pairs globally. The brokers or other local players instead characterise them. The six widely recognised majors that constitute over 80% of forex traders are:

All these forex pairs include the US dollar, the most dominant currency in the global forex trading market.

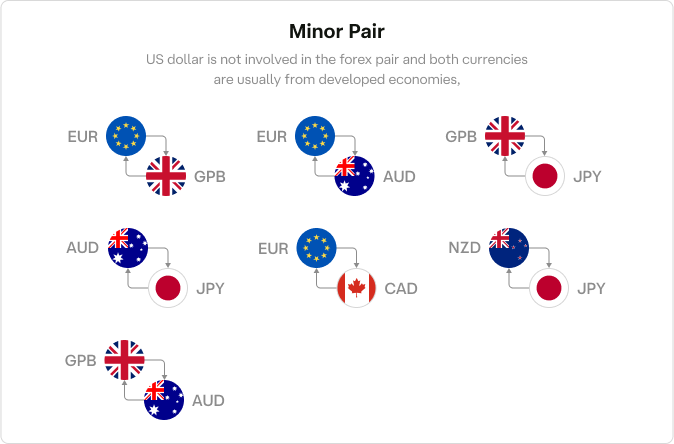

Minor forex pairs

If the US dollar is not involved in the forex pair and both currencies are usually from developed economies, then the pair is often called a minor currency pair. Such forex pairs are also often called cross-currency pairs or simply crosses.

Although there are no rules in such forex pair categorisation, most popular crosses tend to have the euro (EUR), British pound (GBP) or the Japanese yen (JPY). Some of the popular minor forex pairs are:

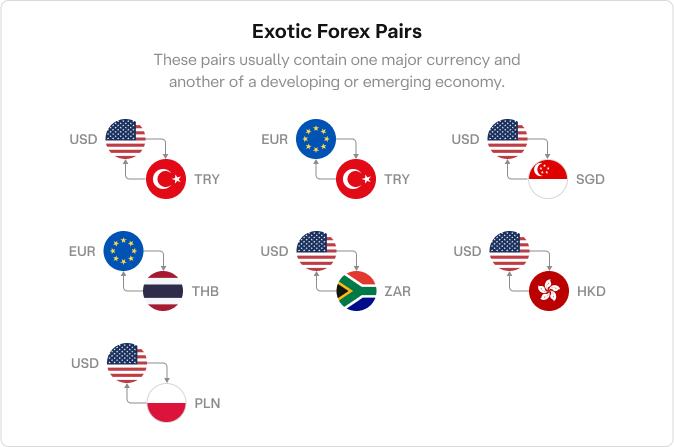

Exotic forex pairs

Some forex pairs are also categorised as exotics. These pairs usually contain one major currency and another of a developing or emerging economy. Such pairs are not traded often, but some traders tend to trade them to speculate on the economies of developing or emerging countries.

Some of the exotic forex pairs are:

Singapore, Poland, Hong Kong (and many other developed regions) currencies are also considered exotic as their economies are much smaller than those of the majors.

There are also some other region-specific forex pair categorisations. Although these regional pairs are rare, some traders tend to trade them.

Two of the such regional forex pairs are Australasian pairs or Scandinavian pairs. The Australasian pair is usually the Australian dollar vs New Zealand dollar (AUD/NZD). In contrast, the Scandinavian pairs are euro vs currency of any Scandinavian countries, like the euro vs Norwegian krona (EUR/NOK).

Understanding a ‘pip’

In the stock market, investors can quickly determine a company share’s value against a fiat currency by tracking the change in dollars, cents, or other currency units. However, a forex pair’s fluctuation can be minuscule.

A ‘pip’ is a tiny unit that usually measures the value fluctuation of a forex pair.

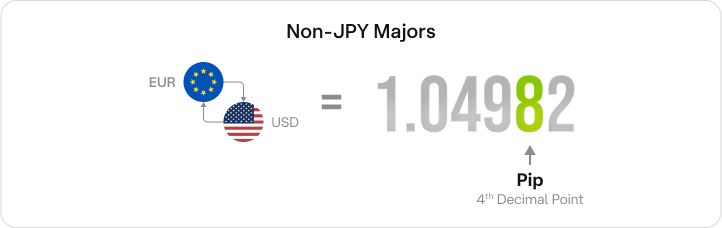

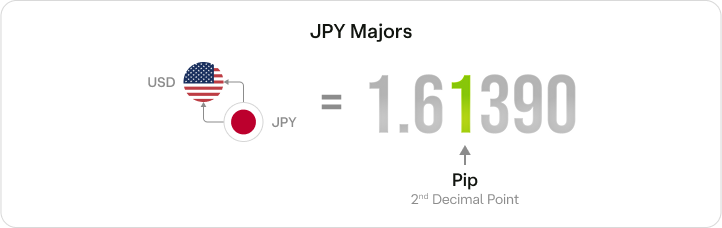

For the non-JPY majors, a pip is the fourth decimal point, representing 1 pip, while for JPY pairs, 1 pip is the second decimal point.

Let’s understand this with examples.

You might have already noticed that a forex pair usually has five decimal places (in non-JPY pairs).

So, if the EUR/USD = 1.04982, a change of 0.0001 USD on either side will represent a movement of 1 pip; if the value of the exact pair changes to 1.04772, then there is a movement change of 21 pips. Similarly, if the EUR/USD value changes to 1.05032, the pair gains 0.0005 pips.

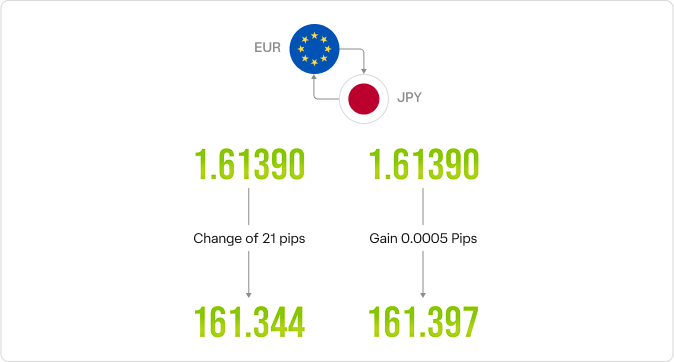

Taking the example of a JPY-based pair, let’s say EUR/JPY is trading at 161.390. If the pair’s value changes to 161.344, it is a 25 pips change. Similarly, if the value of EUR/JPY touches 161.397, then there is a change of 7 pips.

What is a ‘lot’?

Traders track the movement of forex pairs in pips, so the unit change is tiny. They traditionally trade forex pairs in large batches called lots to make trading feasible.

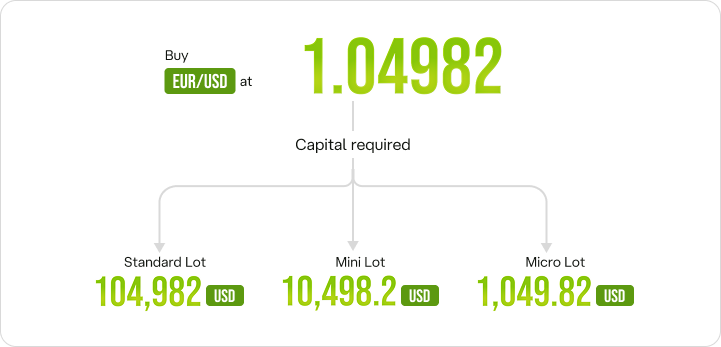

A standard lot has 100,000 units of currency. Mini and micro lots, which are 10,000 and 1,000 units, respectively, lower the entry barrier to forex trades.

For example, to buy a standard lot of EUR/USD at 1.04982, you, as a trader, must have USD 104,982. While taking a position with a mini and micro lot, the capital requirement drops to USD 10,498.2 and USD 1,049.82, respectively.

There is also a nano lot, equivalent to 100 currency units. However, most brokers do not offer nano lots.

In the real world, forex brokers offer leverage to traders, meaning they need only a fraction of the required capital to take a position in the market. We will discuss leverage and margin trading in the upcoming chapters.

Forex trading on Ultima Markets

Ultima Markets is a fully licensed broker and a multi-asset trading platform offering access to 250+ CFD financial instruments, including Forex, Commodities, Indices and Shares. We guarantee tight spreads and fast execution. Until now, we have served clients from 172 countries and regions with our trustworthy services and well-built trading systems.

Ultima Markets has achieved remarkable recognition in 2024, winning prestigious awards such as the Best Affiliates Brokerage, Best Fund Safety in Global Forex Awards, and the Best APAC CFD broker in Traders Fair 2024 Hong Kong. As the first CFD broker to join the United Nations Global Compact, Ultima Markets underscores its commitment to sustainability and the missions to advance ethical financial services and contribute to a sustainable future.

Ultima Markets is a member of The Financial Commission, an international independent body responsible for resolving disputes in the Forex and CFD markets.

All clients of Ultima Markets are protected under insurance coverage provided by Willis Towers Watson (WTW), a global insurance brokerage established in 1828, with claims eligibility up to US$1,000,000 per account.

There is also a nano lot, equivalent to 100 currency units. However, most brokers do not offer nano lots.

In the real world, forex brokers offer leverage to traders, meaning they need only a fraction of the required capital to take a position in the market. We will discuss leverage and margin trading in the upcoming chapters.